- India

- /

- Auto Components

- /

- NSEI:INDNIPPON

Increases to India Nippon Electricals Limited's (NSE:INDNIPPON) CEO Compensation Might Cool off for now

Key Insights

- India Nippon Electricals' Annual General Meeting to take place on 20th of September

- Salary of ₹13.7m is part of CEO Arvind Balaji's total remuneration

- The total compensation is 261% higher than the average for the industry

- India Nippon Electricals' EPS grew by 24% over the past three years while total shareholder return over the past three years was 44%

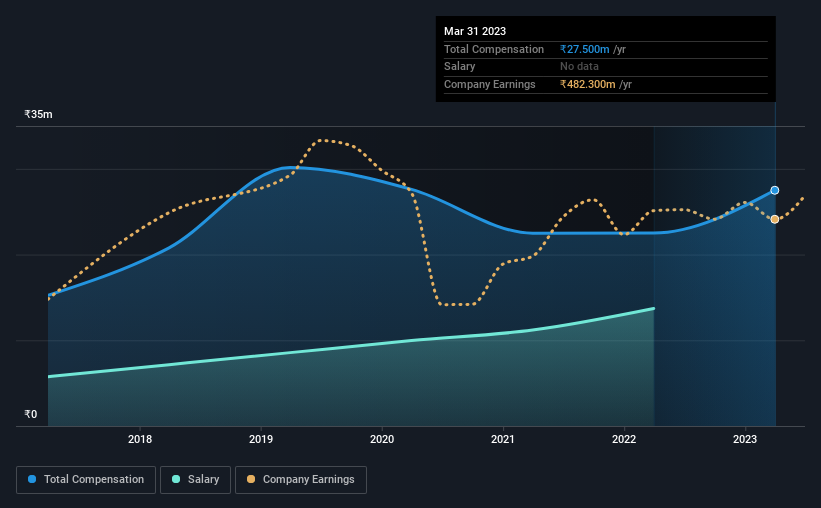

Performance at India Nippon Electricals Limited (NSE:INDNIPPON) has been reasonably good and CEO Arvind Balaji has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 20th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for India Nippon Electricals

Comparing India Nippon Electricals Limited's CEO Compensation With The Industry

At the time of writing, our data shows that India Nippon Electricals Limited has a market capitalization of ₹11b, and reported total annual CEO compensation of ₹28m for the year to March 2023. That's a notable increase of 22% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹14m.

On comparing similar-sized companies in the Indian Auto Components industry with market capitalizations below ₹17b, we found that the median total CEO compensation was ₹7.6m. Accordingly, our analysis reveals that India Nippon Electricals Limited pays Arvind Balaji north of the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹14m | ₹11m | 50% |

| Other | ₹14m | ₹11m | 50% |

| Total Compensation | ₹28m | ₹23m | 100% |

Speaking on an industry level, nearly 76% of total compensation represents salary, while the remainder of 24% is other remuneration. In India Nippon Electricals' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at India Nippon Electricals Limited's Growth Numbers

India Nippon Electricals Limited has seen its earnings per share (EPS) increase by 24% a year over the past three years. In the last year, its revenue is up 8.0%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has India Nippon Electricals Limited Been A Good Investment?

Most shareholders would probably be pleased with India Nippon Electricals Limited for providing a total return of 44% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 2 warning signs for India Nippon Electricals (1 is concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDNIPPON

India Nippon Electricals

Manufactures and sells electronic ignition systems for the automotive industry in India and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026