Discovering Undiscovered Gems with Promising Potential This February 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by fluctuating indices and geopolitical uncertainties, investors are increasingly attentive to the performance of small-cap stocks, particularly in the wake of mixed earnings reports and AI competition concerns. Amidst this backdrop, identifying stocks with robust fundamentals and growth potential becomes crucial for those seeking opportunities beyond the mainstream market narratives.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Petrolimex Insurance | 32.25% | 4.70% | 7.91% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Telink Semiconductor(Shanghai)Co.Ltd (SHSE:688591)

Simply Wall St Value Rating: ★★★★★☆

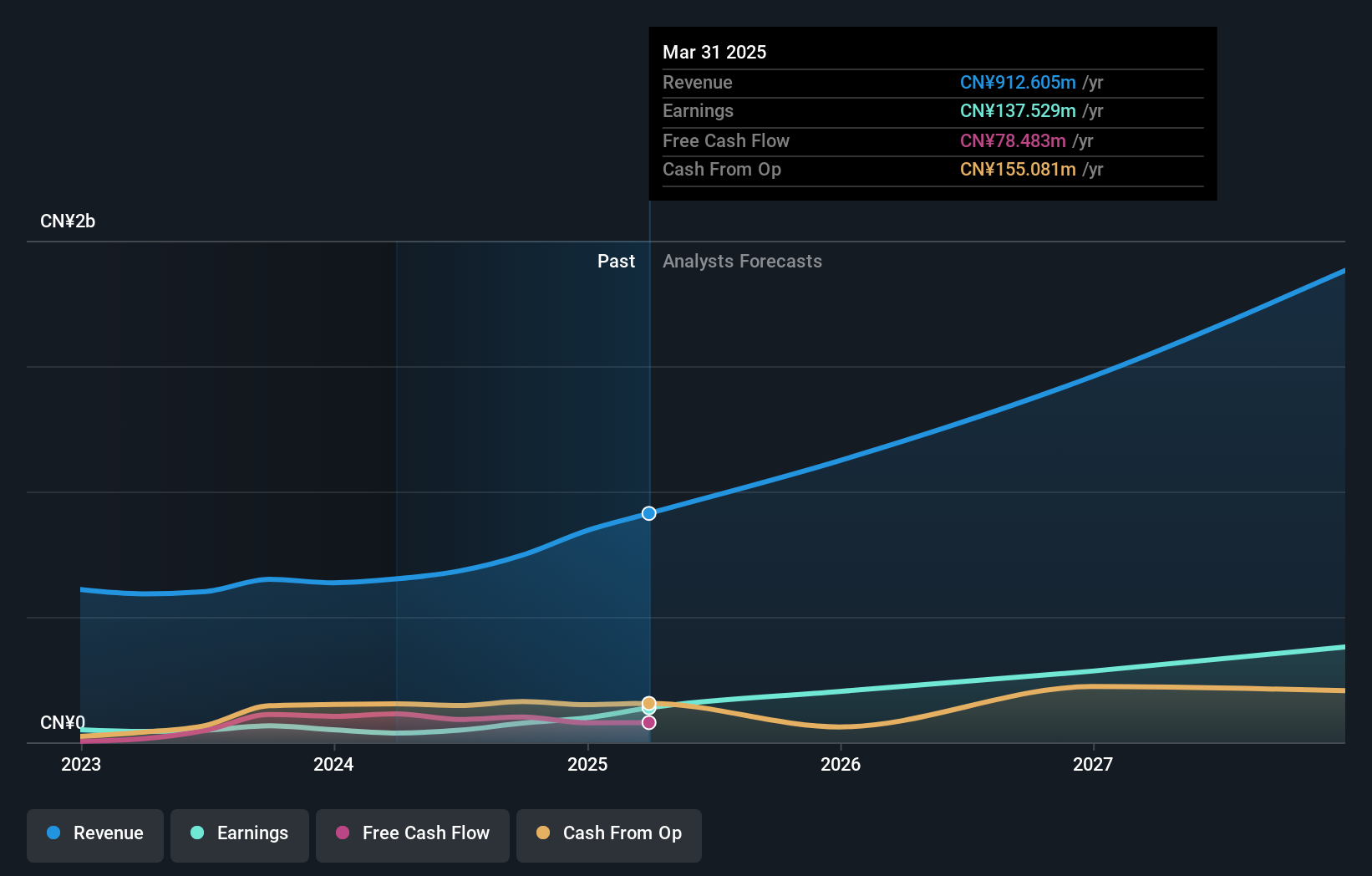

Overview: Telink Semiconductor(Shanghai)Co.,Ltd. focuses on the research, development, design, and sales of low-power wireless IoT chips with a market capitalization of CN¥8.75 billion.

Operations: Telink generates revenue primarily from its semiconductor segment, amounting to CN¥747.24 million.

Telink Semiconductor, a notable player in the semiconductor industry, has demonstrated impressive earnings growth of 16.5% over the past year, surpassing the industry's 12.9%. The company seems to be on solid financial footing with more cash than total debt and positive free cash flow. However, its share price has been highly volatile recently. A significant one-off gain of CN¥24.9 million impacted recent financial results as of September 2024. Contributing to shareholder value, Telink repurchased 1,108,298 shares for CN¥29.55 million in late 2024 as part of an ongoing buyback program totaling CN¥92.96 million for over four million shares repurchased since February 2024.

- Take a closer look at Telink Semiconductor(Shanghai)Co.Ltd's potential here in our health report.

Understand Telink Semiconductor(Shanghai)Co.Ltd's track record by examining our Past report.

Max Stock (TASE:MAXO)

Simply Wall St Value Rating: ★★★★★☆

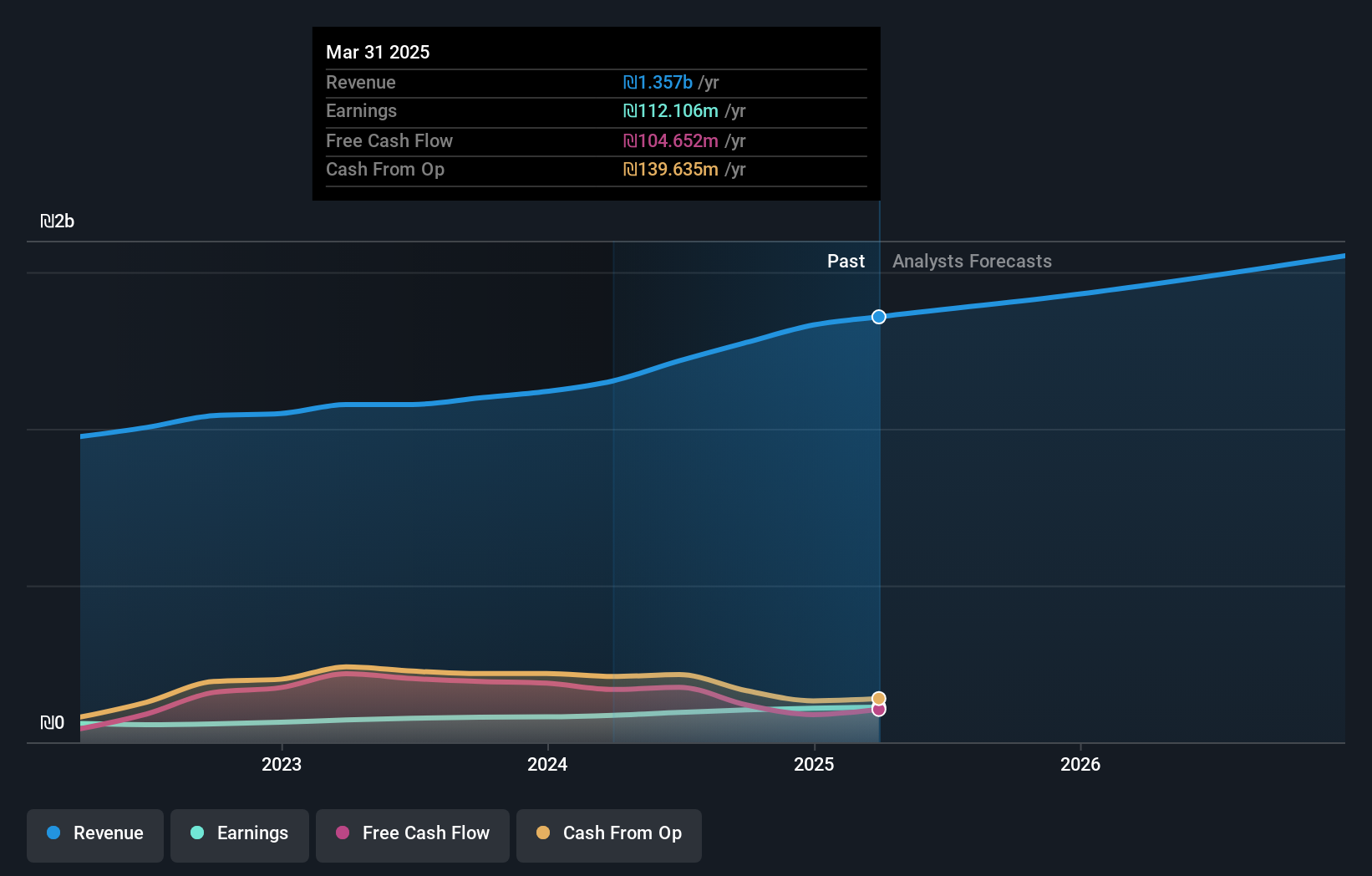

Overview: Max Stock Ltd. operates a chain of discount stores in Israel with a market cap of ₪1.87 billion.

Operations: Max Stock Ltd. generates revenue primarily through its retail trade segment, which accounts for ₪1.28 billion.

Max Stock, a notable player in the retail sector, has shown impressive financial resilience. With earnings growing by 29.4% last year, it outpaced the industry average of 9.3%. The company's debt-to-equity ratio plummeted from 269.9% to just 6.9% over five years, reflecting prudent financial management. Its interest payments are well covered with an EBIT coverage of 7.9 times, indicating strong operational performance. The price-to-earnings ratio stands at 18x, offering better value compared to the industry average of 22.9x and suggesting potential for growth given its forecasted revenue increase of around 7% annually in ILS terms.

- Click to explore a detailed breakdown of our findings in Max Stock's health report.

Examine Max Stock's past performance report to understand how it has performed in the past.

S&B Foods (TSE:2805)

Simply Wall St Value Rating: ★★★★★★

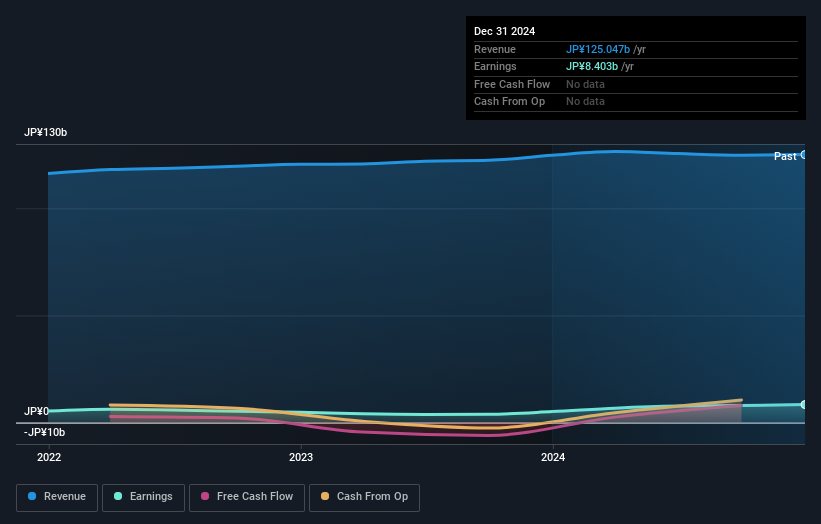

Overview: S&B Foods Inc. is a Japanese company specializing in the production and sale of spices, herbs, instant foods, and spicy seasonings with a market cap of ¥65.25 billion.

Operations: S&B Foods generates revenue through the manufacture and sale of spices, herbs, instant foods, and spicy seasonings. The company focuses its operations primarily in Japan.

S&B Foods, a nimble player in the food sector, has showcased impressive earnings growth of 64.1% over the past year, outpacing the industry's 21.5%. Their debt-to-equity ratio has sharply decreased from 85.6% to 32.4% in five years, reflecting prudent financial management. With a net debt to equity ratio at a satisfactory 14.4%, they are comfortably covering interest obligations and generating positive free cash flow. Trading at about two-thirds below its fair value estimate suggests potential undervaluation, while high-quality earnings underpin its robust financial health amidst industry competition.

- Delve into the full analysis health report here for a deeper understanding of S&B Foods.

Explore historical data to track S&B Foods' performance over time in our Past section.

Taking Advantage

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4710 more companies for you to explore.Click here to unveil our expertly curated list of 4713 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MAXO

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives