Computer Direct Group Ltd. (TLV:CMDR) Will Pay A ₪4.50 Dividend In Three Days

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Computer Direct Group Ltd. (TLV:CMDR) is about to trade ex-dividend in the next three days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. Therefore, if you purchase Computer Direct Group's shares on or after the 7th of December, you won't be eligible to receive the dividend, when it is paid on the 16th of December.

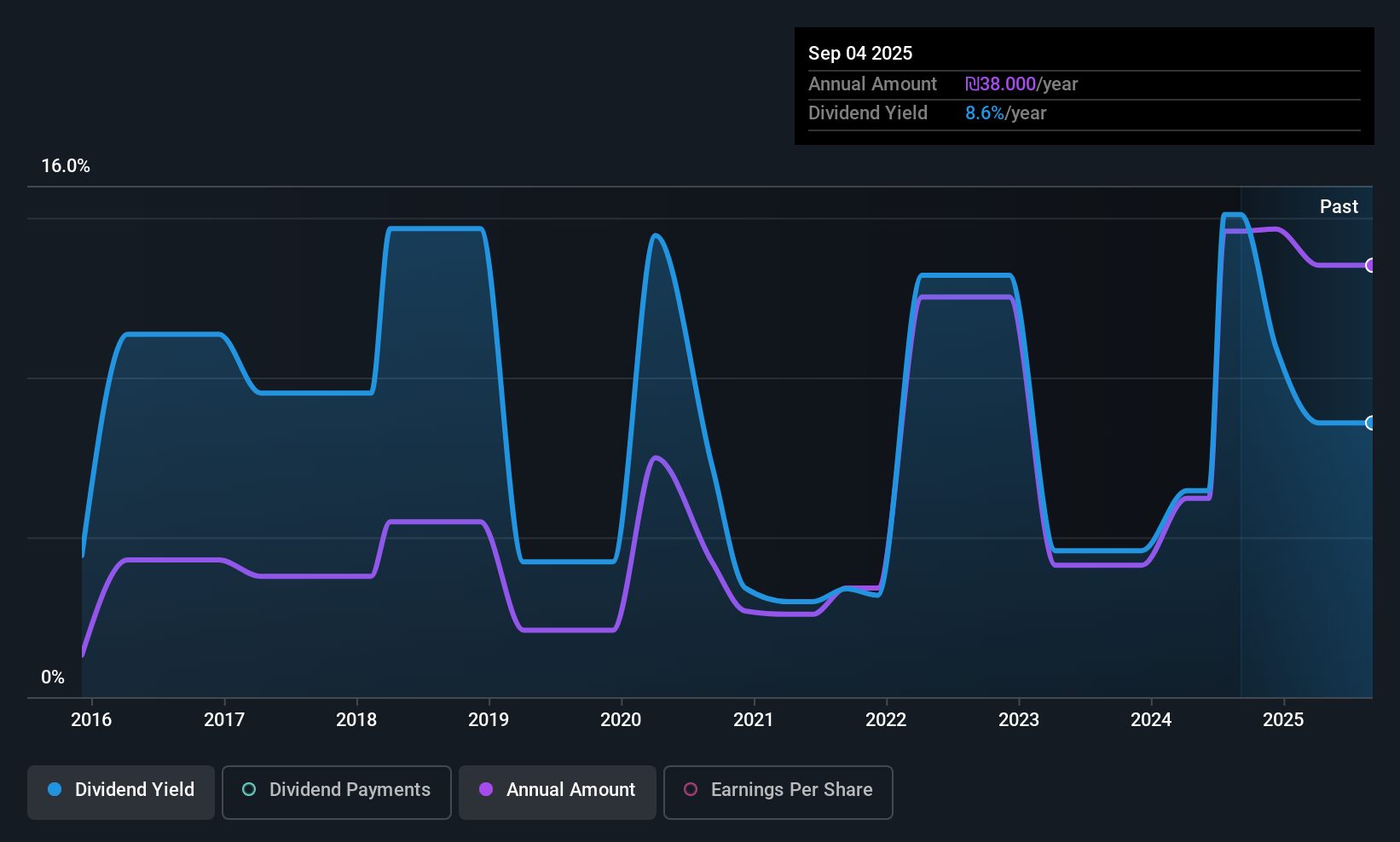

The company's upcoming dividend is ₪4.50 a share, following on from the last 12 months, when the company distributed a total of ₪38.00 per share to shareholders. Last year's total dividend payments show that Computer Direct Group has a trailing yield of 8.1% on the current share price of ₪469.10. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Computer Direct Group can afford its dividend, and if the dividend could grow.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Computer Direct Group distributed an unsustainably high 132% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. The good news is it paid out just 14% of its free cash flow in the last year.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Computer Direct Group fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Check out our latest analysis for Computer Direct Group

Click here to see how much of its profit Computer Direct Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Computer Direct Group's earnings have been skyrocketing, up 20% per annum for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Computer Direct Group has delivered 26% dividend growth per year on average over the past 10 years. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

Final Takeaway

Is Computer Direct Group worth buying for its dividend? Earnings per share have been rising nicely although, even though its cashflow payout ratio is low, we question why Computer Direct Group is paying out so much of its profit. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

While it's tempting to invest in Computer Direct Group for the dividends alone, you should always be mindful of the risks involved. Case in point: We've spotted 1 warning sign for Computer Direct Group you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:CMDR

Computer Direct Group

Engages in the computing and software business in Israel.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026