- India

- /

- Auto Components

- /

- NSEI:CIEINDIA

If EPS Growth Is Important To You, CIE Automotive India (NSE:CIEINDIA) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like CIE Automotive India (NSE:CIEINDIA). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for CIE Automotive India

How Fast Is CIE Automotive India Growing Its Earnings Per Share?

CIE Automotive India has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. CIE Automotive India's EPS skyrocketed from ₹15.88 to ₹21.49, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 35%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of CIE Automotive India's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. CIE Automotive India's EBIT margins have actually improved by 3.9 percentage points in the last year, to reach 12%, but, on the flip side, revenue was down 7.7%. That falls short of ideal.

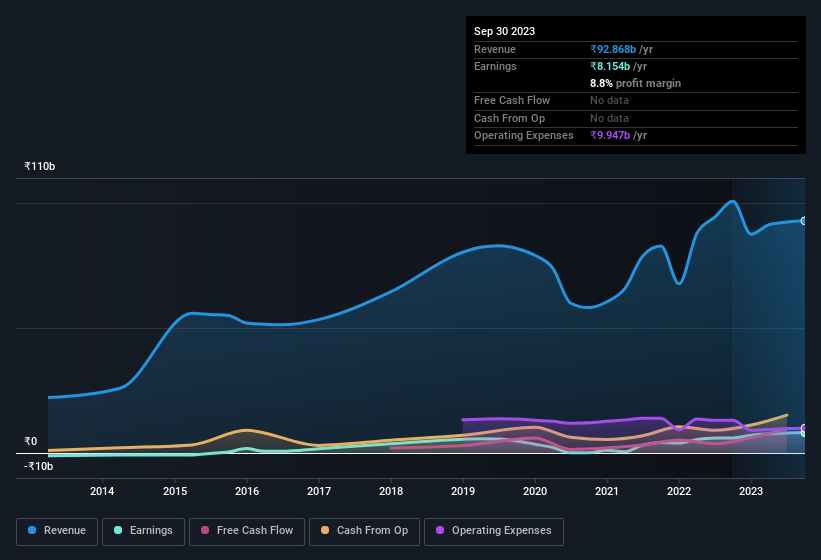

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for CIE Automotive India.

Are CIE Automotive India Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own CIE Automotive India shares worth a considerable sum. To be specific, they have ₹3.5b worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 2.0%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like CIE Automotive India with market caps between ₹83b and ₹266b is about ₹37m.

The CEO of CIE Automotive India was paid just ₹2.3m in total compensation for the year ending December 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add CIE Automotive India To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into CIE Automotive India's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that CIE Automotive India has underlying strengths that make it worth a look at. However, before you get too excited we've discovered 2 warning signs for CIE Automotive India that you should be aware of.

Although CIE Automotive India certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CIEINDIA

CIE Automotive India

Produces and sells automotive components to original equipment manufacturers and other customers in India, Europe, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026