- India

- /

- Auto Components

- /

- NSEI:JBMA

I Ran A Stock Scan For Earnings Growth And JBM Auto (NSE:JBMA) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like JBM Auto (NSE:JBMA), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for JBM Auto

How Fast Is JBM Auto Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. JBM Auto managed to grow EPS by 17% per year, over three years. That's a good rate of growth, if it can be sustained.

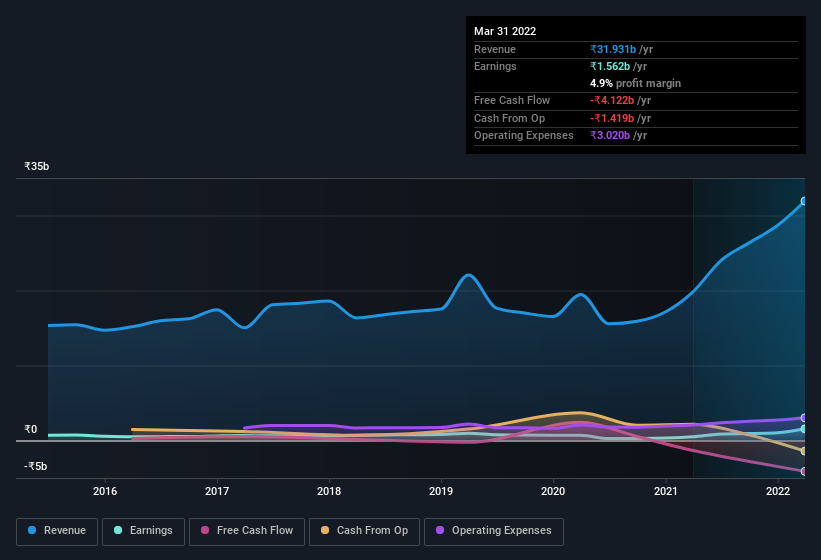

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). JBM Auto maintained stable EBIT margins over the last year, all while growing revenue 61% to ₹32b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are JBM Auto Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that JBM Auto insiders have a significant amount of capital invested in the stock. Indeed, they hold ₹1.2b worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 2.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like JBM Auto with market caps between ₹31b and ₹125b is about ₹27m.

The CEO of JBM Auto was paid just ₹165k in total compensation for the year ending . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add JBM Auto To Your Watchlist?

One positive for JBM Auto is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for JBM Auto, but the pretty picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Still, you should learn about the 3 warning signs we've spotted with JBM Auto (including 2 which are concerning) .

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JBMA

JBM Auto

Engages in the manufacture and sale sheet metal components, tools, dies and moulds, and buses in India and internationally.

Proven track record with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026