- Israel

- /

- Capital Markets

- /

- TASE:MPP

Exploring Three Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

As most Gulf markets experience gains on hopes of U.S. interest rate cuts and a ceasefire in Gaza, the Middle East presents intriguing opportunities for investors looking to capitalize on these shifting dynamics. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those aiming to leverage the region's evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

We'll examine a selection from our screener results.

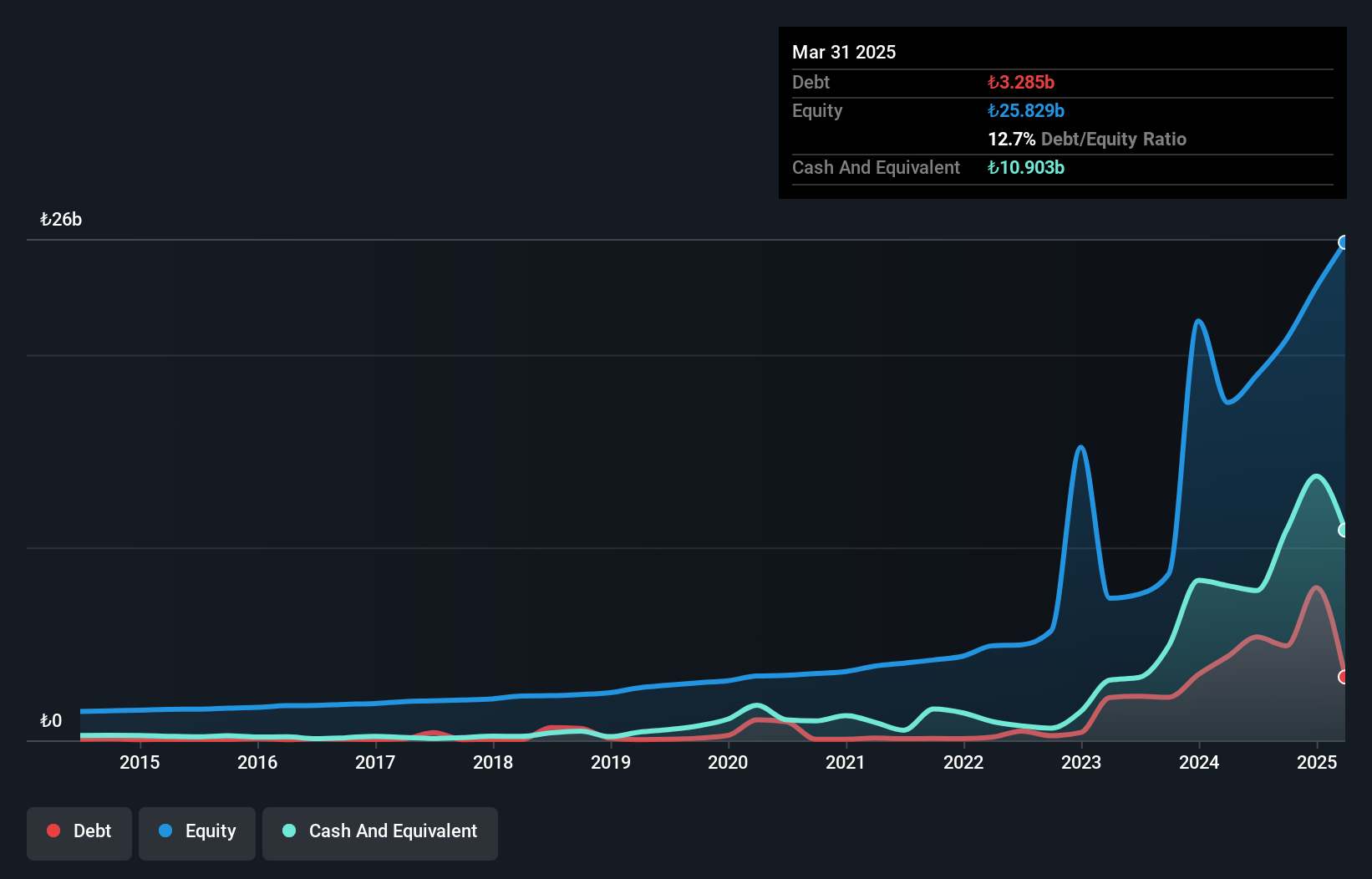

Selçuk Ecza Deposu Ticaret ve Sanayi (IBSE:SELEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Selçuk Ecza Deposu Ticaret ve Sanayi A.S., along with its subsidiary, functions as a pharmacy depot in Turkey and has a market cap of TRY49.06 billion.

Operations: The primary revenue stream for Selçuk Ecza Deposu Ticaret ve Sanayi comes from the wholesale of drugs, generating TRY129.94 billion. The company's financial performance can be evaluated through its net profit margin, which provides insight into profitability after accounting for all expenses.

Selçuk Ecza Deposu, a notable player in the healthcare sector, has shown impressive earnings growth of 92% over the past year, outpacing the industry average. Despite this growth, recent results highlight challenges with a net loss of TRY 321.48 million for Q2 2025 compared to a profit last year. The company’s debt management appears strong, with its debt-to-equity ratio dropping from 28.6% to 6.8% over five years and cash exceeding total debt levels. However, free cash flow remains negative despite robust sales figures reaching TRY 36 billion in Q2 alone.

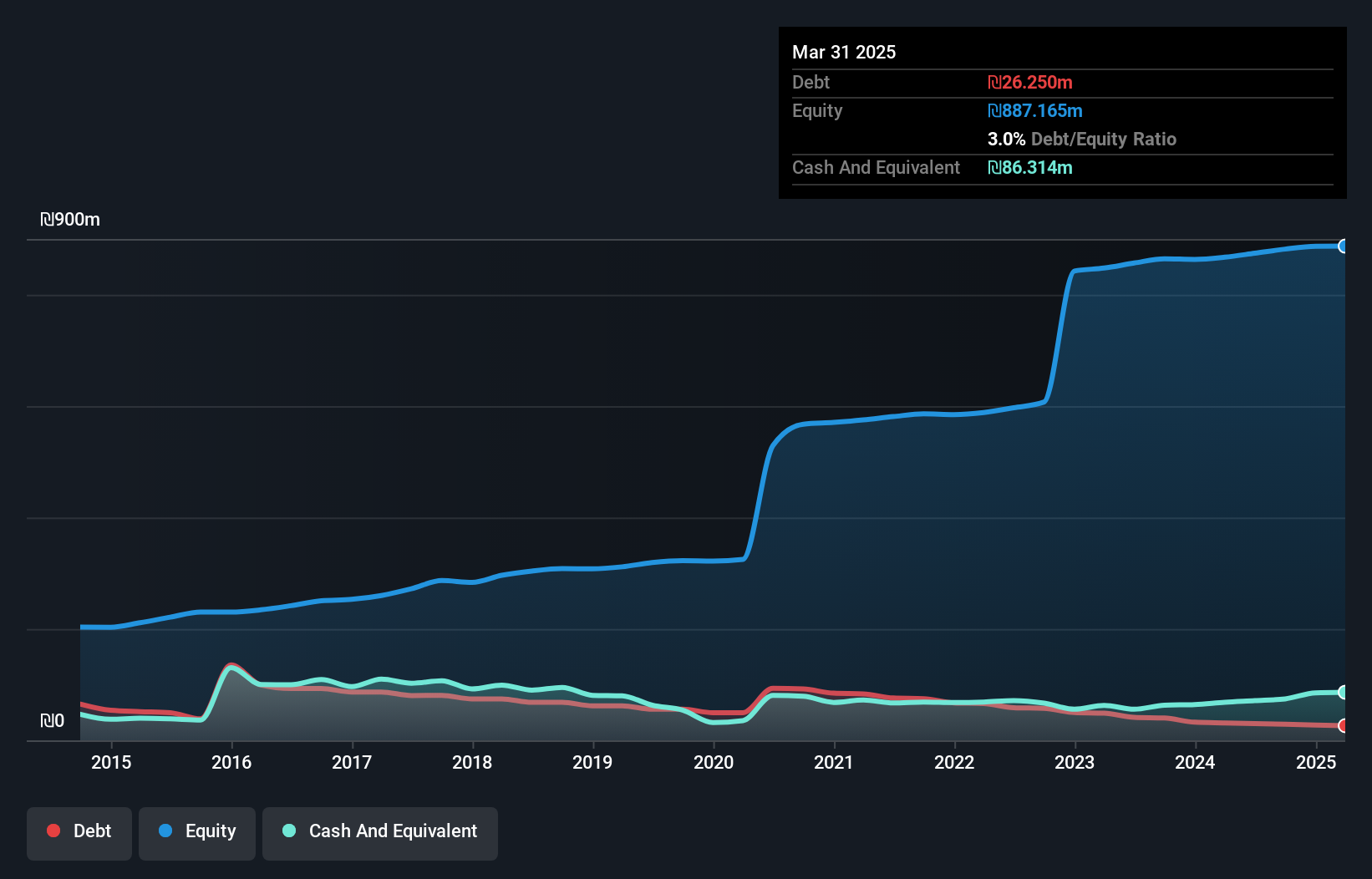

Gold Bond Group (TASE:GOLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gold Bond Group Ltd. specializes in providing storage, conveyance, and logistical solutions for cargoes and containers with a market capitalization of ₪826.42 million.

Operations: Gold Bond Group Ltd. generates revenue primarily from Free Activities (₪89.80 million), FCL Terminal Operations (₪68.95 million), LCL Terminal Operations (₪53.97 million), and Ecommerce Activity (₪14.88 million).

Gold Bond Group, a promising player in the Middle East, has seen its debt to equity ratio drop significantly from 17.6% to 2.8% over five years, indicating strong financial management. Despite a yearly earnings decline of 7.9%, recent performance is encouraging with a robust annual earnings growth of 40.6%, outpacing the infrastructure sector's average growth of 5.5%. Recent reports show sales for Q2 at ILS 62.79 million, up from ILS 43.1 million last year, and net income rising to ILS 6.38 million from ILS 5.94 million, highlighting its potential for continued success in the region's market landscape.

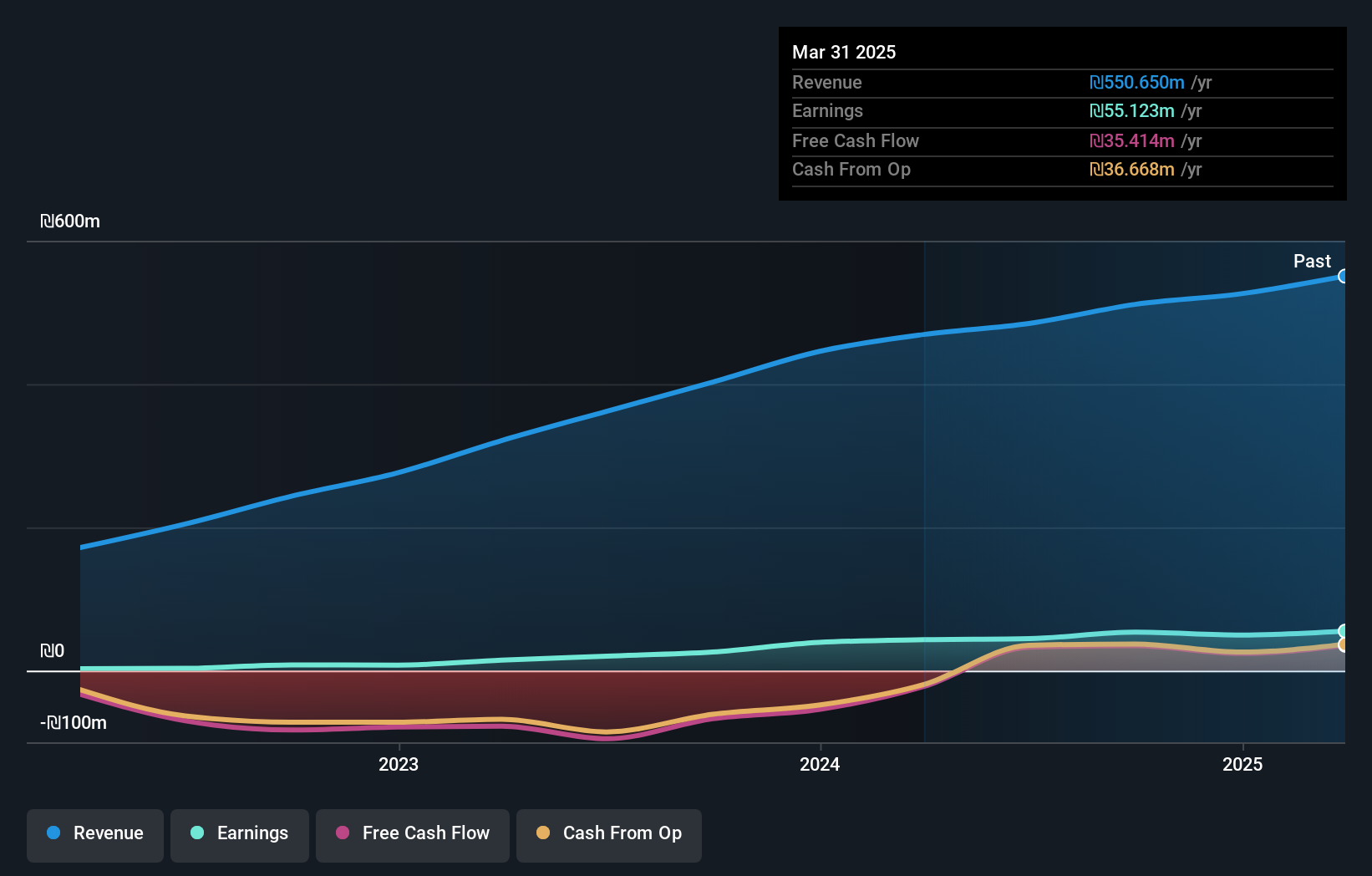

More Provident Funds (TASE:MPP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: More Provident Funds Ltd. manages provident and pension funds in Israel with a market cap of ₪1.93 billion.

Operations: The company generates revenue primarily from the Provident Sector (₪539.64 million) and Pension segment (₪31.73 million).

More Provident Funds, a financial entity in the Middle East, demonstrates robust performance with earnings growth of 42% over the past year. The company's interest payments are well covered by EBIT, showing a coverage ratio of 13.5 times. Over five years, its debt to equity ratio has improved from 104% to 70%, indicating prudent financial management. Recent results highlight revenue of ILS 150.87 million for Q2 2025 compared to ILS 119.86 million last year, with net income rising from ILS 8.27 million to ILS 16.71 million during the same period, reflecting strong operational efficiency and profitability gains amidst market volatility.

- Dive into the specifics of More Provident Funds here with our thorough health report.

Gain insights into More Provident Funds' past trends and performance with our Past report.

Where To Now?

- Embark on your investment journey to our 207 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MPP

Solid track record with adequate balance sheet.

Market Insights

Community Narratives