Undiscovered Gems in Middle East Stocks to Explore December 2025

Reviewed by Simply Wall St

As Gulf markets remain subdued due to weak oil prices and investors await key U.S. economic data, the Middle East's stock landscape presents a unique opportunity for exploration. In this environment, identifying promising stocks involves looking for companies with strong fundamentals and resilience to external pressures, making them potential undiscovered gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

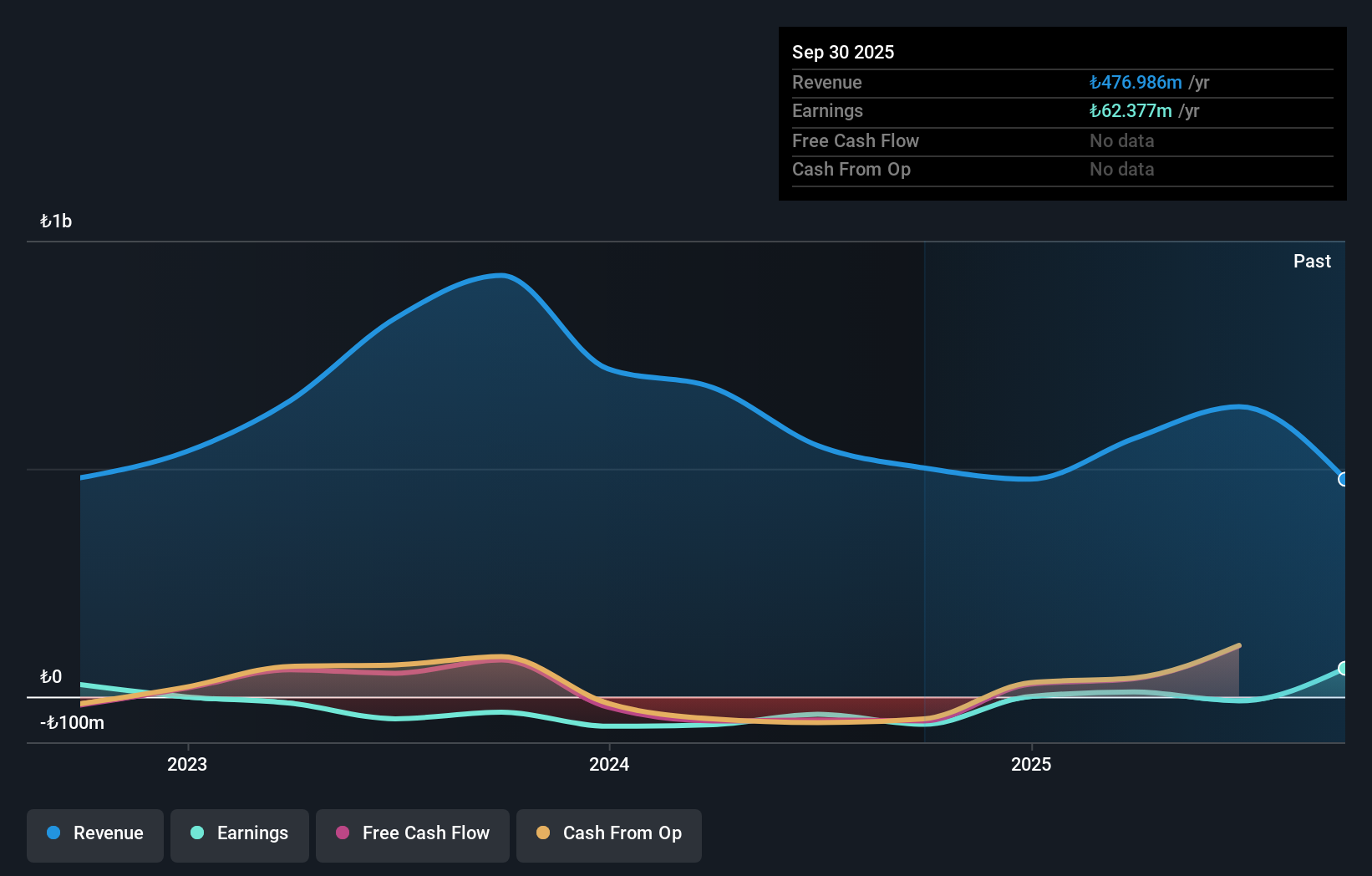

Tera Finansal Yatirimlar Holding (IBSE:TRHOL)

Simply Wall St Value Rating: ★★★★★★

Overview: Tera Finansal Yatirimlar Holding A.S. is involved in investment activities within Turkey and has a market capitalization of TRY18.92 billion.

Operations: Tera Finansal Yatirimlar Holding A.S. generates revenue through its investment activities in Turkey. The company has a market capitalization of TRY18.92 billion, indicating its substantial presence in the Turkish financial market.

Tera Finansal Yatirimlar Holding, a nimble player in the financial sector, recently turned profitable, outperforming the Capital Markets industry which saw a -5.2% growth. With no debt on its books for over five years, interest coverage isn't an issue here. However, a significant one-off loss of TRY30.5 million impacted recent financial results as of September 2025. Despite this hiccup and some share price volatility over the past three months, Tera's ability to generate positive free cash flow remains intact, hinting at potential stability and resilience in its operations moving forward.

- Unlock comprehensive insights into our analysis of Tera Finansal Yatirimlar Holding stock in this health report.

Understand Tera Finansal Yatirimlar Holding's track record by examining our Past report.

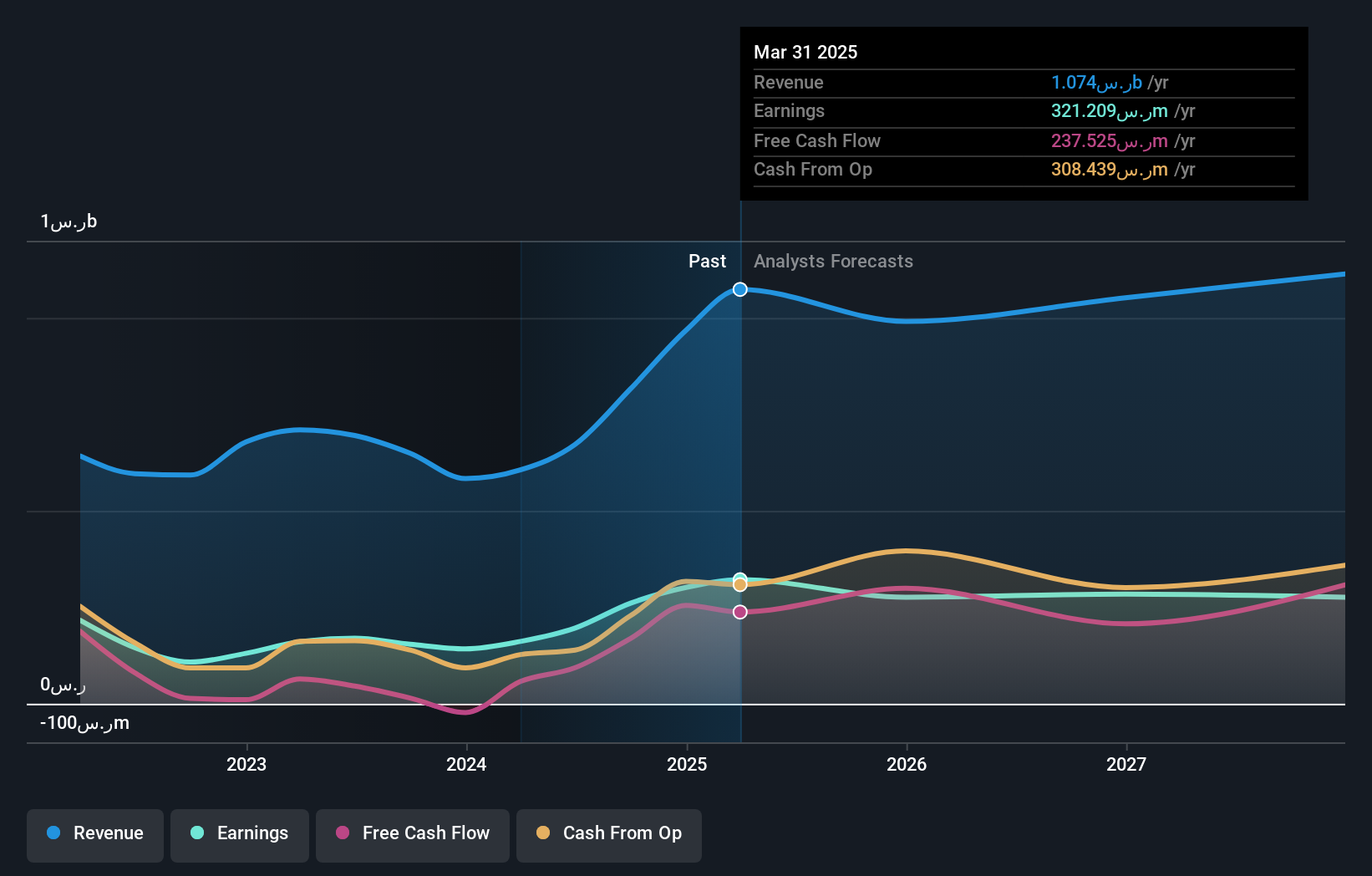

Qassim Cement (SASE:3040)

Simply Wall St Value Rating: ★★★★★★

Overview: Qassim Cement Company operates in the Kingdom of Saudi Arabia, focusing on the manufacture and sale of cement, with a market capitalization of SAR4.61 billion.

Operations: The company generates revenue primarily from the manufacturing and selling of cement, amounting to SAR1.15 billion.

Qassim Cement, a notable player in the Middle East's cement industry, has demonstrated resilience despite some recent challenges. Over the past year, its earnings grew by 11%, outpacing the Basic Materials sector's -4% performance. The company operates debt-free and trades at 31% below its estimated fair value, suggesting potential undervaluation. However, earnings have seen an annual decline of 11% over five years. Recent financials reveal third-quarter sales of SAR 246 million with net income at SAR 41 million compared to SAR 66 million last year. A quarterly dividend of SAR 0.80 per share further highlights shareholder returns amidst fluctuating profits.

- Navigate through the intricacies of Qassim Cement with our comprehensive health report here.

Assess Qassim Cement's past performance with our detailed historical performance reports.

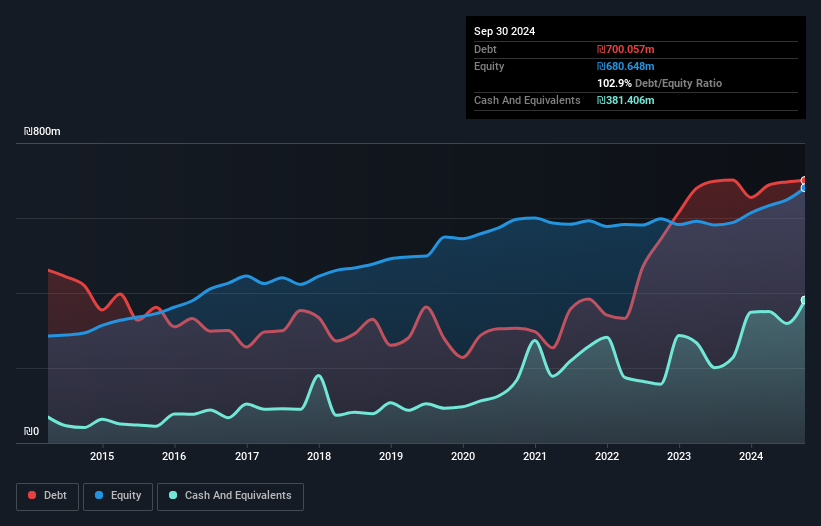

Malam - Team (TASE:MLTM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Malam - Team Ltd is an Israeli company that offers a range of information technology services, with a market capitalization of ₪2.91 billion.

Operations: Malam - Team Ltd generates revenue primarily from Infrastructure and Cloud services (₪2.31 billion) and Software, Projects, and Business Solutions (₪1.47 billion). The company also earns from Payroll Service, Human Resources, and Long-Term Savings (₪335.90 million), along with a minor contribution from its Establishment and Investment Sector in Start-Up Companies (₪4.86 million).

Malam - Team, a notable player in the IT sector, recently reported impressive sales of ILS 1.12 billion for Q3 2025, up from ILS 909.55 million the previous year. Net income also saw an increase to ILS 33.17 million compared to last year’s ILS 31.02 million, reflecting steady growth despite not outpacing industry earnings growth of 14.4%. The company boasts high-quality past earnings and maintains positive free cash flow, yet its net debt to equity ratio stands at a high 42.8%. Interest payments are well covered by EBIT at a multiple of 3.8x, indicating sound financial management amidst rising debt levels over five years from a net debt to equity ratio of 51.2% to now nearly doubling at 98.6%.

- Click here to discover the nuances of Malam - Team with our detailed analytical health report.

Evaluate Malam - Team's historical performance by accessing our past performance report.

Where To Now?

- Access the full spectrum of 182 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MLTM

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026