- India

- /

- Paper and Forestry Products

- /

- NSEI:GREENPANEL

Divgi TorqTransfer Systems And 2 Indian Exchange Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, rising 2.3% over the last week and an impressive 45% over the past year, with earnings expected to grow by 16% annually. In such a thriving market, stocks like Divgi TorqTransfer Systems that combine high insider ownership with strong growth prospects can be particularly appealing to investors looking for aligned interests and potential value.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.5% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.9% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Underneath we present a selection of stocks filtered out by our screen.

Divgi TorqTransfer Systems (NSEI:DIVGIITTS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Divgi TorqTransfer Systems Limited is a company that designs, develops, manufactures, and supplies engineered turnkey solutions and components to automotive OEMs globally, with a market cap of ₹20.94 billion.

Operations: The company generates ₹2.53 billion in revenue from its auto components and parts segment.

Insider Ownership: 10.1%

Earnings Growth Forecast: 26.6% p.a.

Divgi TorqTransfer Systems, a growth company with high insider ownership in India, is experiencing significant earnings growth, forecasted at 26.6% annually over the next three years, outpacing the Indian market's 16%. However, its revenue growth at 16.2% per year slightly lags behind the desired 20% threshold for high-growth categorization. Recent financials show a downturn with net income and revenue declining from the previous year. The low dividend cover and modest forecasted Return on Equity of 10.4% also pose concerns about its financial robustness despite strong growth projections.

- Take a closer look at Divgi TorqTransfer Systems' potential here in our earnings growth report.

- According our valuation report, there's an indication that Divgi TorqTransfer Systems' share price might be on the expensive side.

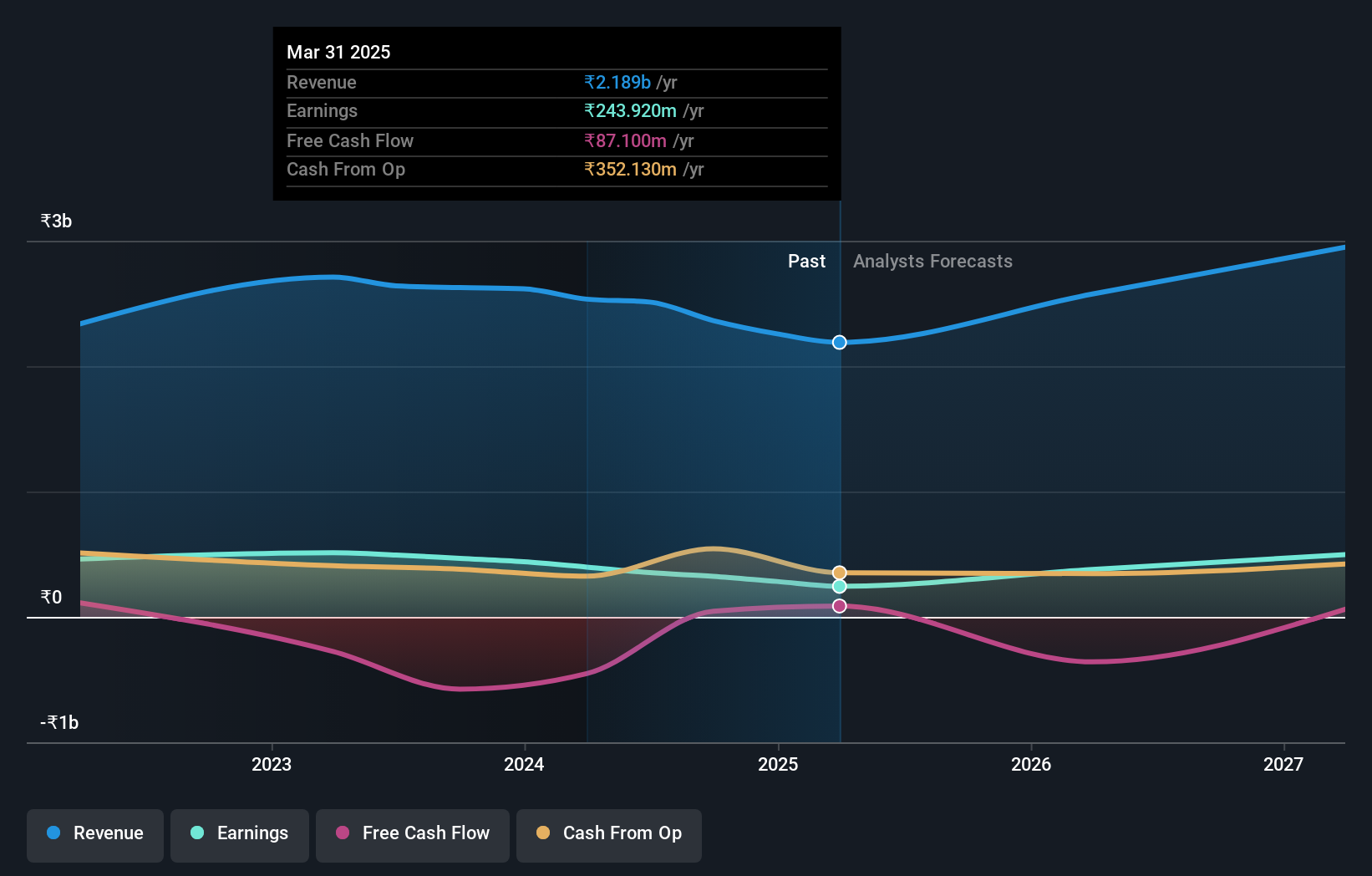

Greenpanel Industries (NSEI:GREENPANEL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Greenpanel Industries Limited specializes in the manufacturing, marketing, and sale of plywood, medium density fibre board (MDF), and related products across both Indian and international markets, with a market capitalization of ₹39.37 billion.

Operations: The company generates revenue primarily from two segments: plywood and allied products, which contributed ₹1.62 billion, and medium density fibre boards (MDF) and related products, with revenues of ₹14.05 billion.

Insider Ownership: 13.6%

Earnings Growth Forecast: 21.3% p.a.

Greenpanel Industries, a company with high insider ownership in India, is set to grow earnings by 21.3% annually, outperforming the Indian market's 16%. Despite this robust growth projection, its revenue increase of 13.6% annually trails behind the ideal high-growth benchmark of 20%. Recent financial results revealed a downturn with lower year-over-year earnings and revenue. Additionally, its dividend sustainability is questionable due to inadequate cash flow coverage.

- Delve into the full analysis future growth report here for a deeper understanding of Greenpanel Industries.

- The valuation report we've compiled suggests that Greenpanel Industries' current price could be inflated.

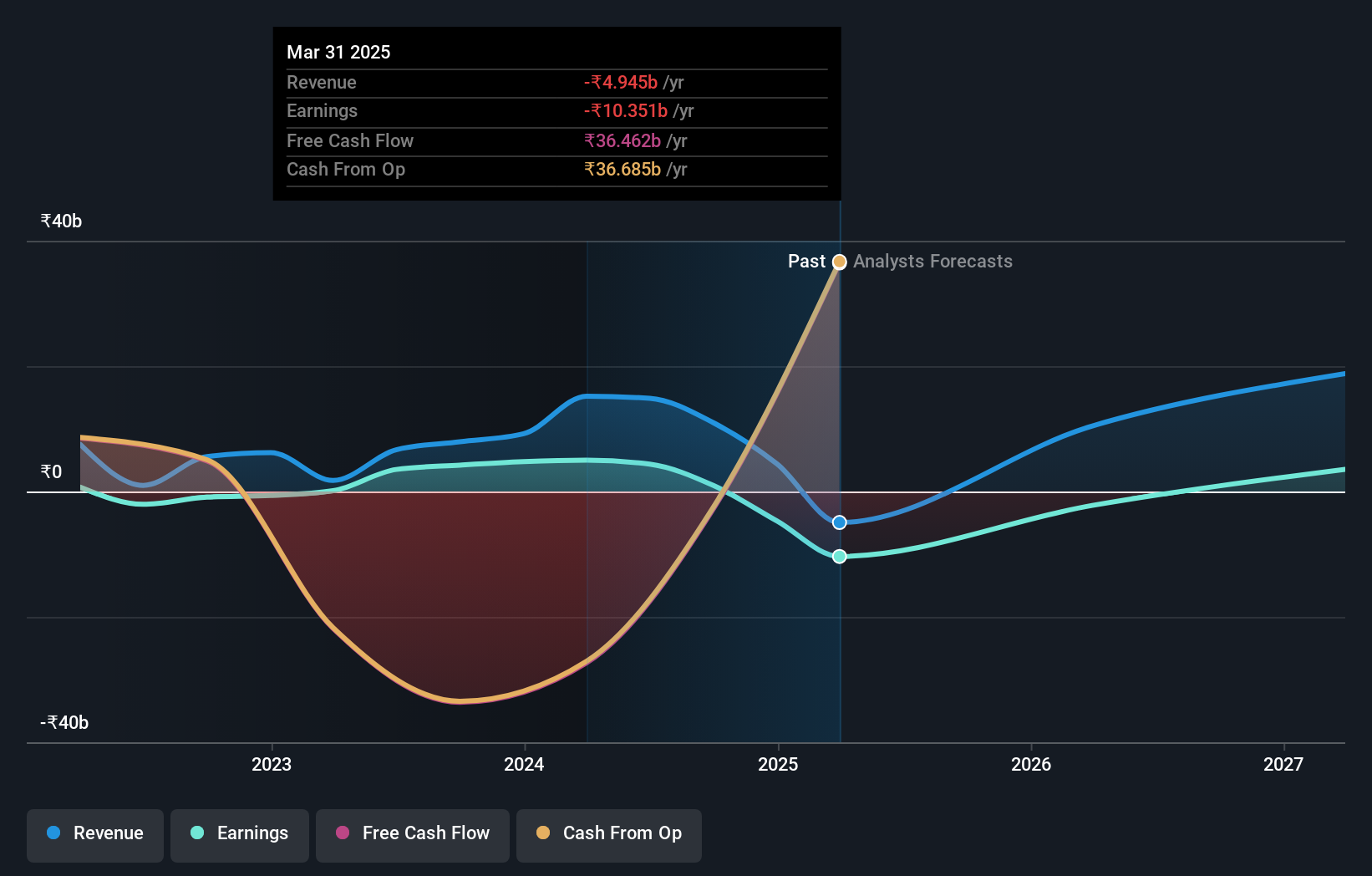

Spandana Sphoorty Financial (NSEI:SPANDANA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spandana Sphoorty Financial Limited operates in the microfinance sector within India, with a market capitalization of approximately ₹55.66 billion.

Operations: The company generates its revenue primarily from financing activities, amounting to ₹13.25 billion.

Insider Ownership: 11.6%

Earnings Growth Forecast: 22.4% p.a.

Spandana Sphoorty Financial, a growth-oriented company with significant insider ownership in India, is expected to see its earnings rise by 22.39% annually. This forecasted growth in earnings outpaces the broader Indian market's projection of 16%. Despite strong revenue gains reported in the recent quarter and full fiscal year, challenges remain as its debt is poorly covered by operating cash flow. Additionally, recent executive changes and substantial private placements suggest active strategic maneuvers within the company's leadership structure.

- Click to explore a detailed breakdown of our findings in Spandana Sphoorty Financial's earnings growth report.

- Our valuation report here indicates Spandana Sphoorty Financial may be undervalued.

Next Steps

- Take a closer look at our Fast Growing Indian Companies With High Insider Ownership list of 82 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GREENPANEL

Greenpanel Industries

Engages in the manufacturing and sale of plywood, medium density fibre board (MDF), and allied products under the Greenpanel brand name in India and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)