As major Gulf markets experience gains amid anticipation of U.S. tariff decisions and geopolitical tensions, investors are keenly observing the Middle Eastern stock landscape for opportunities. In this environment, dividend stocks can offer a compelling blend of income and potential stability, making them an attractive consideration for enhancing your portfolio.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Commercial Bank of Dubai PSC (DFM:CBD) | 7.20% | ★★★★★★ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.46% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.82% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.95% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.30% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.68% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.80% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.46% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.38% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.21% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top Middle Eastern Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Riyad Bank (SASE:1010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riyad Bank offers banking and investment services in the Kingdom of Saudi Arabia with a market capitalization of SAR92.85 billion.

Operations: Riyad Bank's revenue segments include Riyad Capital at SAR987.19 million, Retail Banking at SAR4.09 billion, Corporate Banking at SAR8.25 billion, and Treasury and Investment at SAR2.33 billion.

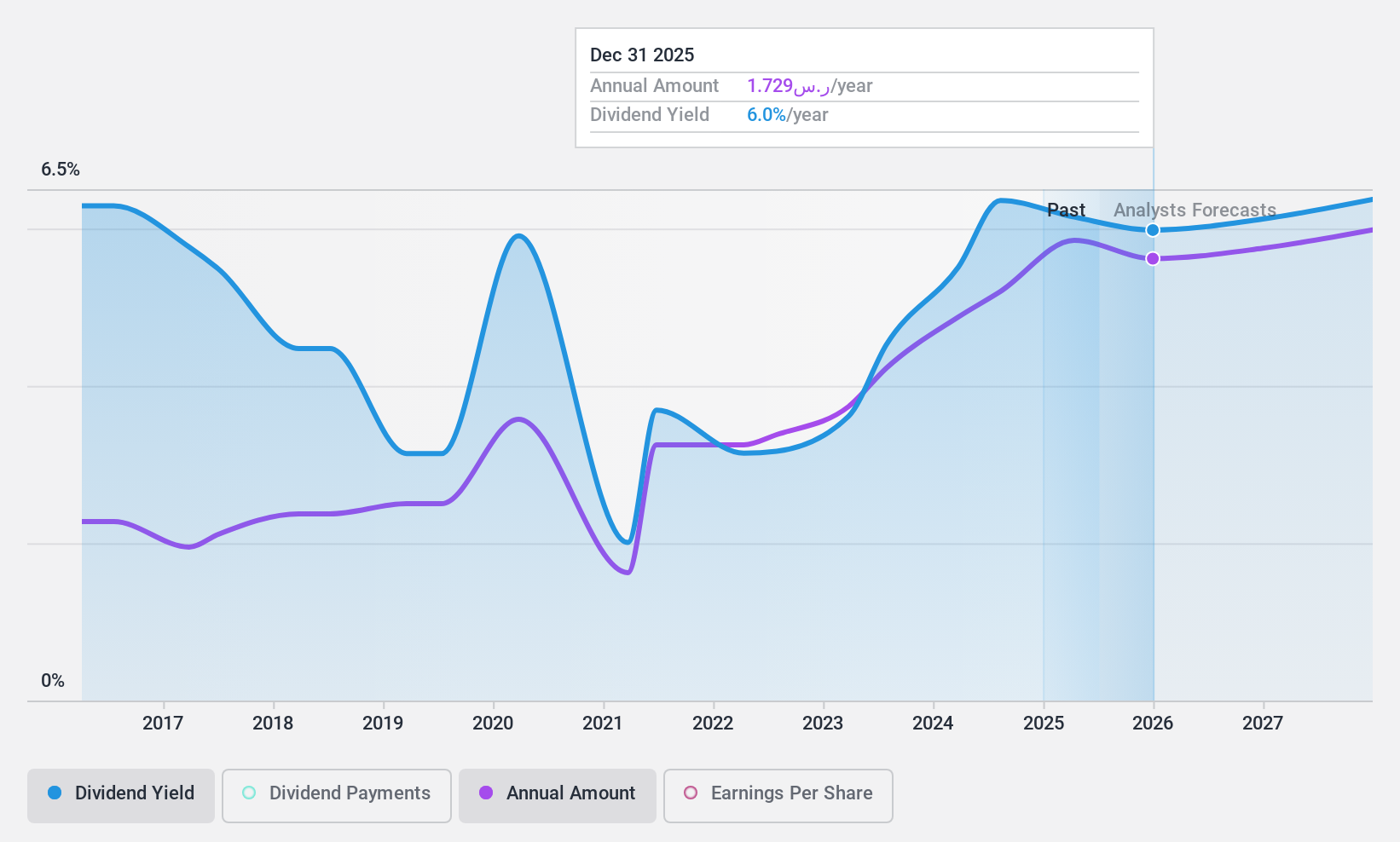

Dividend Yield: 5.8%

Riyad Bank's dividend yield is among the top 25% in Saudi Arabia, supported by a payout ratio of 56.5%, indicating dividends are covered by earnings. However, its dividend history has been volatile over the past decade. Recent earnings show net income growth to SAR 9.32 billion for 2024, up from SAR 8.05 billion in 2023, suggesting improved financial health which may support future dividends despite historical volatility concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Riyad Bank.

- According our valuation report, there's an indication that Riyad Bank's share price might be on the expensive side.

Saudi Telecom (SASE:7010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Telecom Company, with a market cap of SAR222.17 billion, operates in telecommunications, information, media, and digital payment services both within the Kingdom of Saudi Arabia and internationally through its subsidiaries.

Operations: Saudi Telecom's revenue is primarily driven by its main segment, Saudi Telecom Company, contributing SAR49.64 billion, followed by significant contributions from Saudi Telecom Channels Company at SAR15.11 billion and Arabian Internet and Communications Services Company at SAR12.06 billion; other notable segments include STC Bahrain with SAR1.93 billion, Center 3 with SAR1.91 billion, STC Bank with SAR1.26 billion, Kuwait Telecommunications Company at SAR4.11 billion, Advanced Technology and Cybersecurity Company (Sirar) generating SAR732.68 million, Gulf Digital Media Model Company LTD (Intigral) contributing SAR686 million, Public Telecommunications Company (Specialized) at SAR371.76 million, SCCC providing SAR187.90 million in revenue and Iot adding another SAR301.43 million to the total revenue mix.

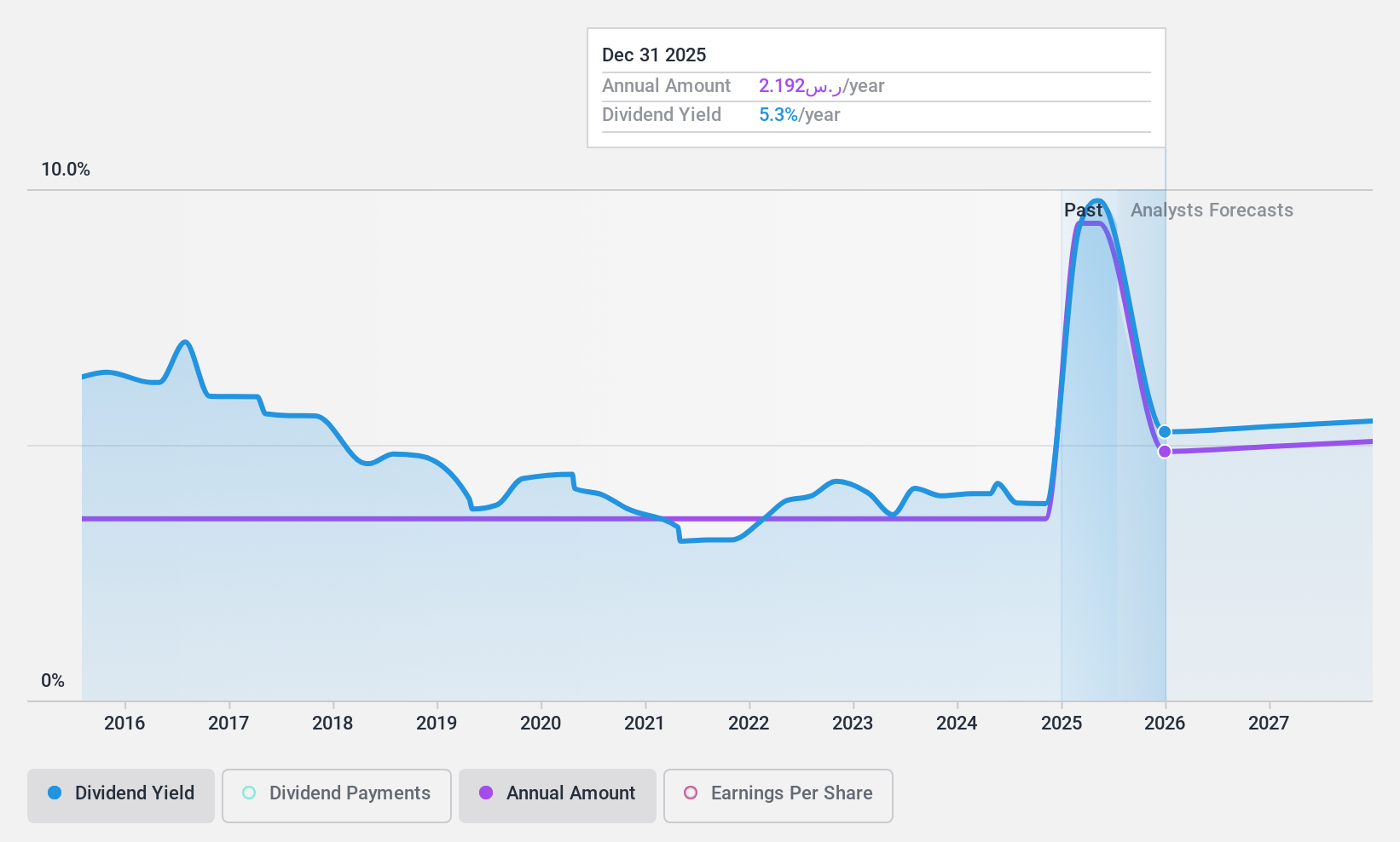

Dividend Yield: 9.4%

Saudi Telecom's dividends have been stable and growing over the past decade, placing its yield in the top 25% of Saudi Arabian dividend payers. Despite this, a high cash payout ratio of 257.9% indicates dividends are not well covered by free cash flows, though earnings do cover them at an 81.4% payout ratio. Recent enhancements in network infrastructure and strong financial performance with net income rising to SAR 24.69 billion may support future payouts despite coverage concerns.

- Dive into the specifics of Saudi Telecom here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Saudi Telecom is trading beyond its estimated value.

Arad (TASE:ARD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arad Ltd. designs, develops, manufactures, and sells water systems in Israel and internationally with a market cap of ₪1.22 billion.

Operations: Arad Ltd. generates revenue through its design, development, manufacturing, and sales of water systems both domestically and globally.

Dividend Yield: 3.6%

Arad Ltd.'s dividend yield of 3.6% is below the top 25% in the IL market, and its dividend history has been volatile, with significant annual drops. Despite this instability, dividends are covered by earnings and cash flows with payout ratios of 51.7% and 54.5%, respectively. Recent earnings showed sales growth to US$394.04 million, though net income decreased to US$24.29 million, suggesting financial pressures that may impact future dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Arad.

- Our comprehensive valuation report raises the possibility that Arad is priced lower than what may be justified by its financials.

Key Takeaways

- Reveal the 63 hidden gems among our Top Middle Eastern Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ARD

Arad

Designs, develops, manufactures, and sells water systems in Israel and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives