- India

- /

- Auto Components

- /

- NSEI:RANEHOLDIN

Rane Holdings (NSE:RANEHOLDIN) Share Prices Have Dropped 75% In The Last Three Years

Every investor on earth makes bad calls sometimes. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Rane Holdings Limited (NSE:RANEHOLDIN); the share price is down a whopping 75% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And more recent buyers are having a tough time too, with a drop of 51% in the last year. Even worse, it's down 12% in about a month, which isn't fun at all.

Check out our latest analysis for Rane Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

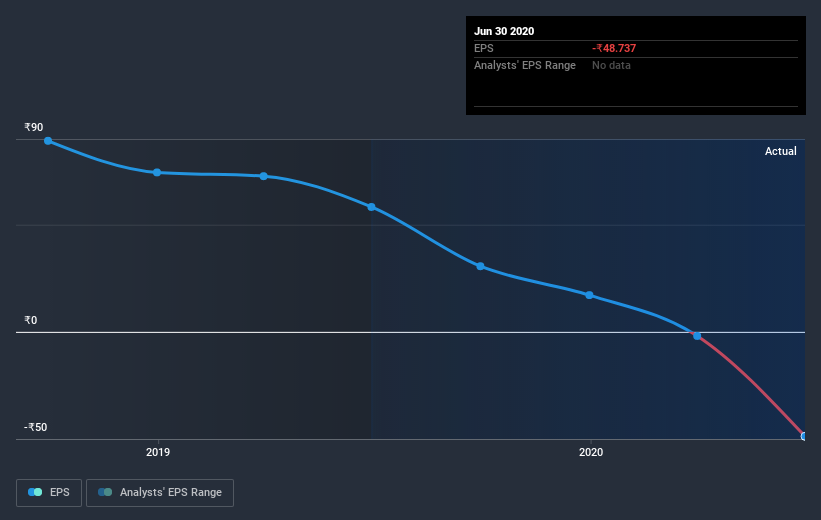

Over the three years that the share price declined, Rane Holdings' earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Rane Holdings' key metrics by checking this interactive graph of Rane Holdings's earnings, revenue and cash flow.

A Different Perspective

Investors in Rane Holdings had a tough year, with a total loss of 51% (including dividends), against a market gain of about 3.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Rane Holdings better, we need to consider many other factors. Take risks, for example - Rane Holdings has 5 warning signs (and 1 which is a bit concerning) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Rane Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:RANEHOLDIN

Rane Holdings

Manufactures and markets automotive components for the transportation industry in India and internationally.

Solid track record established dividend payer.