- Israel

- /

- Real Estate

- /

- TASE:ALHE

Here's Why Alony-Hetz Properties & Investments Ltd's (TLV:ALHE) CEO Is Unlikely to Expect A Pay Rise This Year

Key Insights

- Alony-Hetz Properties & Investments will host its Annual General Meeting on 21st of October

- Salary of ₪3.75m is part of CEO Nathan Hetz Haitchook's total remuneration

- The overall pay is comparable to the industry average

- Alony-Hetz Properties & Investments' EPS declined by 42% over the past three years while total shareholder return over the past three years was 2.0%

CEO Nathan Hetz Haitchook has done a decent job of delivering relatively good performance at Alony-Hetz Properties & Investments Ltd (TLV:ALHE) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 21st of October. We present our case of why we think CEO compensation looks fair.

View our latest analysis for Alony-Hetz Properties & Investments

Comparing Alony-Hetz Properties & Investments Ltd's CEO Compensation With The Industry

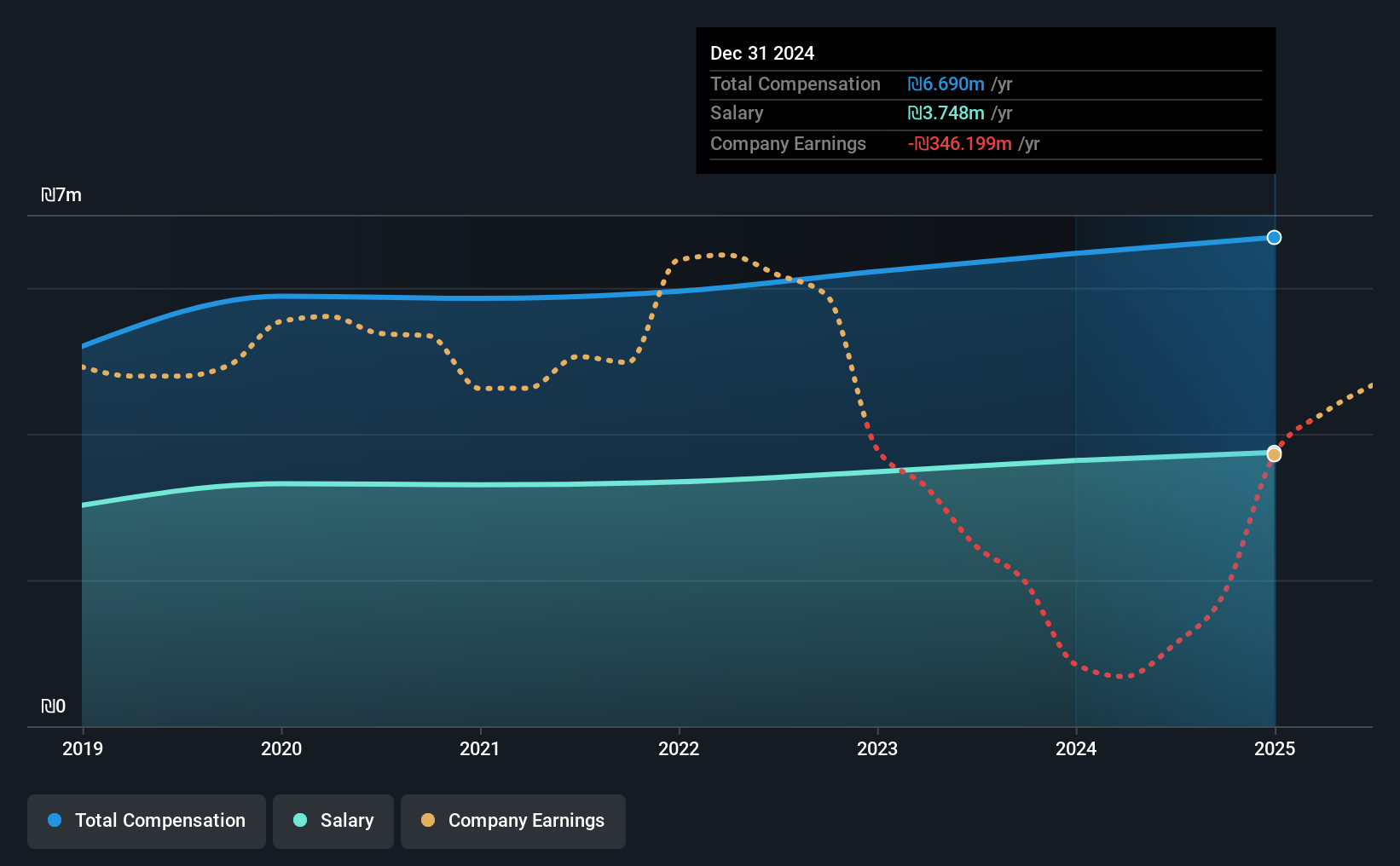

Our data indicates that Alony-Hetz Properties & Investments Ltd has a market capitalization of ₪8.9b, and total annual CEO compensation was reported as ₪6.7m for the year to December 2024. That's just a smallish increase of 3.4% on last year. We note that the salary of ₪3.75m makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the Israel Real Estate industry with market capitalizations ranging from ₪6.6b to ₪21b, the reported median CEO total compensation was ₪6.4m. So it looks like Alony-Hetz Properties & Investments compensates Nathan Hetz Haitchook in line with the median for the industry. Moreover, Nathan Hetz Haitchook also holds ₪1.1b worth of Alony-Hetz Properties & Investments stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₪3.7m | ₪3.6m | 56% |

| Other | ₪2.9m | ₪2.8m | 44% |

| Total Compensation | ₪6.7m | ₪6.5m | 100% |

Speaking on an industry level, nearly 62% of total compensation represents salary, while the remainder of 38% is other remuneration. Alony-Hetz Properties & Investments is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Alony-Hetz Properties & Investments Ltd's Growth Numbers

Over the last three years, Alony-Hetz Properties & Investments Ltd has shrunk its earnings per share by 42% per year. It achieved revenue growth of 393% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Alony-Hetz Properties & Investments Ltd Been A Good Investment?

With a total shareholder return of 2.0% over three years, Alony-Hetz Properties & Investments Ltd has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

The overall company performance has been commendable, however there are still areas for improvement. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for Alony-Hetz Properties & Investments (2 shouldn't be ignored!) that you should be aware of before investing here.

Switching gears from Alony-Hetz Properties & Investments, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ALHE

Alony-Hetz Properties & Investments

Alony Hetz Properties and Investments Ltd.

Slight risk second-rate dividend payer.

Market Insights

Community Narratives