- Israel

- /

- Real Estate

- /

- TASE:ISCN

Israel Canada (TASE:ISCN) Valuation Check After Q3 Sales Growth But Sharp Earnings Decline

Reviewed by Simply Wall St

Israel Canada (T.R) (TASE:ISCN) just reported mixed third quarter results, with solid top line growth but a sharp drop in net income and earnings per share that helps explain the recent share move.

See our latest analysis for Israel Canada (T.R).

The latest results seem to have nudged sentiment higher, with a 16.9% 3 month share price return and a near doubling of 3 year total shareholder return. This suggests momentum is still broadly constructive despite earnings volatility.

If this earnings update has you rethinking your exposure, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas for your watchlist.

With revenues climbing but profits shrinking, and the shares still trading below analyst targets, is Israel Canada quietly undervalued after this mixed quarter, or is the recent rally already pricing in a rebound in earnings?

Price-to-Earnings of 115.2x: Is it justified?

Israel Canada (T.R)'s latest close at ₪16.97 implies a steep price-to-earnings ratio of 115.2x, pointing to a rich valuation versus its fundamentals.

The price-to-earnings ratio compares the share price to the company’s earnings per share, making it a direct yardstick for how much investors pay for current profits. For a real estate investment business with cyclical and sometimes lumpy earnings, such an elevated multiple usually signals the market is either looking past near term weakness or heavily discounting a future recovery.

However, ISCN is described as expensive on this metric when stacked against its peers, with its 115.2x P/E far above both the peer group average of 14.7x and the broader IL Real Estate industry average of 14.8x. Combined with a five year earnings decline of 18.7% per year and a very low 1.5% return on equity, the current multiple suggests investors are paying a premium price while underlying profitability trends remain weak.

In other words, the stock is trading on a valuation that is dramatically higher than comparable real estate names in Israel, even though earnings fell 82.4% over the last year and profit margins dropped from 52.8% to 6.3%, a pattern more consistent with a de rating than a re rating.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 115.2x (OVERVALUED)

However, persistent earnings pressure and any setback in Israel’s real estate market could quickly challenge the current valuation and stall recent share price momentum.

Find out about the key risks to this Israel Canada (T.R) narrative.

Another View Using Our DCF Model

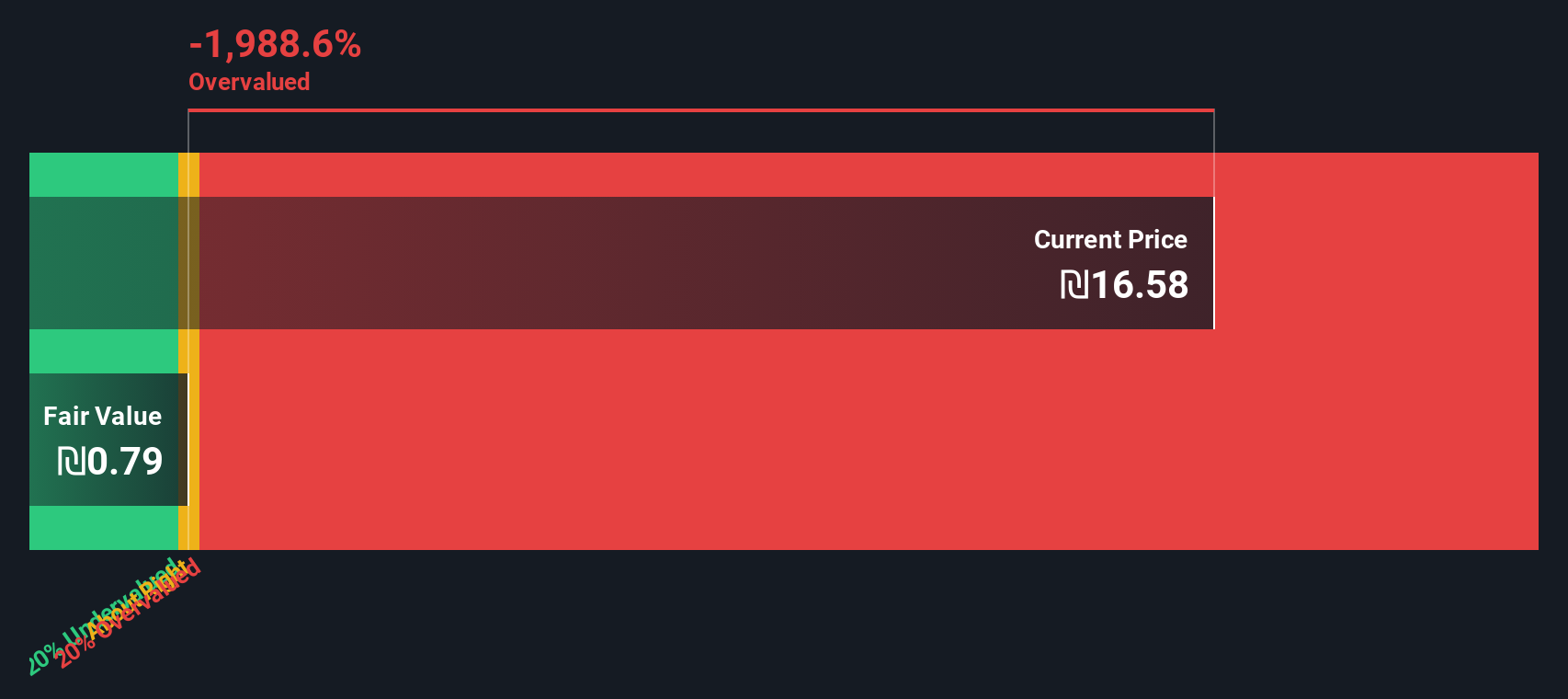

Our DCF model presents a much more conservative picture than the headline P E ratio. At ₪16.97, ISCN trades well above our estimate of fair value at just ₪0.79, which suggests potential overvaluation and limited margin of safety if earnings do not recover quickly.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Israel Canada (T.R) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Israel Canada (T.R) Narrative

If you see the story differently or would rather rely on your own analysis, you can quickly build a personalised view in under three minutes using Do it your way.

A great starting point for your Israel Canada (T.R) research is our analysis highlighting 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter opportunities by running targeted screens on Simply Wall Street now, so you are not left watching others capture the upside first.

- Capitalize on mispriced opportunities by scanning these 895 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride powerful secular trends by targeting these 27 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Strengthen your income stream by zeroing in on these 15 dividend stocks with yields > 3% that can support more resilient portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISCN

Israel Canada (T.R)

Pangaea Real-Estate Ltd. is a principal investment firm specializing in investments in real estate.

Moderate risk with worrying balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026