- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NYAX

3 Stocks Estimated To Be Undervalued By Up To 44.9%

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indices like the Nasdaq reaching record highs while others decline, investors are closely watching central bank decisions and economic indicators that suggest potential shifts in monetary policy. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities amidst fluctuating market conditions. A good stock to consider is one that not only appears undervalued based on fundamental analysis but also has the potential for resilience or growth despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.70 | CN¥11.35 | 49.8% |

| Hanwha Systems (KOSE:A272210) | ₩20850.00 | ₩41692.30 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.92 | CA$11.83 | 50% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP579.00 | 49.9% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| Compagnia dei Caraibi (BIT:TIME) | €0.542 | €1.08 | 50% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.28 | 49.9% |

| Fnac Darty (ENXTPA:FNAC) | €29.45 | €58.67 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.00 | CN¥125.29 | 49.7% |

Here's a peek at a few of the choices from the screener.

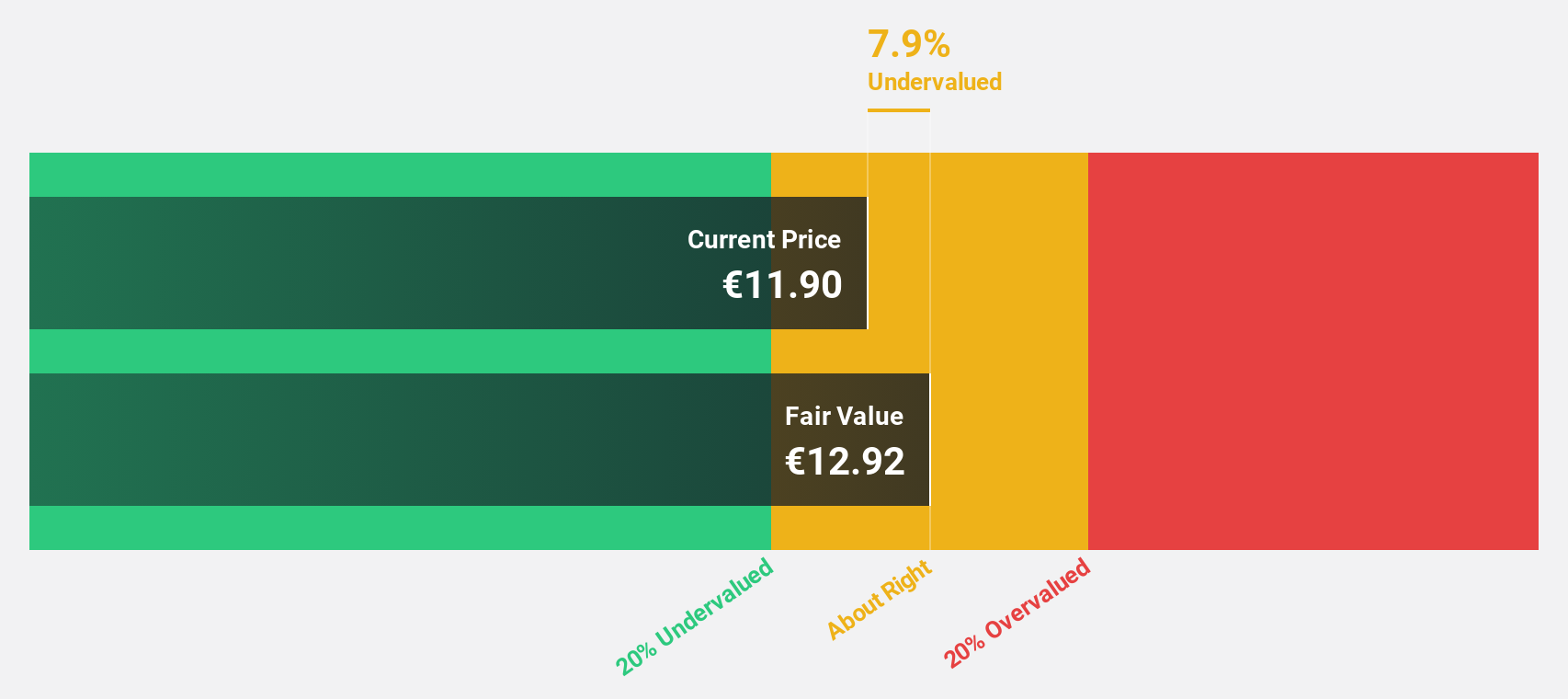

Arteche Lantegi Elkartea (BME:ART)

Overview: Arteche Lantegi Elkartea, S.A. specializes in designing, manufacturing, integrating, and supplying electrical equipment and solutions for renewable energies and smart grids globally, with a market cap of €384.66 million.

Operations: The company's revenue is divided into three main segments: Network Reliability (€48.70 million), Systems Measurement and Monitoring (€304.31 million), and Automation of Transmission and Distribution Networks (€85.32 million).

Estimated Discount To Fair Value: 43.5%

Arteche Lantegi Elkartea is trading at €6.75, significantly below its estimated fair value of €11.94, highlighting its potential undervaluation based on cash flows. Despite high debt levels and recent share price volatility, the company's earnings have grown by 70.1% over the past year and are forecast to grow significantly at 28.8% per year—outpacing both revenue growth and the broader Spanish market's profit growth expectations.

- Upon reviewing our latest growth report, Arteche Lantegi Elkartea's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Arteche Lantegi Elkartea stock in this financial health report.

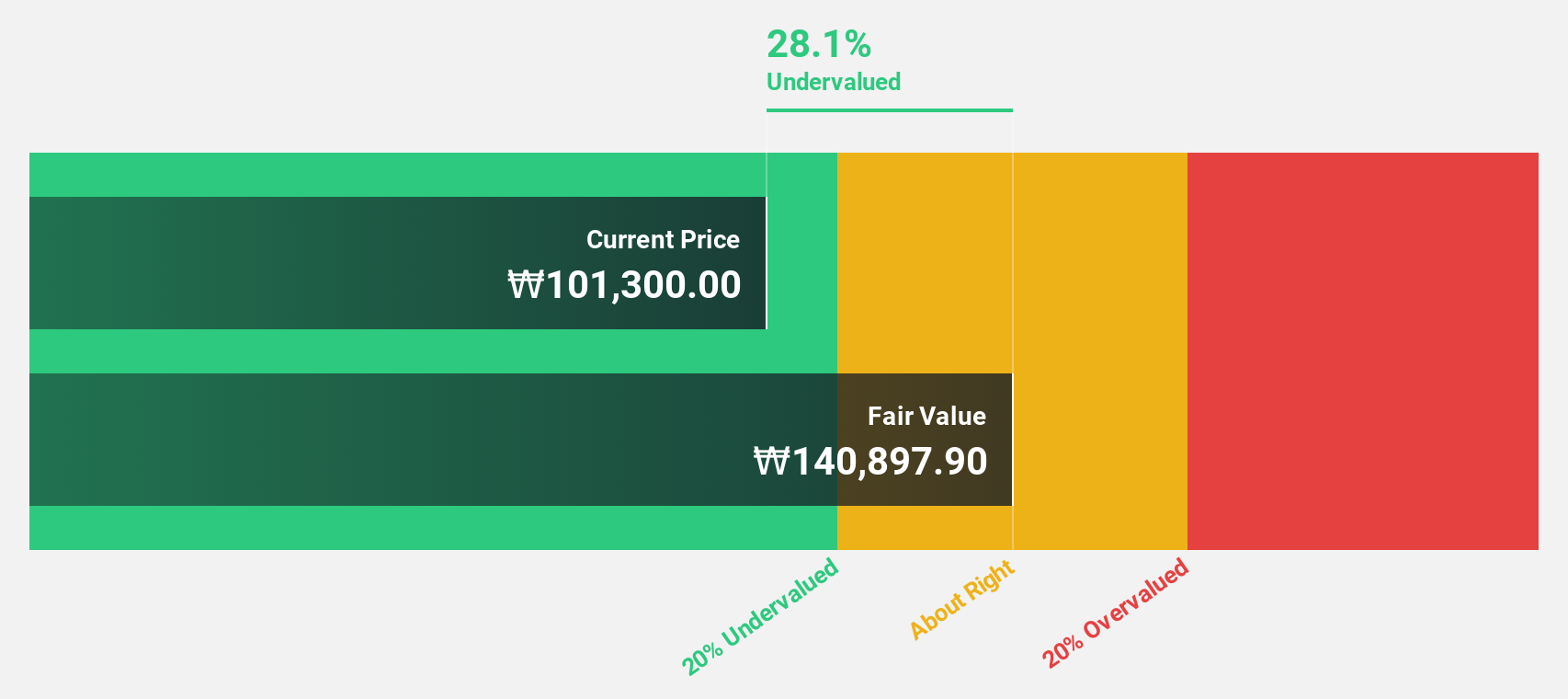

HD Hyundai Construction Equipment (KOSE:A267270)

Overview: HD Hyundai Construction Equipment Co., Ltd. operates in the construction equipment industry and has a market cap of ₩1.10 trillion.

Operations: The company's revenue is primarily derived from its Construction Machinery & Equipment segment, amounting to ₩3.49 billion.

Estimated Discount To Fair Value: 41.3%

HD Hyundai Construction Equipment is trading at ₩62,000, significantly below its estimated fair value of ₩105,684.17. Despite a decline in recent earnings and profit margins from 4.2% to 1.4%, the company's earnings are forecast to grow substantially at 40.3% annually over the next three years, outpacing both revenue growth and the broader Korean market's profit growth expectations. Revenue is expected to increase by 5.7% per year, surpassing market averages slightly.

- In light of our recent growth report, it seems possible that HD Hyundai Construction Equipment's financial performance will exceed current levels.

- Click here to discover the nuances of HD Hyundai Construction Equipment with our detailed financial health report.

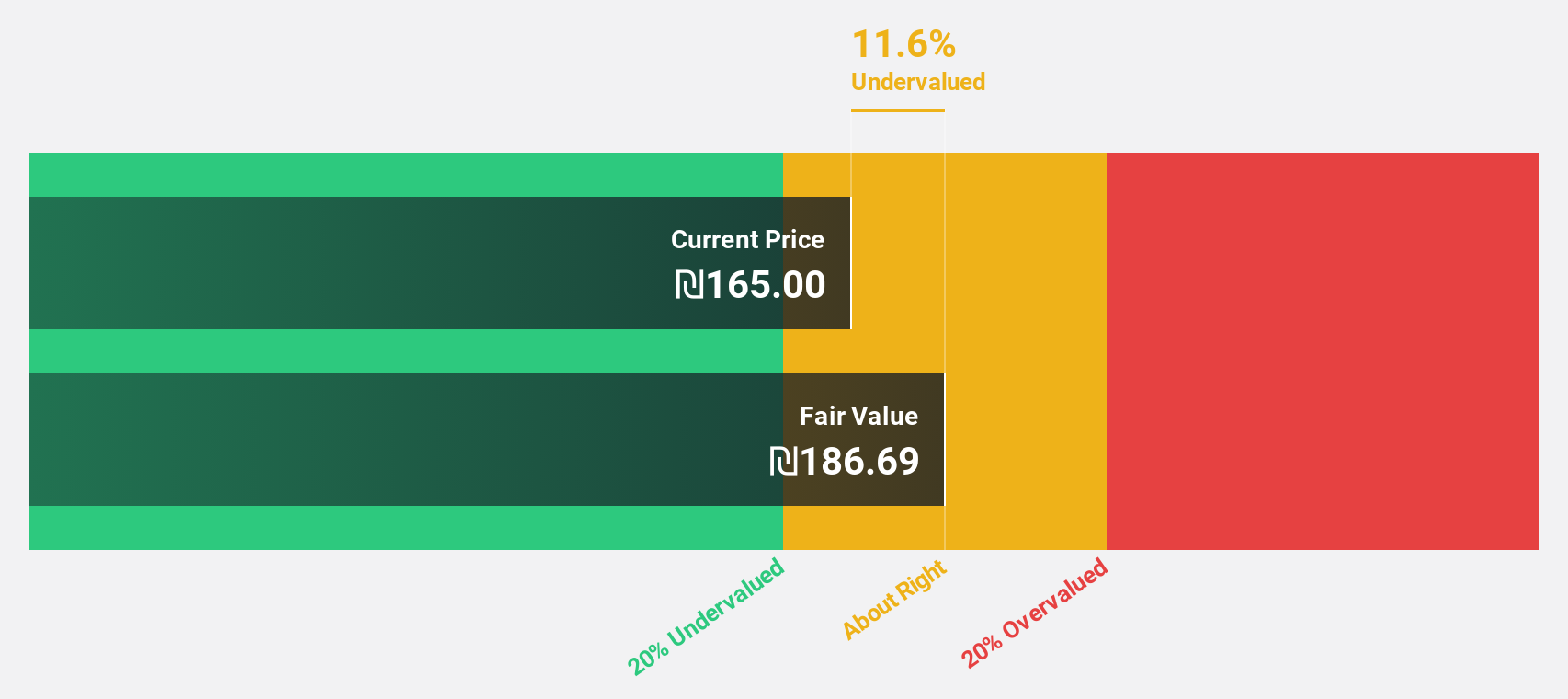

Nayax (TASE:NYAX)

Overview: Nayax Ltd. is a fintech company that provides a system and payment platform for multiple retailers across the United States, Europe, the United Kingdom, Australia, Israel, and other regions worldwide with a market cap of ₪3.64 billion.

Operations: The company's revenue from Internet Software and Services amounts to $291.65 million.

Estimated Discount To Fair Value: 44.9%

Nayax is trading at ₪100.4, significantly below its estimated fair value of ₪182.22, indicating potential undervaluation based on cash flows. The company forecasts robust revenue growth of 23% annually, outpacing the IL market average. Recent collaborations with Discover® Global Network and product expansions into new European markets enhance growth prospects. Despite past shareholder dilution and a revised revenue guidance for 2024 due to certification delays, Nayax's profitability outlook remains strong over the next three years.

- Our expertly prepared growth report on Nayax implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Nayax.

Key Takeaways

- Explore the 885 names from our Undervalued Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nayax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NYAX

Nayax

A fintech company, operates system and payment platform for multiple retailers in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world.

High growth potential with excellent balance sheet.