- Switzerland

- /

- Insurance

- /

- SWX:VAHN

Unearthing February 2025's Undiscovered Gems on None

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are grappling with geopolitical tensions and consumer spending concerns, leading to declines in major indices like the S&P 500. Amid this backdrop of uncertainty, investors are increasingly seeking opportunities in small-cap stocks that demonstrate resilience and potential for growth despite broader economic challenges. Identifying such undiscovered gems requires a keen eye for companies with strong fundamentals and innovative strategies that can navigate the current market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.92% | 8.23% | 18.26% | ★★★★★★ |

| Intelligent Wave | NA | 7.78% | 15.50% | ★★★★★★ |

| Kyoritsu Electric | 7.58% | 3.45% | 12.53% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yashima Denki | 2.71% | -1.00% | 18.12% | ★★★★★★ |

| Toyo Kanetsu K.K | 33.97% | 3.33% | 18.20% | ★★★★★☆ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Loadstar Capital K.K | 244.76% | 17.29% | 21.16% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Reysas Tasimacilik ve Lojistik Ticaret (IBSE:RYSAS)

Simply Wall St Value Rating: ★★★★★★

Overview: Reysas Tasimacilik ve Lojistik Ticaret A.S. operates as a logistics and transportation company in Turkey, with a market capitalization of TRY38.10 billion.

Operations: RYSAS generates revenue primarily from its Transportation Storage Logistics Services, which contributed TRY4.77 billion, and Real Estate Rental Activities, adding TRY3.29 billion. The Vehicle Inspection Service Activities segment also plays a significant role with TRY1.10 billion in revenue.

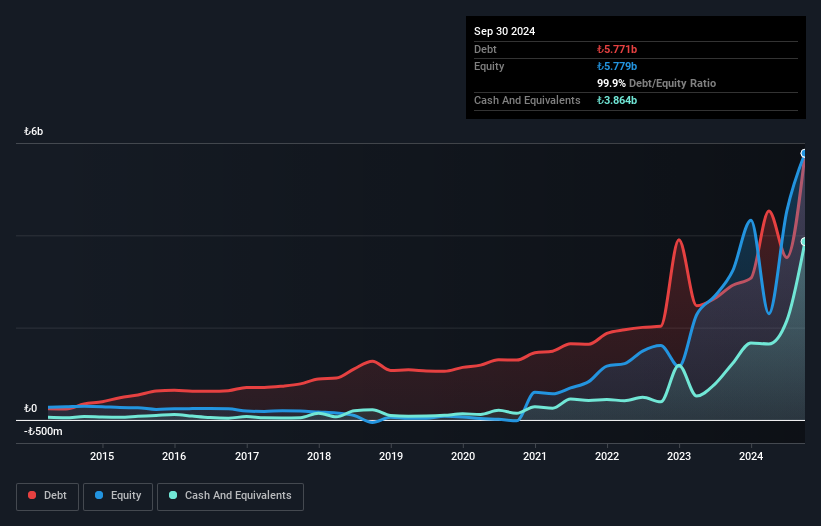

Reysas, a logistics company, has shown impressive earnings growth of 215% over the past year, outpacing the industry average of 6.7%. This growth is supported by a significant reduction in its debt to equity ratio from 1351.9% to 99.9% over five years, reflecting improved financial health. The company's net debt to equity ratio stands at a satisfactory 33%, and its interest payments are well-covered with an EBIT coverage of 4.6x. Despite these strengths, Reysas's share price has been highly volatile recently and it remains free cash flow negative as of now.

- Click to explore a detailed breakdown of our findings in Reysas Tasimacilik ve Lojistik Ticaret's health report.

Understand Reysas Tasimacilik ve Lojistik Ticaret's track record by examining our Past report.

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vaudoise Assurances Holding SA offers a range of insurance products and services primarily in Switzerland, with a market capitalization of CHF1.47 billion.

Operations: Revenue streams for Vaudoise Assurances Holding SA are derived from its insurance products and services offered in Switzerland. The company operates with a market capitalization of CHF1.47 billion.

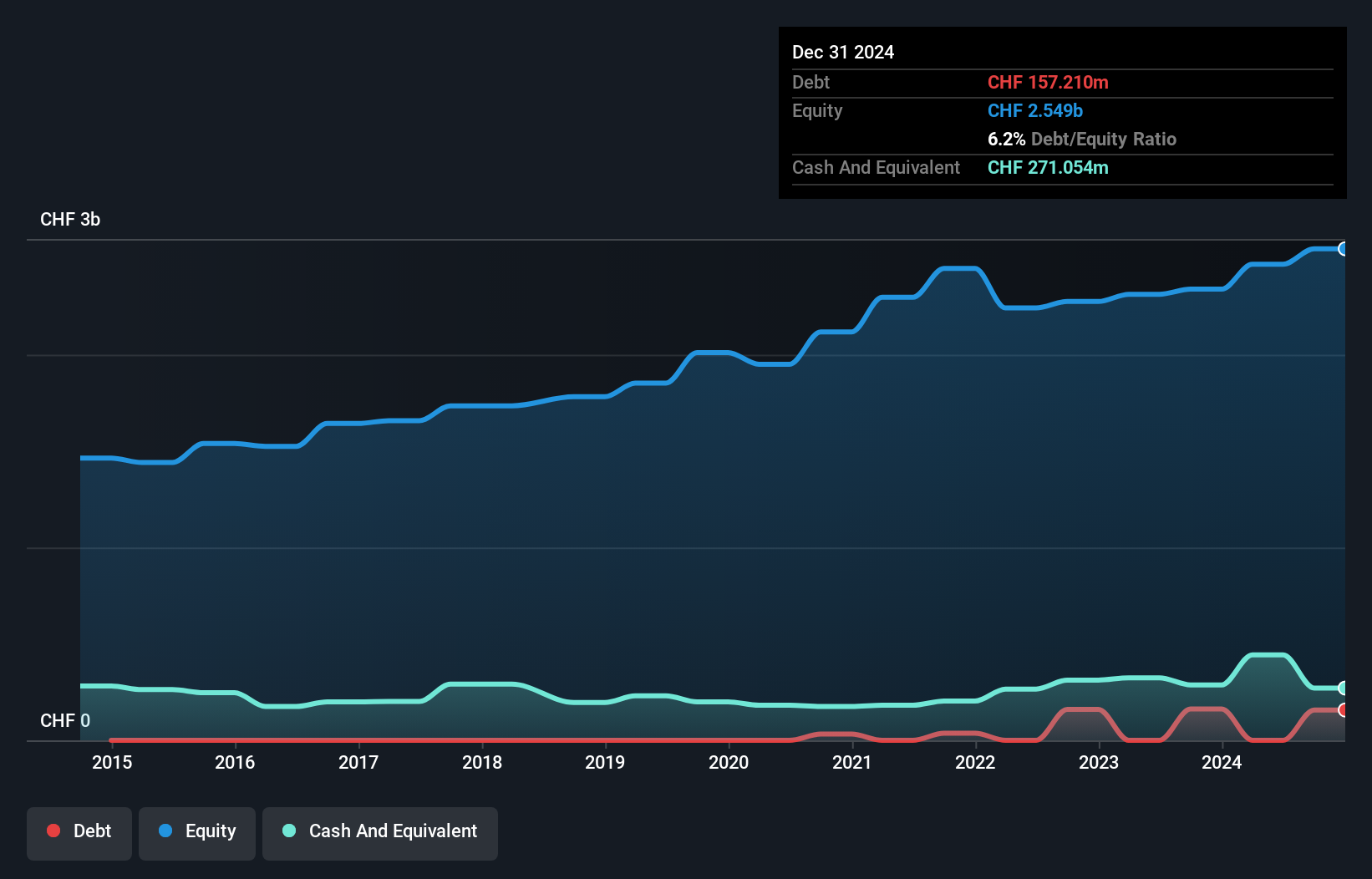

Vaudoise Assurances Holding, a player in the insurance sector, stands out with its robust financial health. The company boasts high-quality earnings and is entirely debt-free, which eliminates concerns about interest coverage. Impressively, Vaudoise's earnings growth of 7% over the past year surpasses the industry average of 3%. Trading at a notable discount of 57% below its estimated fair value suggests potential undervaluation. Additionally, their free cash flow remains positive and consistent, with recent figures showing US$210 million as of June 2024. This financial stability positions Vaudoise well within its industry landscape despite being relatively under-the-radar.

- Get an in-depth perspective on Vaudoise Assurances Holding's performance by reading our health report here.

Gain insights into Vaudoise Assurances Holding's past trends and performance with our Past report.

El Al Israel Airlines (TASE:ELAL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: El Al Israel Airlines Ltd., along with its subsidiaries, offers passenger and cargo transportation services and has a market capitalization of ₪5.28 billion.

Operations: The airline's primary revenue stream comes from passenger aircraft, generating $3.12 billion, followed by cargo aircraft at $78.81 million. Gross profit margin trends are noteworthy for their fluctuations over recent periods.

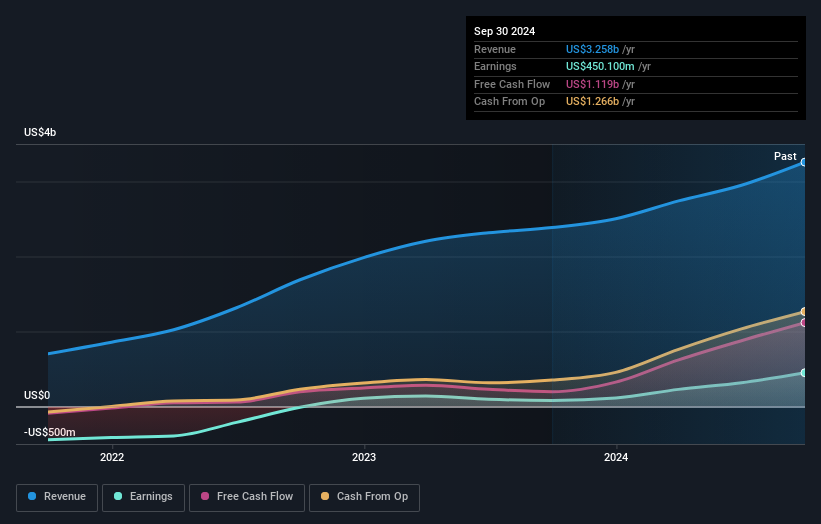

El Al Israel Airlines, a notable player in the airline sector, has shown remarkable financial improvement. Over the last five years, its debt to equity ratio decreased significantly from 561% to 247%, showcasing effective debt management. The company's earnings surged by 454% over the past year, outpacing the broader airline industry growth of 56%. Trading at a substantial discount of around 97% below its estimated fair value suggests potential undervaluation. Despite recent volatility in share price and shareholder dilution concerns, El Al's interest payments are well-covered with an EBIT coverage of 6x, indicating robust financial health.

- Delve into the full analysis health report here for a deeper understanding of El Al Israel Airlines.

Explore historical data to track El Al Israel Airlines' performance over time in our Past section.

Summing It All Up

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4749 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VAHN

Vaudoise Assurances Holding

Provides insurance products and services primarily in Switzerland.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives