- India

- /

- Auto Components

- /

- NSEI:EXIDEIND

Exide Industries (NSE:EXIDEIND) shareholders have earned a 39% CAGR over the last three years

Exide Industries Limited (NSE:EXIDEIND) shareholders might be concerned after seeing the share price drop 12% in the last quarter. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 165% compared to three years ago. After a run like that some may not be surprised to see prices moderate. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Exide Industries

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, Exide Industries actually saw its earnings per share (EPS) drop 2.9% per year.

Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. Therefore, it makes sense to look into other metrics.

Languishing at just 0.5%, we doubt the dividend is doing much to prop up the share price. It could be that the revenue growth of 5.7% per year is viewed as evidence that Exide Industries is growing. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

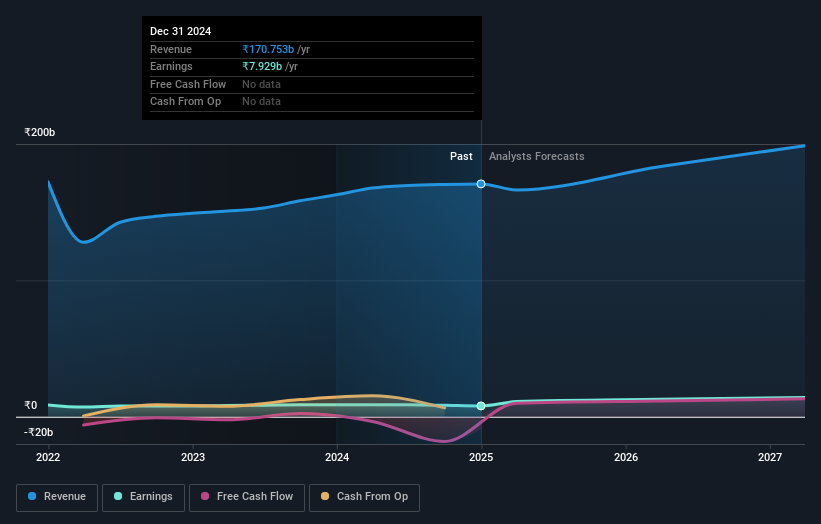

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Exide Industries is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Exide Industries' TSR for the last 3 years was 168%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Exide Industries shareholders have received a total shareholder return of 13% over the last year. And that does include the dividend. Having said that, the five-year TSR of 18% a year, is even better. It's always interesting to track share price performance over the longer term. But to understand Exide Industries better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Exide Industries you should be aware of.

But note: Exide Industries may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Exide Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EXIDEIND

Exide Industries

Designs, manufactures, markets, and sells lead acid storage batteries in India and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026