- India

- /

- Auto Components

- /

- NSEI:JTEKTINDIA

There's Reason For Concern Over JTEKT India Limited's (NSE:JTEKTINDIA) Massive 31% Price Jump

The JTEKT India Limited (NSE:JTEKTINDIA) share price has done very well over the last month, posting an excellent gain of 31%. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

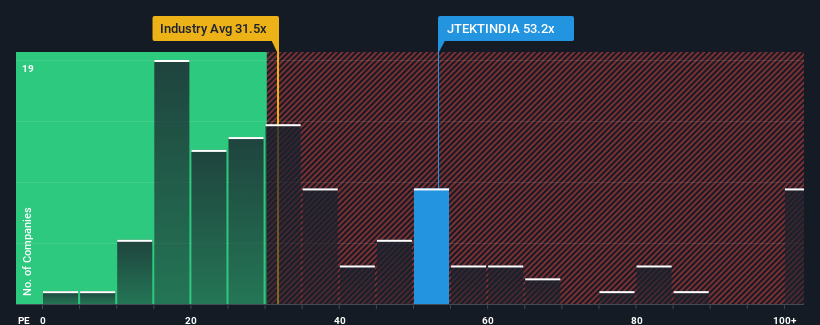

After such a large jump in price, JTEKT India's price-to-earnings (or "P/E") ratio of 53.2x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 30x and even P/E's below 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

There hasn't been much to differentiate JTEKT India's and the market's earnings growth lately. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for JTEKT India

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like JTEKT India's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 19% per year as estimated by the lone analyst watching the company. With the market predicted to deliver 19% growth per year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that JTEKT India is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On JTEKT India's P/E

The strong share price surge has got JTEKT India's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that JTEKT India currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - JTEKT India has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JTEKTINDIA

JTEKT India

Engages in the manufacture and sale of steering systems and auto components for the passenger car and utility vehicle manufacturers in the automobile sector in India.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives