- United Arab Emirates

- /

- Pharma

- /

- ADX:JULPHAR

Three Undiscovered Gems In The Middle East With Promising Potential

Reviewed by Simply Wall St

In recent weeks, most Gulf markets have experienced a slight downturn amid economic uncertainty, with indices in Dubai and Abu Dhabi easing slightly and Qatar's index also declining. Despite these challenges, the potential for further U.S. Federal Reserve rate cuts and rising oil prices offers a glimmer of hope for investors seeking opportunities in the region's small-cap sector. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on emerging opportunities in the Middle East market.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Gulf Medical Projects Company (PJSC) (ADX:GMPC)

Simply Wall St Value Rating: ★★★★★★

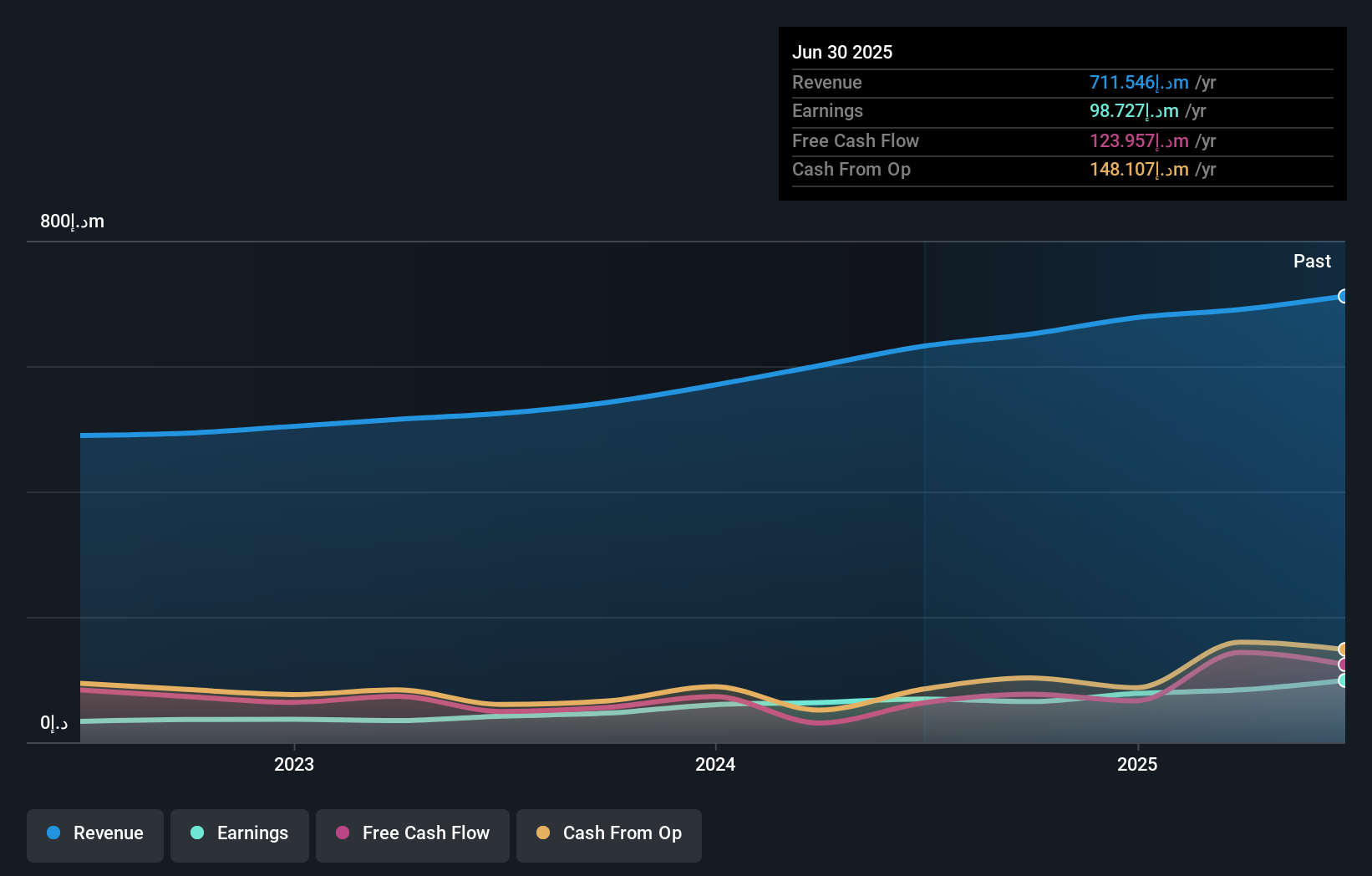

Overview: Gulf Medical Projects Company (PJSC) operates hospitals in the United Arab Emirates and has a market capitalization of AED 1.43 billion.

Operations: The company's primary revenue comes from Health Services, generating AED 711.55 million, while investments contribute AED 50.66 million.

Gulf Medical Projects Company (PJSC) showcases a promising profile with its earnings growing by 43% over the past year, outpacing the healthcare industry's 6%. This debt-free entity seems to have improved significantly from five years ago when it had a debt to equity ratio of 5.6%, suggesting prudent financial management. Recent earnings reports highlight robust performance, with net income for Q2 reaching AED 34.98 million compared to AED 19.79 million last year and sales hitting AED 185.37 million from AED 164.16 million previously. Despite its small size, GMPC trades at nearly 80% below estimated fair value, indicating potential undervaluation in the market.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Value Rating: ★★★★★☆

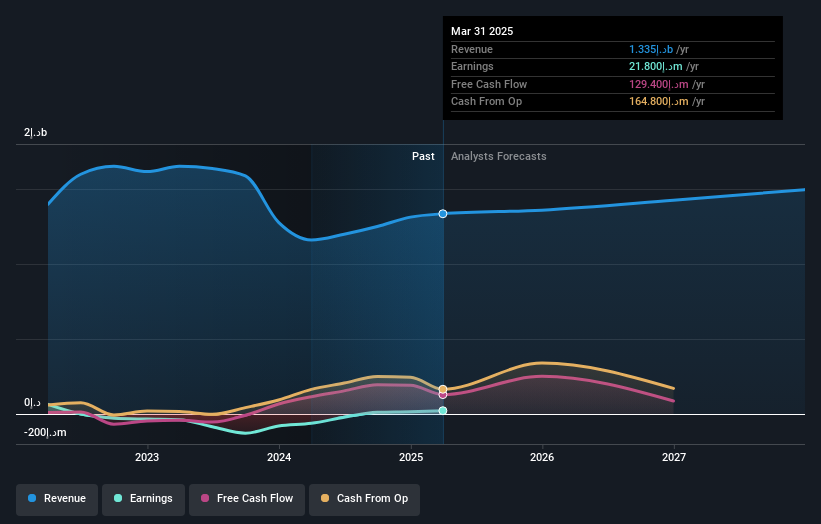

Overview: Gulf Pharmaceutical Industries P.S.C. operates in the pharmaceutical sector by manufacturing and selling medicines, drugs, and various pharmaceutical, cosmetic, and medical compounds across the United Arab Emirates, other GCC countries, and internationally with a market capitalization of AED1.50 billion.

Operations: Revenue primarily comes from the manufacturing segment, contributing AED640.80 million. The company has a market capitalization of AED1.50 billion and experiences adjustments amounting to AED1.03 billion in its financial reporting.

Gulf Pharmaceutical Industries, known as JULPHAR, has seen a remarkable turnaround with a net income of AED 17 million in Q2 2025 compared to a net loss of AED 3.3 million the previous year. Sales for the same quarter reached AED 348.1 million, up from AED 339 million last year, showcasing its growing market presence. The company reported basic earnings per share of AED 0.015 against last year's loss per share of AED 0.003, indicating improved profitability and operational efficiency. Despite these gains, interest coverage remains tight at just over twice EBIT, highlighting room for financial optimization moving forward.

Villar International (TASE:VILR)

Simply Wall St Value Rating: ★★★★★☆

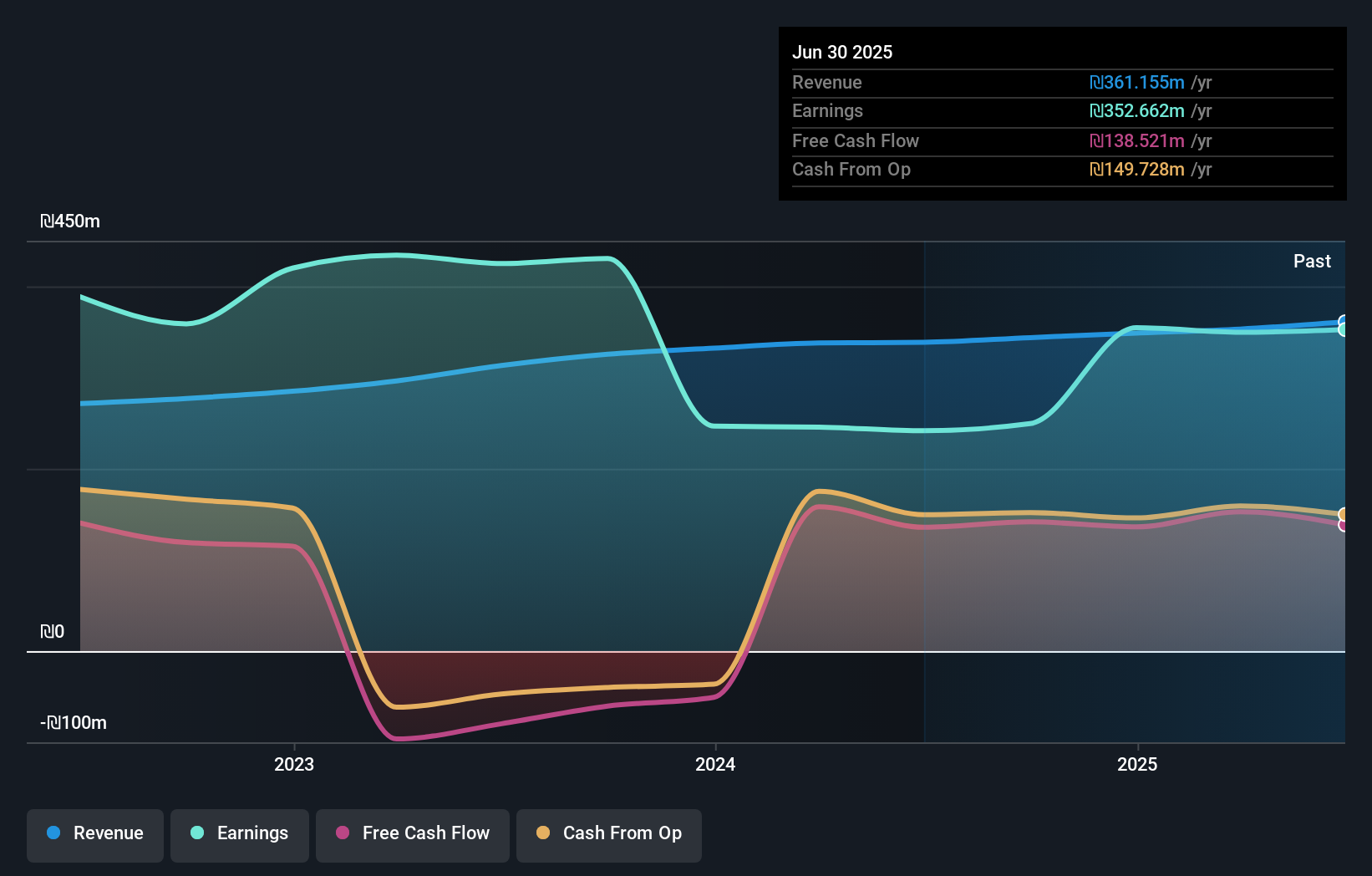

Overview: Villar International Ltd. is involved in the acquisition, development, and construction of real estate properties both in Israel and internationally, with a market capitalization of ₪3.41 billion.

Operations: Villar International Ltd. generates revenue primarily from the rental of buildings (₪257.98 million), construction of buildings (₪68.81 million), and provision of archival services (₪93.85 million).

Villar International, a nimble player in the real estate sector, shows promising financial health with a net debt to equity ratio of 11.8%, which is satisfactory. The company’s earnings have surged by 46% over the past year, outpacing its industry peers' growth of 31.9%. Despite this robust performance, a one-off gain of ₪236M has notably influenced recent results. Villar's price-to-earnings ratio stands at an attractive 9.7x compared to the IL market average of 15.1x, suggesting potential value for investors seeking opportunities in emerging markets like Israel's real estate landscape.

- Click here and access our complete health analysis report to understand the dynamics of Villar International.

Gain insights into Villar International's past trends and performance with our Past report.

Seize The Opportunity

- Navigate through the entire inventory of 204 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:JULPHAR

Gulf Pharmaceutical Industries P.S.C

Manufactures and sells medicines, drugs, and various other types of pharmaceutical, cosmetic, and medical compounds in United Arab Emirates, other GCC countries, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)