Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Lodzia Rotex Investment Ltd. (TLV:LODZ) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Lodzia Rotex Investment

How Much Debt Does Lodzia Rotex Investment Carry?

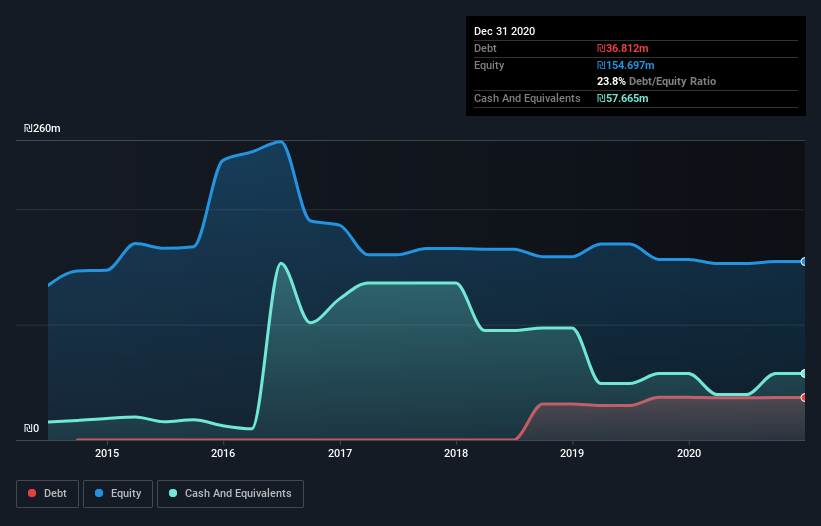

As you can see below, Lodzia Rotex Investment had ₪36.8m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. But on the other hand it also has ₪57.7m in cash, leading to a ₪20.9m net cash position.

How Healthy Is Lodzia Rotex Investment's Balance Sheet?

According to the last reported balance sheet, Lodzia Rotex Investment had liabilities of ₪14.5m due within 12 months, and liabilities of ₪35.1m due beyond 12 months. On the other hand, it had cash of ₪57.7m and ₪4.22m worth of receivables due within a year. So it can boast ₪12.3m more liquid assets than total liabilities.

This surplus suggests that Lodzia Rotex Investment has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Lodzia Rotex Investment has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Lodzia Rotex Investment's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Lodzia Rotex Investment reported revenue of ₪5.9m, which is a gain of 13%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Lodzia Rotex Investment?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Lodzia Rotex Investment had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of ₪4.8m and booked a ₪149k accounting loss. With only ₪20.9m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Lodzia Rotex Investment (1 is significant) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Lodzia Real Estate, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:LODZ

Lodzia Real Estate

Engages in the acquisition, development, enhancement, operation, rental, and management of real estate properties in Israel and internationally.

Medium-low and good value.