- Israel

- /

- Specialty Stores

- /

- TASE:CRSM

These 4 Measures Indicate That Carasso Motors (TLV:CRSO) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Carasso Motors Ltd. (TLV:CRSO) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Carasso Motors

How Much Debt Does Carasso Motors Carry?

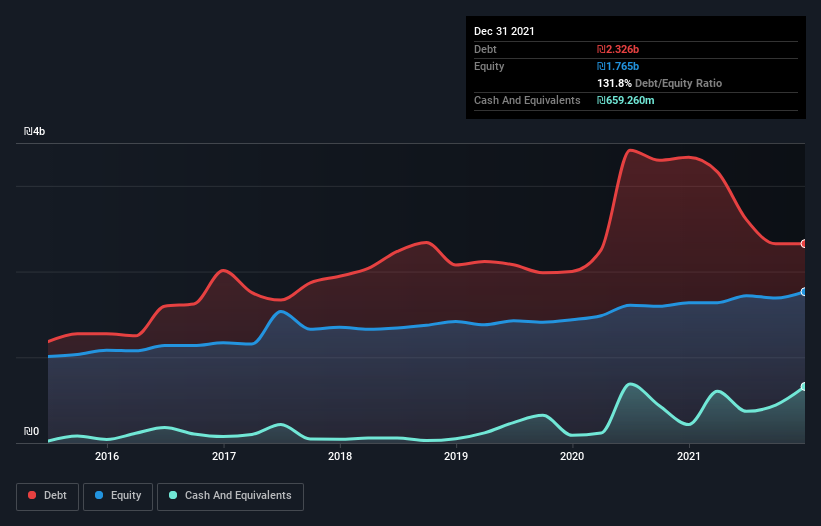

The image below, which you can click on for greater detail, shows that Carasso Motors had debt of ₪2.33b at the end of December 2021, a reduction from ₪3.33b over a year. On the flip side, it has ₪659.3m in cash leading to net debt of about ₪1.67b.

A Look At Carasso Motors' Liabilities

According to the last reported balance sheet, Carasso Motors had liabilities of ₪1.70b due within 12 months, and liabilities of ₪1.68b due beyond 12 months. Offsetting this, it had ₪659.3m in cash and ₪504.5m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪2.21b.

When you consider that this deficiency exceeds the company's ₪1.51b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Carasso Motors has net debt worth 1.7 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.6 times the interest expense. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. Importantly, Carasso Motors grew its EBIT by 88% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is Carasso Motors's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Carasso Motors actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Carasso Motors's conversion of EBIT to free cash flow was a real positive on this analysis, as was its EBIT growth rate. But truth be told its level of total liabilities had us nibbling our nails. When we consider all the factors mentioned above, we do feel a bit cautious about Carasso Motors's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for Carasso Motors (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:CRSM

Carasso Motors

Engages in the import, distribution, and sale of automobiles in Israel.

Average dividend payer low.

Market Insights

Community Narratives