- Israel

- /

- Capital Markets

- /

- TASE:MTRD

Middle East's Undiscovered Gems Three Promising Stocks to Watch

Reviewed by Simply Wall St

As Gulf equities recently experienced a dip, largely influenced by global market trends and anticipation of U.S. interest rate signals, the Middle East's investment landscape remains dynamic and full of potential opportunities. In this context, identifying promising stocks involves looking for resilient companies with strong fundamentals that can weather economic fluctuations and capitalize on regional growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi (IBSE:TCKRC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi is a Turkish company specializing in the supply of guardrails, with a market capitalization of TRY10.32 billion.

Operations: Kirac Galvaniz generates revenue primarily from its guardrail supply operations in Turkey. The company has a market capitalization of TRY10.32 billion.

Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi, a small player in its field, has shown robust earnings growth of 27.8% over the past year, surpassing the Metals and Mining industry average of -20.1%. The company boasts a price-to-earnings ratio of 22.7x, slightly below the TR market's 22.9x, suggesting it might be undervalued compared to peers. Despite not being free cash flow positive recently, TCKRC maintains more cash than its total debt and enjoys high-quality non-cash earnings. These factors position it as an intriguing prospect in its sector.

Castro Model (TASE:CAST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, fashion accessories, and cosmetics and care products with a market capitalization of ₪1.25 billion.

Operations: The company generates revenue primarily from apparel fashions and fashion accessories, with these segments contributing ₪1.47 billion and ₪551.33 million respectively. Additionally, the care and cosmetics segment adds ₪81.42 million to its revenue streams.

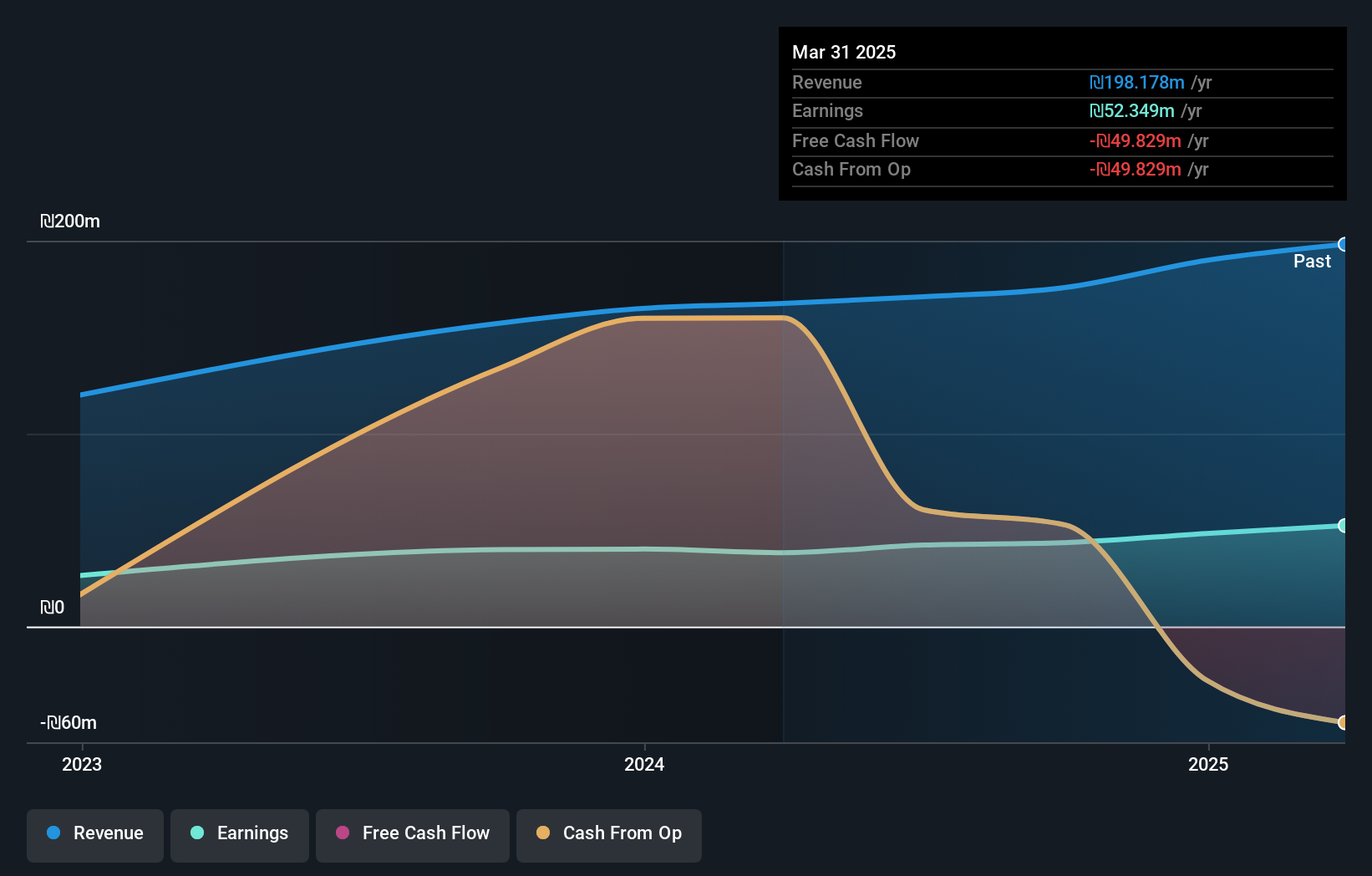

Castro Model, a notable player in the Middle Eastern market, boasts a price-to-earnings ratio of 9.4x, undercutting the IL market average of 15.7x, indicating potential value. Over five years, its debt-to-equity ratio impressively fell from 63.9% to just 8.2%, showcasing effective financial management and reducing leverage concerns. The company's earnings surged by 69.7% last year, outpacing the specialty retail sector's growth rate of 69.2%. Despite reporting lower net income for Q1 at ILS 1.42 million compared to ILS 3.91 million previously, Castro Model remains profitable with high-quality earnings and sufficient interest coverage at an EBIT multiple of 3.1x.

- Click to explore a detailed breakdown of our findings in Castro Model's health report.

Review our historical performance report to gain insights into Castro Model's's past performance.

Meitav Trade Investments (TASE:MTRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Meitav Trade Investments Ltd offers financial investment services and has a market capitalization of ₪997.26 million.

Operations: Meitav Trade Investments generates revenue through its financial investment services. The company reports a market capitalization of ₪997.26 million.

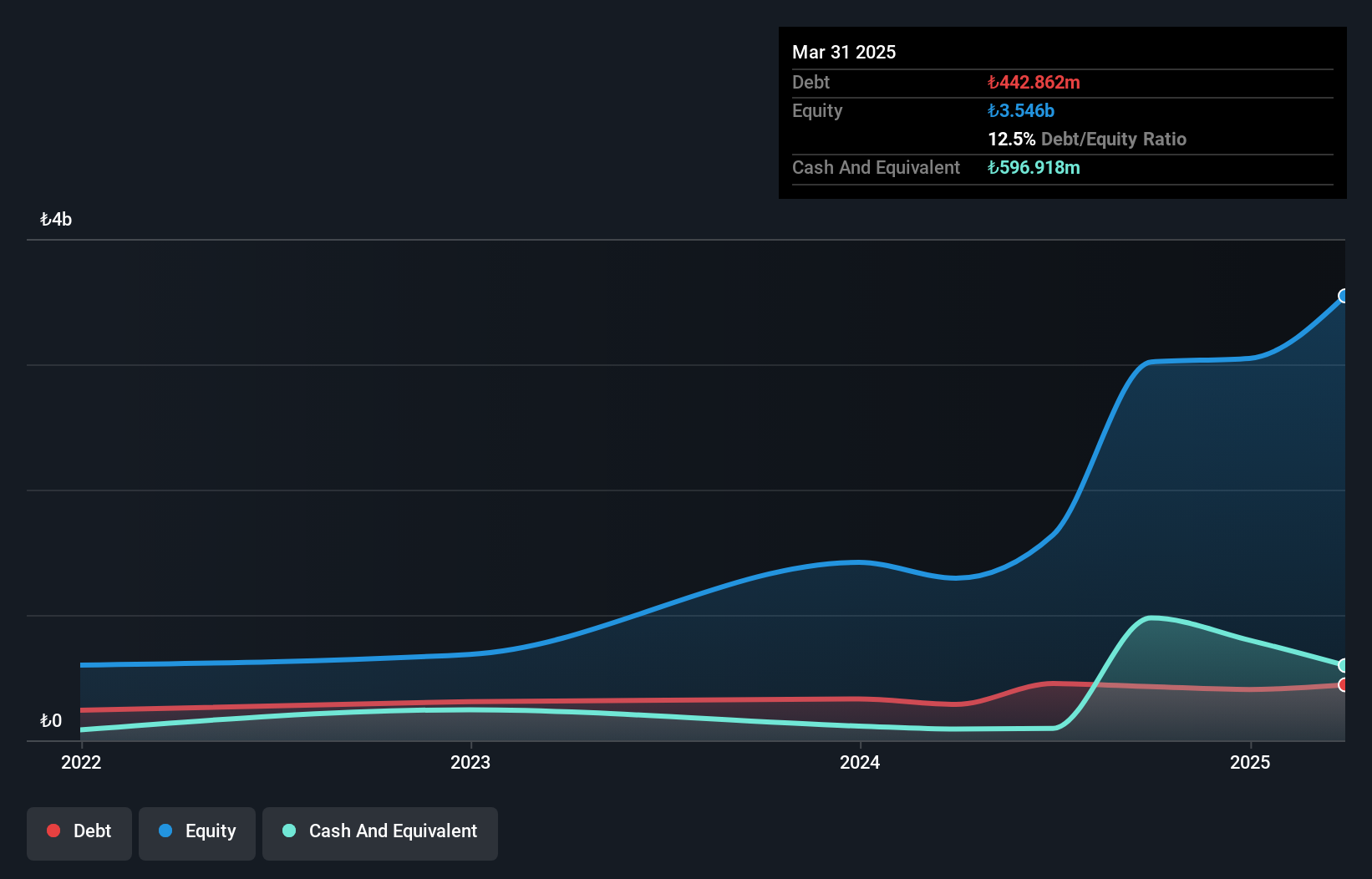

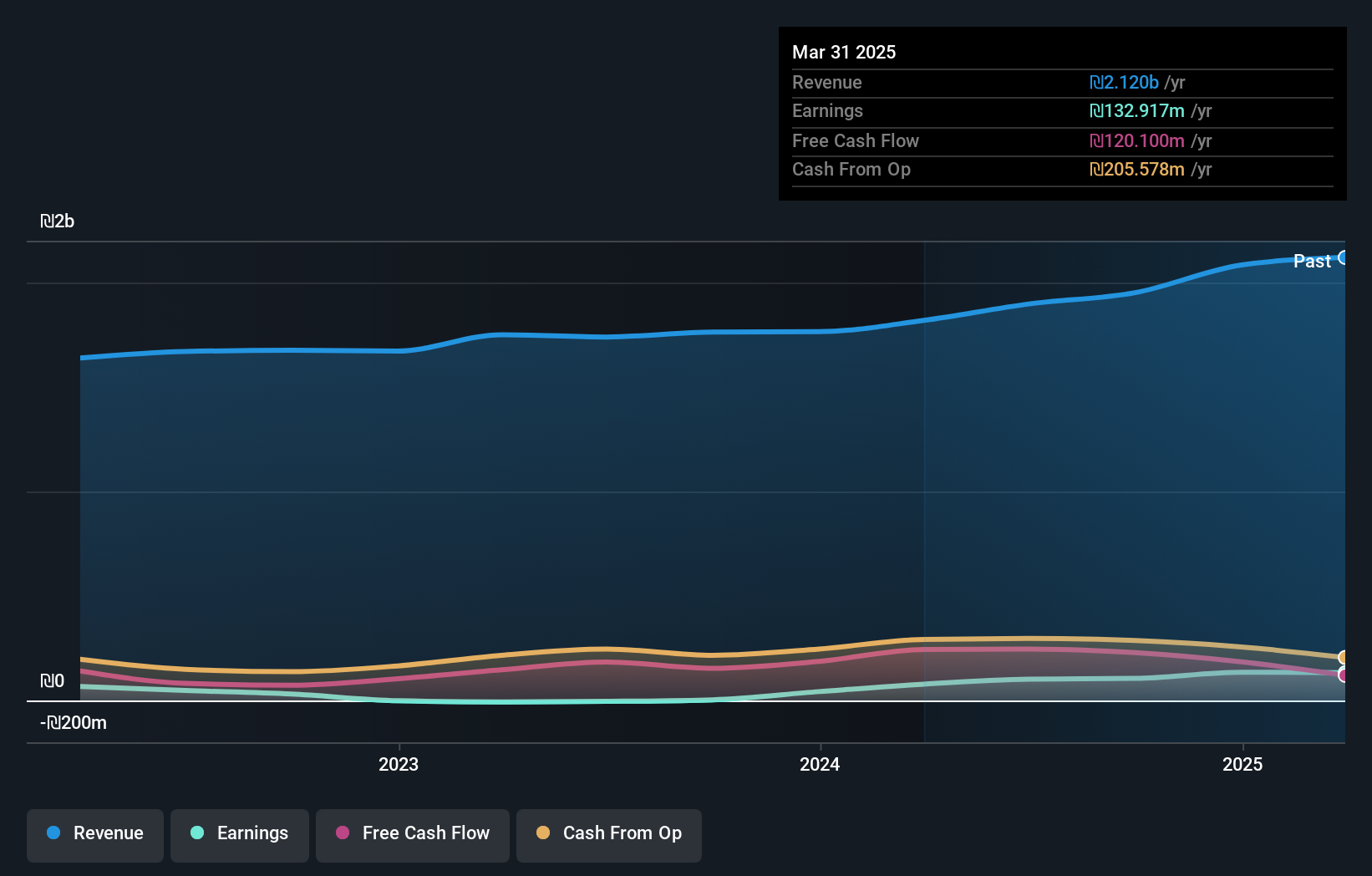

Meitav Trade Investments, a nimble player in the Middle East market, showcases robust performance with earnings growth of 29.6% over the past year, outpacing its industry. The company is debt-free and boasts high-quality earnings, which aligns well with its Price-To-Earnings ratio of 18.2x—an attractive figure compared to the industry average of 20.6x. Recent results highlight revenue climbing to ILS 52.84 million for Q2 2025 from ILS 44.64 million last year, while net income rose to ILS 13.39 million from ILS 11.01 million—a testament to its operational efficiency despite share price volatility recently observed.

- Get an in-depth perspective on Meitav Trade Investments' performance by reading our health report here.

Understand Meitav Trade Investments' track record by examining our Past report.

Seize The Opportunity

- Delve into our full catalog of 213 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MTRD

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives