- India

- /

- Auto Components

- /

- NSEI:OMAXAUTO

Positive Sentiment Still Eludes Omax Autos Limited (NSE:OMAXAUTO) Following 27% Share Price Slump

Omax Autos Limited (NSE:OMAXAUTO) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

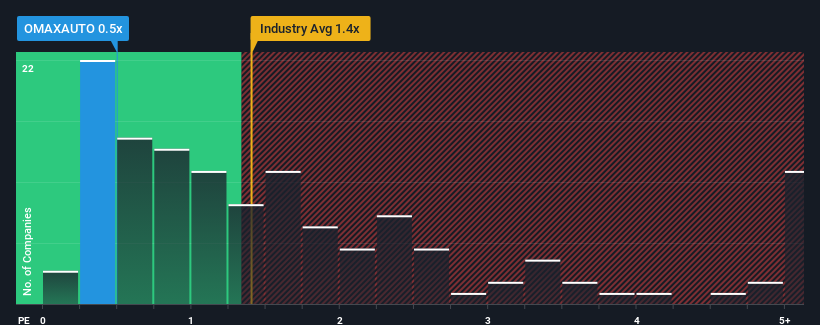

After such a large drop in price, when close to half the companies operating in India's Auto Components industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Omax Autos as an enticing stock to check out with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Omax Autos

What Does Omax Autos' P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Omax Autos, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Omax Autos will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Omax Autos?

Omax Autos' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 4.1% gain to the company's revenues. Pleasingly, revenue has also lifted 81% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.6% shows it's noticeably more attractive.

With this information, we find it odd that Omax Autos is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Omax Autos' P/S

Omax Autos' recently weak share price has pulled its P/S back below other Auto Components companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Omax Autos revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Omax Autos that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OMAXAUTO

Omax Autos

Engages in the manufacture and sale of automotive components in India.

Excellent balance sheet and good value.

Market Insights

Community Narratives