- Israel

- /

- Specialty Stores

- /

- TASE:RTLS

Retailors Ltd's (TLV:RTLS) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Most readers would already be aware that Retailors' (TLV:RTLS) stock increased significantly by 20% over the past month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Retailors' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Retailors

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Retailors is:

12% = ₪112m ÷ ₪942m (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every ₪1 worth of equity, the company was able to earn ₪0.12 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Retailors' Earnings Growth And 12% ROE

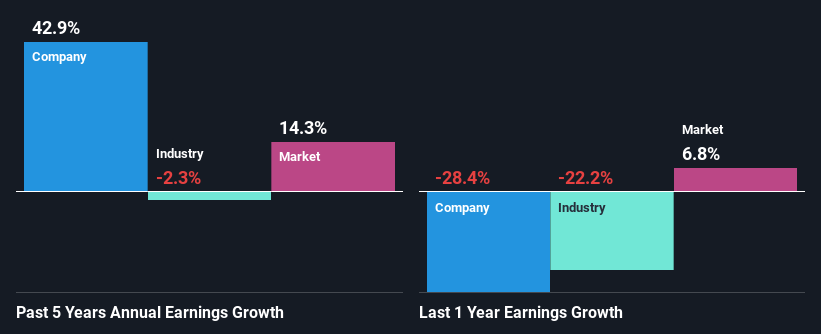

To begin with, Retailors seems to have a respectable ROE. Even when compared to the industry average of 12% the company's ROE looks quite decent. This probably goes some way in explaining Retailors' significant 43% net income growth over the past five years amongst other factors. We reckon that there could also be other factors at play here. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that the growth figure reported by Retailors compares quite favourably to the industry average, which shows a decline of 2.3% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Retailors is trading on a high P/E or a low P/E, relative to its industry.

Is Retailors Using Its Retained Earnings Effectively?

The high three-year median payout ratio of 98% (implying that it keeps only 1.9% of profits) for Retailors suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Besides, Retailors has been paying dividends over a period of three years. This shows that the company is committed to sharing profits with its shareholders.

Conclusion

In total, it does look like Retailors has some positive aspects to its business. Namely, its high earnings growth, which was likely due to its high ROE. However, investors could have benefitted even more from the high ROE, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining hardly any of its profits. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of Retailors' past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:RTLS

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives