- India

- /

- Auto Components

- /

- NSEI:IGARASHI

How Much Did Igarashi Motors India's(NSE:IGARASHI) Shareholders Earn From Share Price Movements Over The Last Three Years?

Igarashi Motors India Limited (NSE:IGARASHI) shareholders should be happy to see the share price up 17% in the last quarter. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 61%. So the improvement may be a real relief to some. After all, could be that the fall was overdone.

Check out our latest analysis for Igarashi Motors India

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

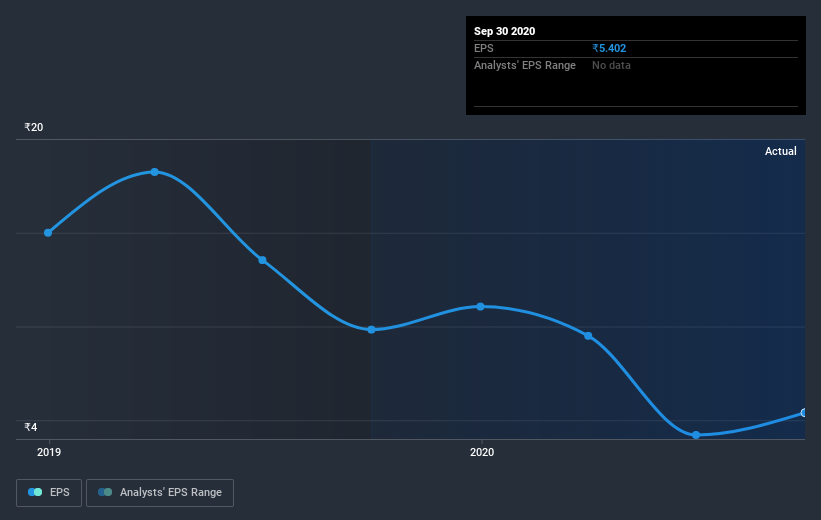

During the three years that the share price fell, Igarashi Motors India's earnings per share (EPS) dropped by 38% each year. In comparison the 27% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. This positive sentiment is also reflected in the generous P/E ratio of 59.14.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Igarashi Motors India's key metrics by checking this interactive graph of Igarashi Motors India's earnings, revenue and cash flow.

A Different Perspective

Igarashi Motors India shareholders gained a total return of 10% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 7% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Igarashi Motors India better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Igarashi Motors India (including 1 which is potentially serious) .

Of course Igarashi Motors India may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Igarashi Motors India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:IGARASHI

Igarashi Motors India

Manufactures and sells electric micro motors and motor components in India, the United States, Japan, Germany, Hong Kong, and internationally.

Flawless balance sheet with proven track record.