- India

- /

- Auto Components

- /

- NSEI:HITECHGEAR

Hi-Tech Gears (NSE:HITECHGEAR) Will Pay A Smaller Dividend Than Last Year

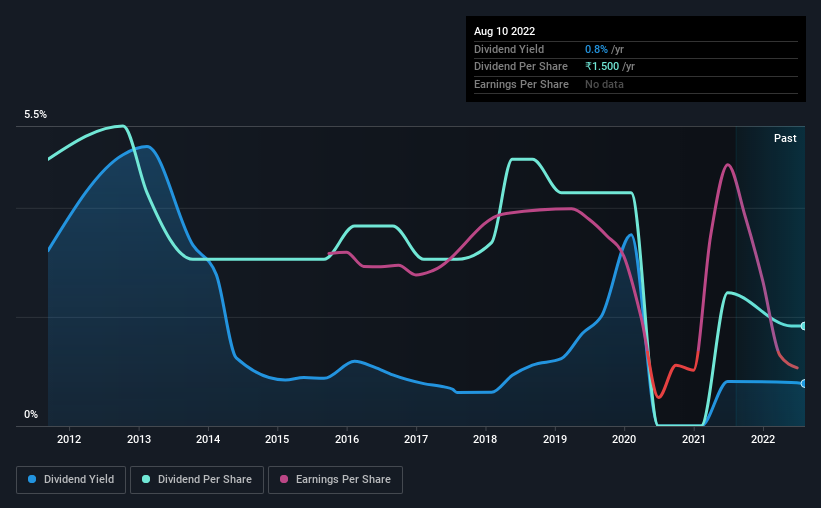

The Hi-Tech Gears Limited (NSE:HITECHGEAR) is reducing its dividend from last year's comparable payment to ₹1.50 on the 29th of October. However, the dividend yield of 0.8% is still a decent boost to shareholder returns.

Check out our latest analysis for Hi-Tech Gears

Hi-Tech Gears' Distributions May Be Difficult To Sustain

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even though Hi-Tech Gears is not generating a profit, it is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Over the next year, EPS might fall by 27.7% based on recent performance. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was ₹4.00 in 2012, and the most recent fiscal year payment was ₹1.50. This works out to be a decline of approximately 9.3% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Hi-Tech Gears' earnings per share has shrunk at 28% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

We're Not Big Fans Of Hi-Tech Gears' Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 5 warning signs for Hi-Tech Gears (of which 4 are concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Hi-Tech Gears might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HITECHGEAR

Hi-Tech Gears

Manufactures and sells auto components for automobile manufacturers in India, the United States, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.