This article will reflect on the compensation paid to Shradha Marwah who has served as CEO of Subros Limited (NSE:SUBROS) since 2008. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Subros.

View our latest analysis for Subros

How Does Total Compensation For Shradha Marwah Compare With Other Companies In The Industry?

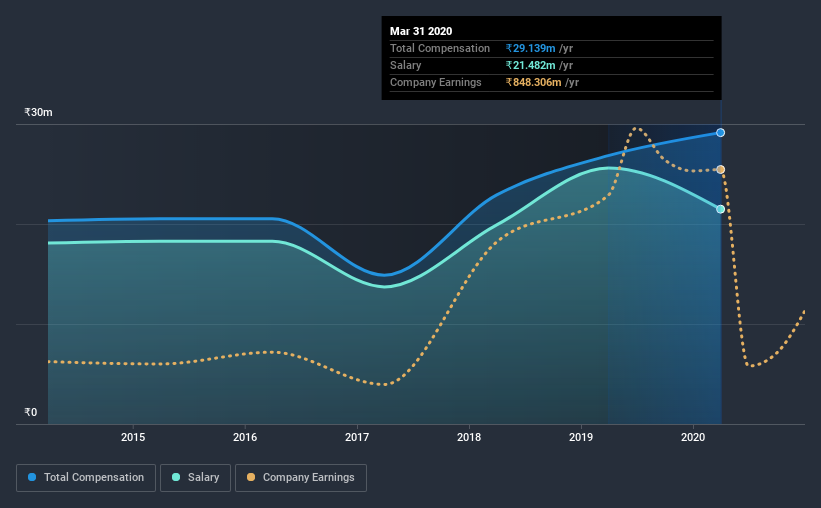

According to our data, Subros Limited has a market capitalization of ₹22b, and paid its CEO total annual compensation worth ₹29m over the year to March 2020. Notably, that's an increase of 8.6% over the year before. In particular, the salary of ₹21.5m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between ₹15b and ₹58b had a median total CEO compensation of ₹29m. From this we gather that Shradha Marwah is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹21m | ₹26m | 74% |

| Other | ₹7.7m | ₹1.2m | 26% |

| Total Compensation | ₹29m | ₹27m | 100% |

On an industry level, roughly 79% of total compensation represents salary and 21% is other remuneration. There isn't a significant difference between Subros and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Subros Limited's Growth

Subros Limited has reduced its earnings per share by 17% a year over the last three years. In the last year, its revenue is down 22%.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Subros Limited Been A Good Investment?

Since shareholders would have lost about 8.0% over three years, some Subros Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As previously discussed, Shradha is compensated close to the median for companies of its size, and which belong to the same industry. Meanwhile, EPS growth and shareholder returns have been in the red for the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Subros that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Subros, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SUBROS

Subros

Engages in the manufacture and sale of thermal products for automotive applications in India.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in