- Israel

- /

- Capital Markets

- /

- TASE:SPRG

If You Like EPS Growth Then Check Out Spring Ventures (TLV:SPRG) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Spring Ventures (TLV:SPRG), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Spring Ventures

How Fast Is Spring Ventures Growing Its Earnings Per Share?

Over the last three years, Spring Ventures has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Spring Ventures's EPS shot from ₪0.35 to ₪1.01, over the last year. You don't see 193% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

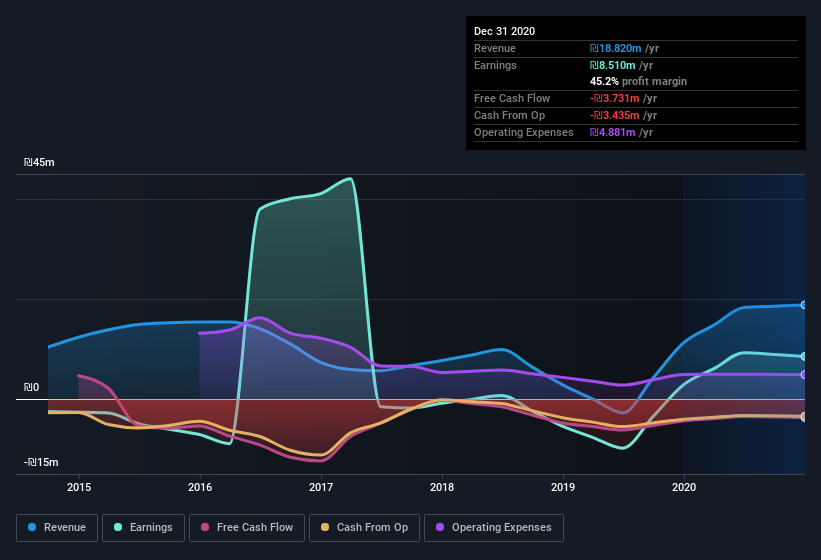

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Spring Ventures's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Spring Ventures shareholders can take confidence from the fact that EBIT margins are up from 56% to 74%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Spring Ventures is no giant, with a market capitalization of ₪122m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Spring Ventures Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Spring Ventures insiders own a meaningful share of the business. In fact, they own 53% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about ₪65m riding on the stock, at current prices. That's nothing to sneeze at!

Is Spring Ventures Worth Keeping An Eye On?

Spring Ventures's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Spring Ventures is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. We don't want to rain on the parade too much, but we did also find 3 warning signs for Spring Ventures (1 can't be ignored!) that you need to be mindful of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:SPRG

Spring Ventures

A venture capital firm specializes in Seed stage, Series A stage and early stage investments.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026