- Israel

- /

- Real Estate

- /

- TASE:ALMA

Additional Considerations Required While Assessing Almogim Holdings' (TLV:ALMA) Strong Earnings

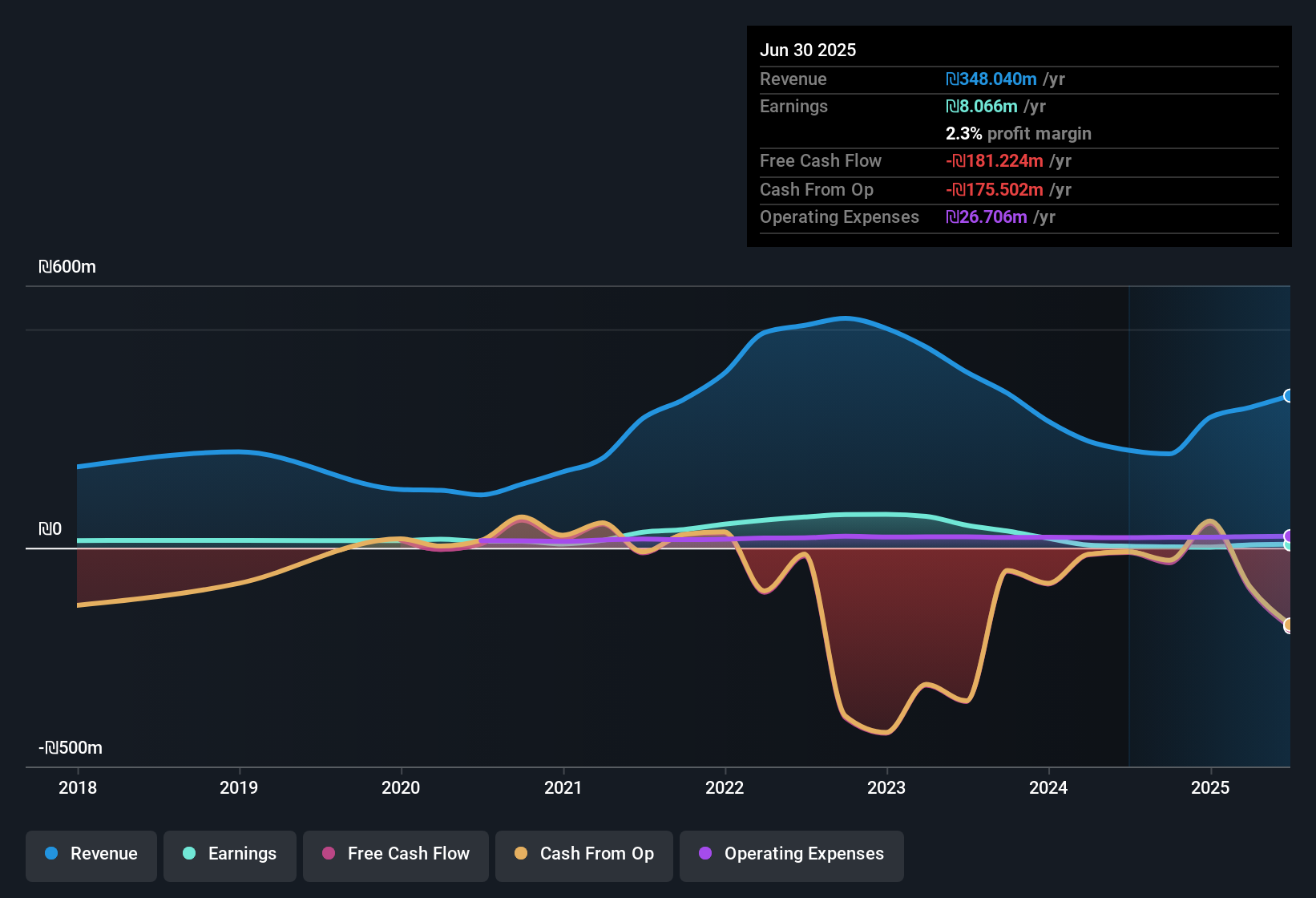

Almogim Holdings Ltd (TLV:ALMA) announced strong profits, but the stock was stagnant. Our analysis suggests that shareholders have noticed something concerning in the numbers.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Almogim Holdings increased the number of shares on issue by 15% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Almogim Holdings' EPS by clicking here.

How Is Dilution Impacting Almogim Holdings' Earnings Per Share (EPS)?

Unfortunately, Almogim Holdings' profit is down 89% per year over three years. On the bright side, in the last twelve months it grew profit by 123%. On the other hand, earnings per share are only up 151% over the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So Almogim Holdings shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Almogim Holdings.

Our Take On Almogim Holdings' Profit Performance

Each Almogim Holdings share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that Almogim Holdings' statutory profits are better than its underlying earnings power. The silver lining is that its EPS growth over the last year has been really wonderful, even if it's not a perfect measure. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Almogim Holdings at this point in time. Be aware that Almogim Holdings is showing 3 warning signs in our investment analysis and 2 of those are significant...

Today we've zoomed in on a single data point to better understand the nature of Almogim Holdings' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ALMA

Almogim Holdings

Develops and sells real estate properties in Israel and internationally.

Slight risk with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)