- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:GMPC

Exploring Three Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

The Middle East market has recently experienced varied performances across its major Gulf markets, with influences such as oil oversupply fears and geopolitical developments impacting investor sentiment. As these dynamics unfold, identifying promising stocks in this region requires a keen understanding of how companies can navigate such challenges and leverage potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.51% | 29.05% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Gulf Medical Projects Company (PJSC) (ADX:GMPC)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Medical Projects Company (PJSC) operates hospitals in the United Arab Emirates and has a market capitalization of AED 1.45 billion.

Operations: Gulf Medical Projects Company generates revenue primarily from health services, amounting to AED 677.34 million, with additional income from investments totaling AED 31.16 million.

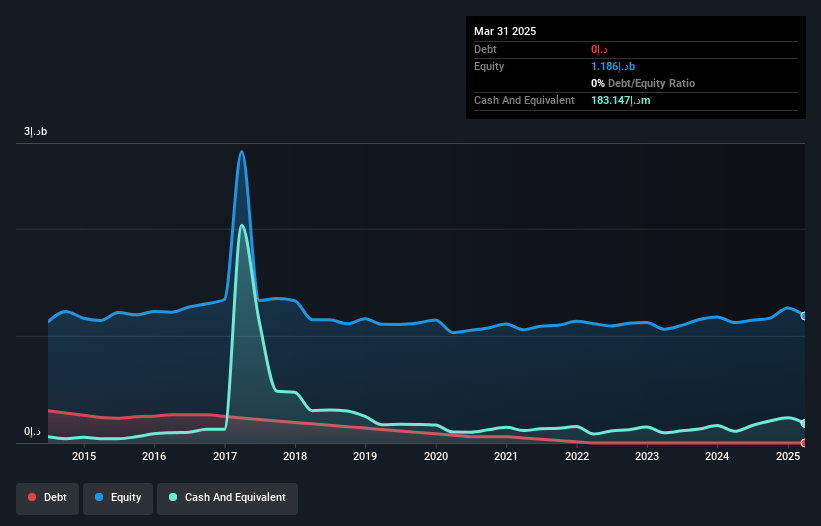

Gulf Medical Projects Company (PJSC) showcases a promising profile with its earnings surging by 30% over the past year, outpacing the healthcare industry's 6%. This debt-free entity has improved its financial health from five years ago when it had a debt-to-equity ratio of 7.5%. Its price-to-earnings ratio stands at 18.6x, which is slightly below the industry average of 19.9x, indicating potential value for investors. Despite recent share price volatility, GMPC reported solid Q1 results with sales reaching AED 180 million and net income climbing to AED 22 million from AED16 million last year.

Aksigorta (IBSE:AKGRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Aksigorta A.S. is a Turkish company offering a range of life and non-life insurance products and services to both retail and business clients, with a market capitalization of TRY10.40 billion.

Operations: Aksigorta's primary revenue streams are derived from Motor Vehicles (TRY5.82 billion) and Motor Vehicles Liability insurance (TRY3.67 billion). The company's net profit margin is a key financial metric to consider when evaluating its profitability.

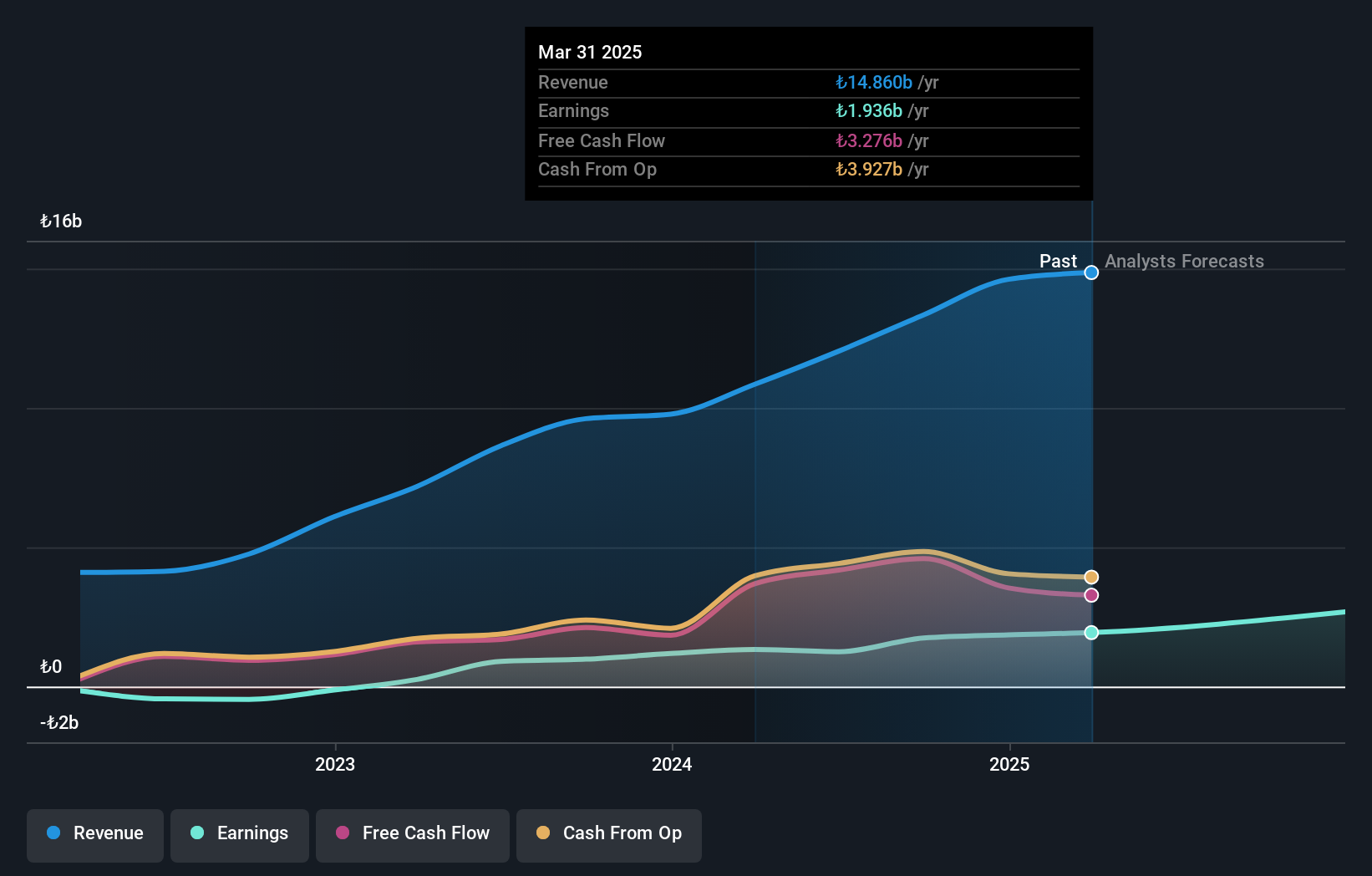

Aksigorta, a notable player in the insurance sector, has been making waves with its impressive financial performance. The company posted a robust earnings growth of 56.7% over the past year, outpacing the industry average of 50.4%. This growth is supported by its high-quality earnings and debt-free status, which marks an improvement from five years ago when it had a debt to equity ratio of 6.8%. With a price-to-earnings ratio at just 5.6x compared to the TR market's 19.2x, Aksigorta seems attractively valued for investors seeking potential opportunities in emerging markets like Turkey.

- Click here to discover the nuances of Aksigorta with our detailed analytical health report.

Examine Aksigorta's past performance report to understand how it has performed in the past.

One Software Technologies (TASE:ONE)

Simply Wall St Value Rating: ★★★★★★

Overview: One Software Technologies Ltd, with a market cap of ₪5.62 billion, offers a range of software, hardware, and integration services.

Operations: With a market cap of ₪5.62 billion, One Software Technologies generates revenue primarily from Technological Solutions and Services, Management Consulting, and Value-Added Services (₪2.49 billion), followed by Infrastructure and Computing Solutions (₪1.22 billion), and Outsourcing of Business Processes and Technological Support Centers (₪316 million).

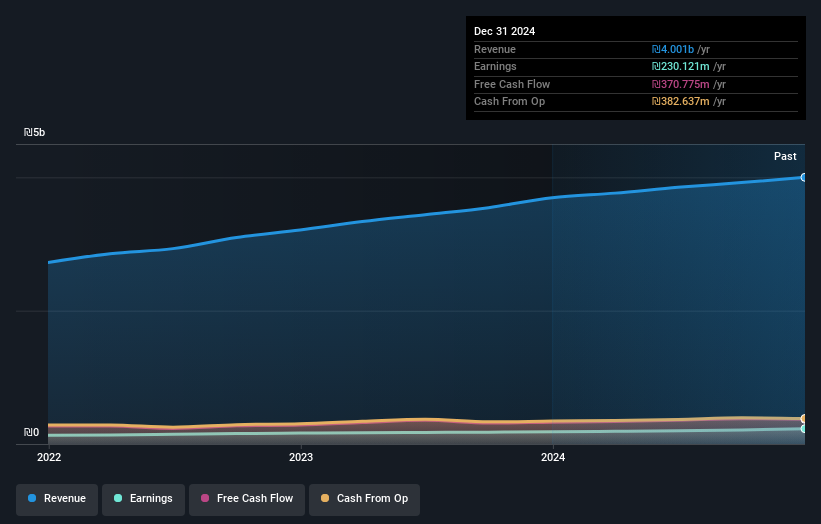

With a notable reduction in debt to equity from 51.2% to 24.8% over five years, One Software Technologies demonstrates solid financial management. The company's earnings growth of 26.5% outpaced the IT industry's 24.5%, showcasing its competitive edge in a dynamic sector. Its EBIT covers interest payments 23 times over, indicating robust profitability and financial health. Last year, net income rose to ILS 230 million from ILS 182 million previously, while earnings per share increased from ILS 2.54 to ILS 3.22, reflecting strong operational performance and shareholder value enhancement in this small cap gem's journey forward.

- Navigate through the intricacies of One Software Technologies with our comprehensive health report here.

Evaluate One Software Technologies' historical performance by accessing our past performance report.

Next Steps

- Unlock our comprehensive list of 242 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:GMPC

Gulf Medical Projects Company (PJSC)

Manages hospitals in the United Arab Emirates.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives