- Turkey

- /

- Construction

- /

- IBSE:YYAPI

3 Middle Eastern Penny Stocks With Market Caps Under US$40M

Reviewed by Simply Wall St

As Gulf markets show gains ahead of earnings announcements and key U.S. economic data releases, investors are keenly watching for opportunities in the Middle East's dynamic financial landscape. Penny stocks, a term that may seem outdated but remains relevant, often represent smaller or emerging companies that can offer significant value potential. By focusing on those with strong financial health and clear growth prospects, investors can uncover promising opportunities within this niche market segment.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.02 | SAR1.61B | ✅ 2 ⚠️ 1 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.987 | ₪121.56M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.54 | ₪177.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.912 | ₪2.84B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.13 | ₪158.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.691 | AED420.3M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.69 | AED426.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.09 | AED2.18B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.31 | AED9.86B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

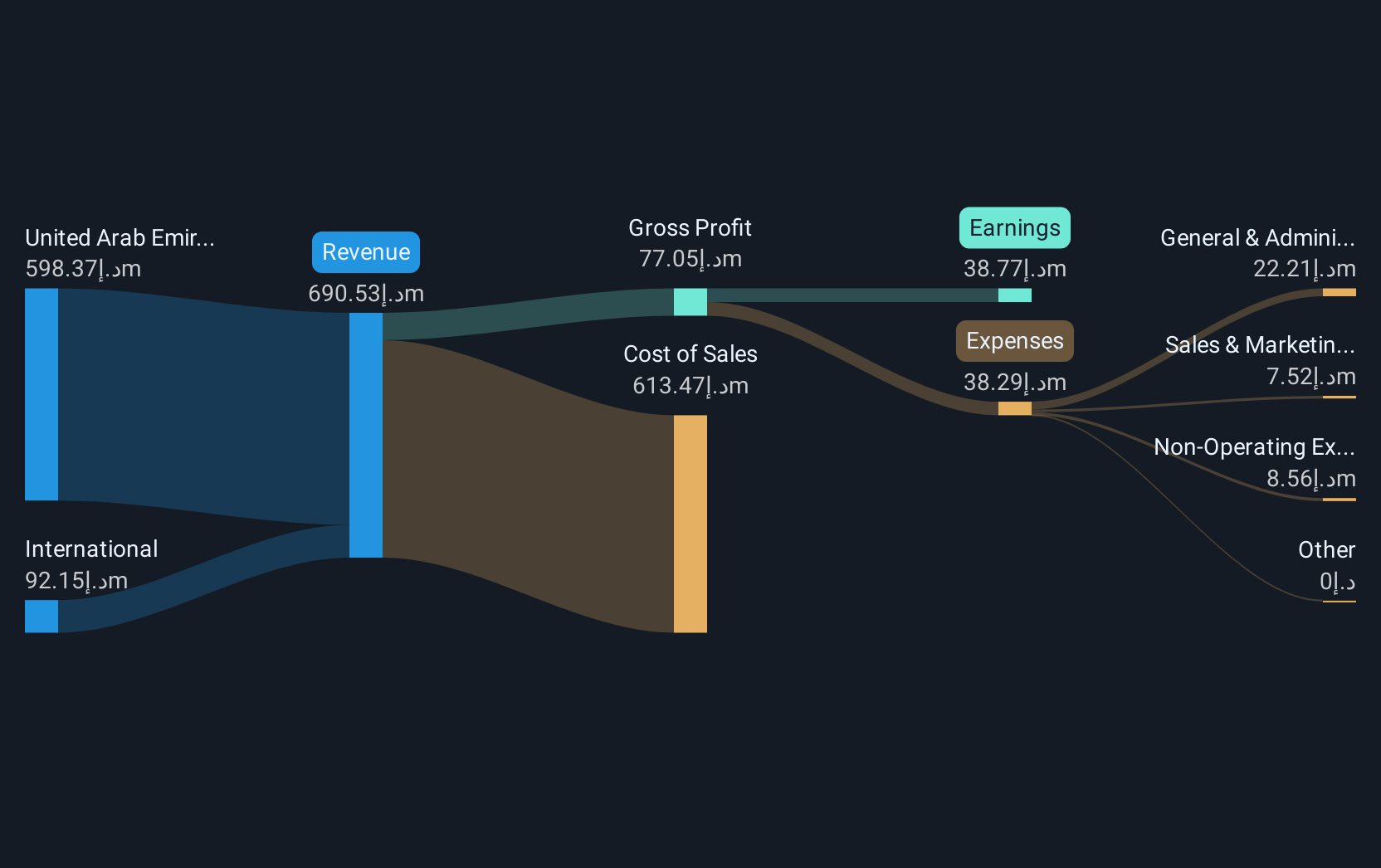

Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Cement and Industrial Development (PJSC) operates in the cement and industrial development sector, with a market capitalization of AED420.30 million.

Operations: The company generates revenue from its manufacturing segment, amounting to AED680.15 million.

Market Cap: AED420.3M

Sharjah Cement and Industrial Development (PJSC) has demonstrated significant earnings growth, with a 762.2% increase over the past year, surpassing industry averages. Despite its low Return on Equity of 2.4%, the company maintains a satisfactory net debt to equity ratio of 21.7%. Its short-term assets comfortably cover both short- and long-term liabilities, indicating financial stability. However, the board's inexperience may pose governance challenges. The company's recent dividend announcement reflects ongoing shareholder returns despite earnings not covering dividends fully, suggesting potential sustainability concerns for income-focused investors amidst high share price volatility.

- Take a closer look at Sharjah Cement and Industrial Development (PJSC)'s potential here in our financial health report.

- Evaluate Sharjah Cement and Industrial Development (PJSC)'s historical performance by accessing our past performance report.

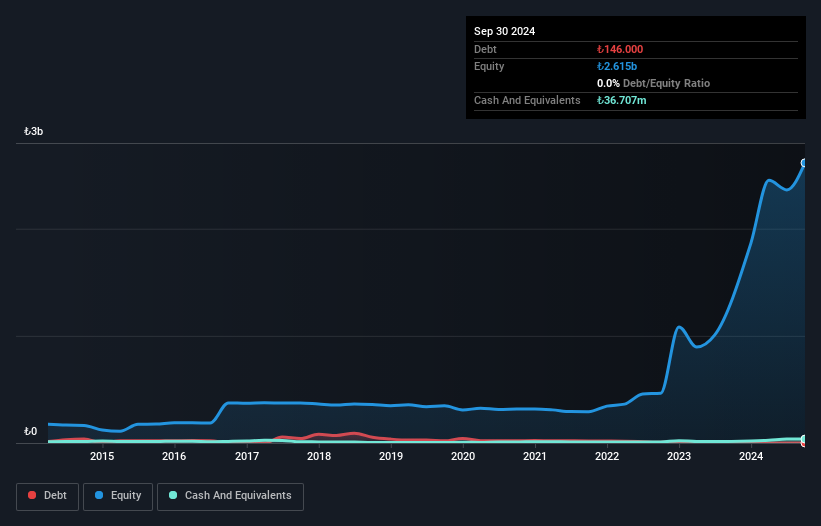

Yesil Yapi Endüstrisi (IBSE:YYAPI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yesil Yapi Endüstrisi A.S. is a construction company operating both in Turkey and internationally, with a market capitalization of TRY1.17 billion.

Operations: The company generates revenue primarily from its heavy construction segment, amounting to TRY29.58 million.

Market Cap: TRY1.17B

Yesil Yapi Endüstrisi A.S. has shown volatility stability over the past year, with a weekly volatility of 8%. The company maintains a strong financial position, having more cash than total debt and covering short-term liabilities with assets valued at TRY394 million. Despite this, it faces challenges such as lower profit margins and negative earnings growth of -41.4% compared to last year. Its debt-to-equity ratio has significantly decreased to 0.01%, highlighting improved financial leverage management. However, its long-term liabilities exceed short-term assets by TRY1.31 billion, which could impact future liquidity despite its low price-to-earnings ratio of 2x suggesting potential undervaluation in the market.

- Jump into the full analysis health report here for a deeper understanding of Yesil Yapi Endüstrisi.

- Examine Yesil Yapi Endüstrisi's past performance report to understand how it has performed in prior years.

PlantArc Bio (TASE:PLNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PlantArc Bio Ltd. is an Ag-Bio company focused on crop protection and yield enhancement, with a market cap of ₪7.66 million.

Operations: The company's revenue segment consists of Agricultural Biotech, generating ₪4.40 million.

Market Cap: ₪7.66M

PlantArc Bio Ltd., with a market cap of ₪7.66 million, is currently pre-revenue, generating only ₪4.40 million in sales last year and reporting a net loss of ₪2.57 million. Despite being unprofitable, the company has reduced its losses over the past five years and maintains a cash runway exceeding three years without incurring debt. Its management and board are experienced, with average tenures of 4.7 and 4.2 years respectively. However, PlantArc Bio's share price remains highly volatile despite decreased weekly volatility over the past year from 14% to 8%, still higher than most IL stocks.

- Unlock comprehensive insights into our analysis of PlantArc Bio stock in this financial health report.

- Gain insights into PlantArc Bio's historical outcomes by reviewing our past performance report.

Summing It All Up

- Gain an insight into the universe of 96 Middle Eastern Penny Stocks by clicking here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:YYAPI

Yesil Yapi Endüstrisi

Operates as a construction company in Turkey and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives