- Israel

- /

- Electronic Equipment and Components

- /

- TASE:EEAM-M

Strong week for Ecoppia Scientific (TLV:ECPA-M) shareholders doesn't alleviate pain of three-year loss

This week we saw the Ecoppia Scientific Ltd (TLV:ECPA-M) share price climb by 13%. But over the last three years we've seen a quite serious decline. Indeed, the share price is down a tragic 98% in the last three years. So it is really good to see an improvement. Perhaps the company has turned over a new leaf. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Ecoppia Scientific

Ecoppia Scientific recorded just US$3,018,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Ecoppia Scientific will significantly advance the business plan before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. It certainly is a dangerous place to invest, as Ecoppia Scientific investors might realise.

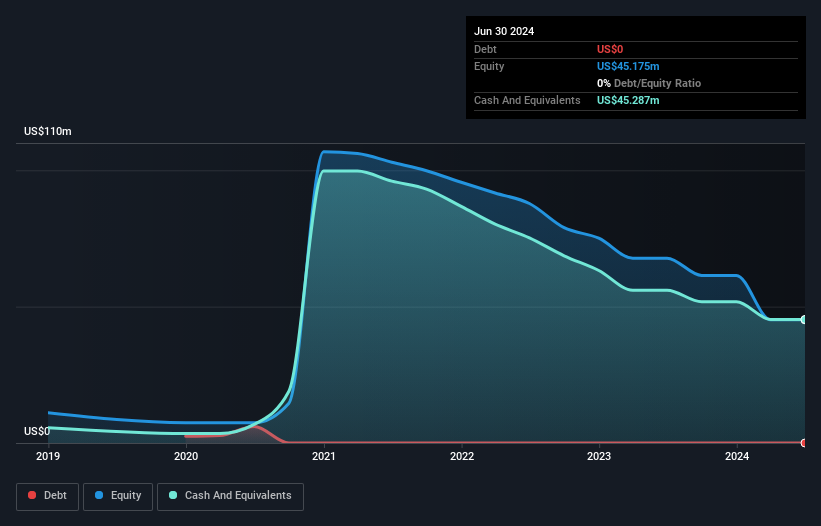

When it last reported its balance sheet in June 2024, Ecoppia Scientific could boast a strong position, with cash in excess of all liabilities of US$45m. That allows management to focus on growing the business, and not worry too much about raising capital. But since the share price has dropped 26% per year, over 3 years , it seems like the market might have been over-excited previously. You can see in the image below, how Ecoppia Scientific's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Ecoppia Scientific the TSR over the last 3 years was -58%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Over the last year Ecoppia Scientific shareholders have received a TSR of 10%. It's always nice to make money but this return falls short of the market return which was about 34% for the year. On the bright side, that's certainly better than the yearly loss of about 17% endured over the last three years, implying that the company is doing better recently. We hope the turnaround in fortunes continues. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Ecoppia Scientific (3 can't be ignored) that you should be aware of.

We will like Ecoppia Scientific better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're here to simplify it.

Discover if E.E.A.M.I might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:EEAM-M

E.E.A.M.I

Engages in the development, sale, and maintenance of robotic cleaning solutions for PV modules in Israel, India, and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives