Exploring Undiscovered Gems with Potential This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, with smaller-cap indices experiencing notable declines. The Fed's recent rate cut and tempered expectations for future reductions have added to investor apprehension, impacting market sentiment across the board. In this environment, identifying stocks with strong fundamentals and resilience becomes crucial. Such undiscovered gems can offer potential opportunities amid broader market volatility by demonstrating robust financial health and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Conoil | 27.59% | 16.64% | 46.05% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Mediterranean and Gulf Cooperative Insurance and Reinsurance (SASE:8030)

Simply Wall St Value Rating: ★★★★★☆

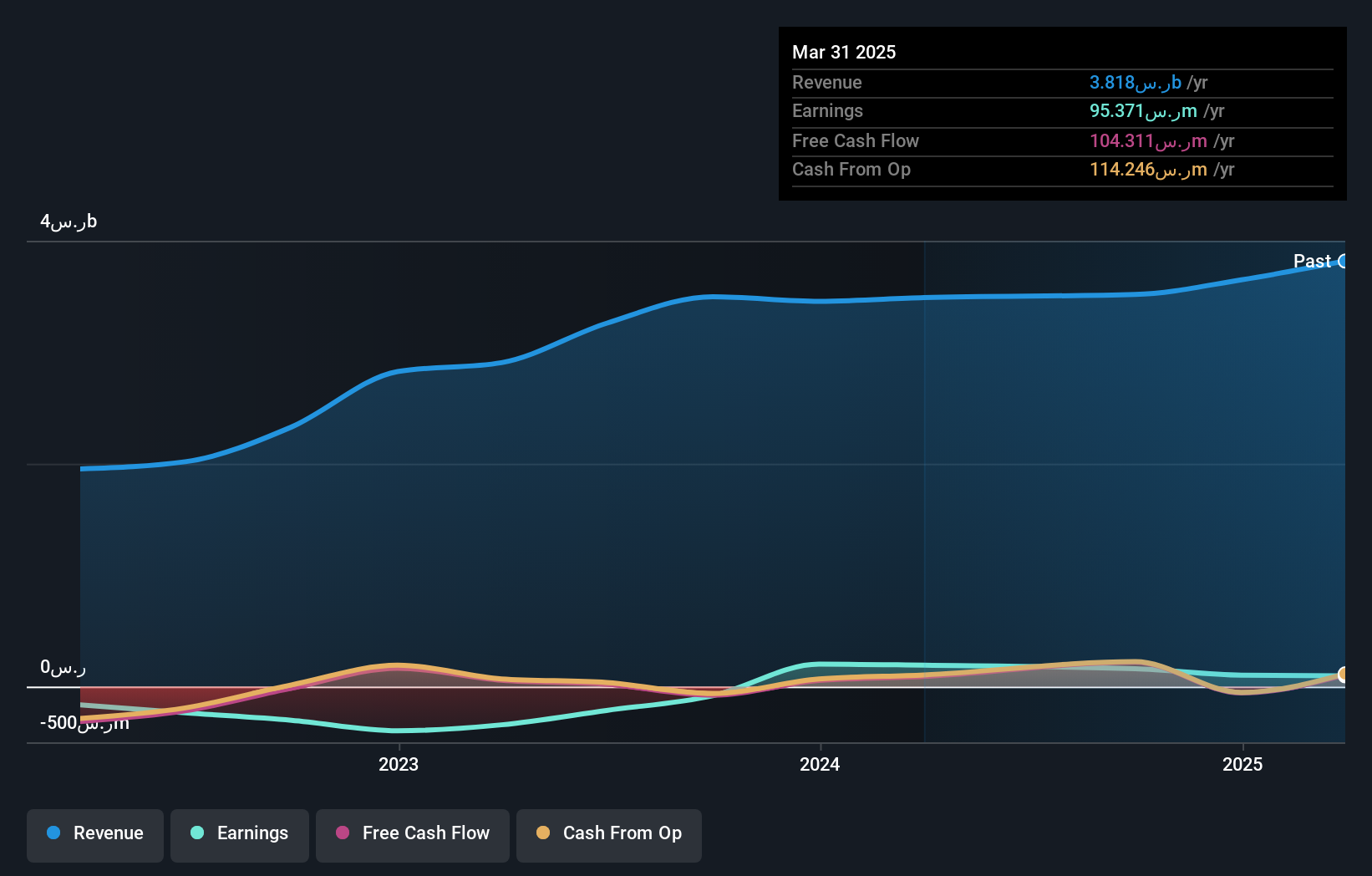

Overview: The Mediterranean and Gulf Cooperative Insurance and Reinsurance Company operates in the Kingdom of Saudi Arabia, offering a range of insurance and reinsurance products, with a market capitalization of SAR 2.37 billion.

Operations: MedGulf generates revenue primarily from its insurance operations, with the Medical segment contributing SAR 2.72 billion and the Motor segment adding SAR 358.78 million. The company's net profit margin is a key indicator to consider when evaluating its financial performance.

Mediterranean and Gulf Cooperative Insurance and Reinsurance, a smaller player in the insurance sector, has recently shown mixed performance. With a Price-To-Earnings ratio of 14.8x, it presents better value than the SA market's 23.3x. The company is debt-free for five years, easing concerns about interest coverage or financial strain. Despite becoming profitable this year, its net income for Q3 was SAR 39 million compared to SAR 40 million last year, with nine-month earnings at SAR 99 million down from SAR 141 million previously. Basic earnings per share also dipped slightly over these periods.

Kingclean ElectricLtd (SHSE:603355)

Simply Wall St Value Rating: ★★★★★☆

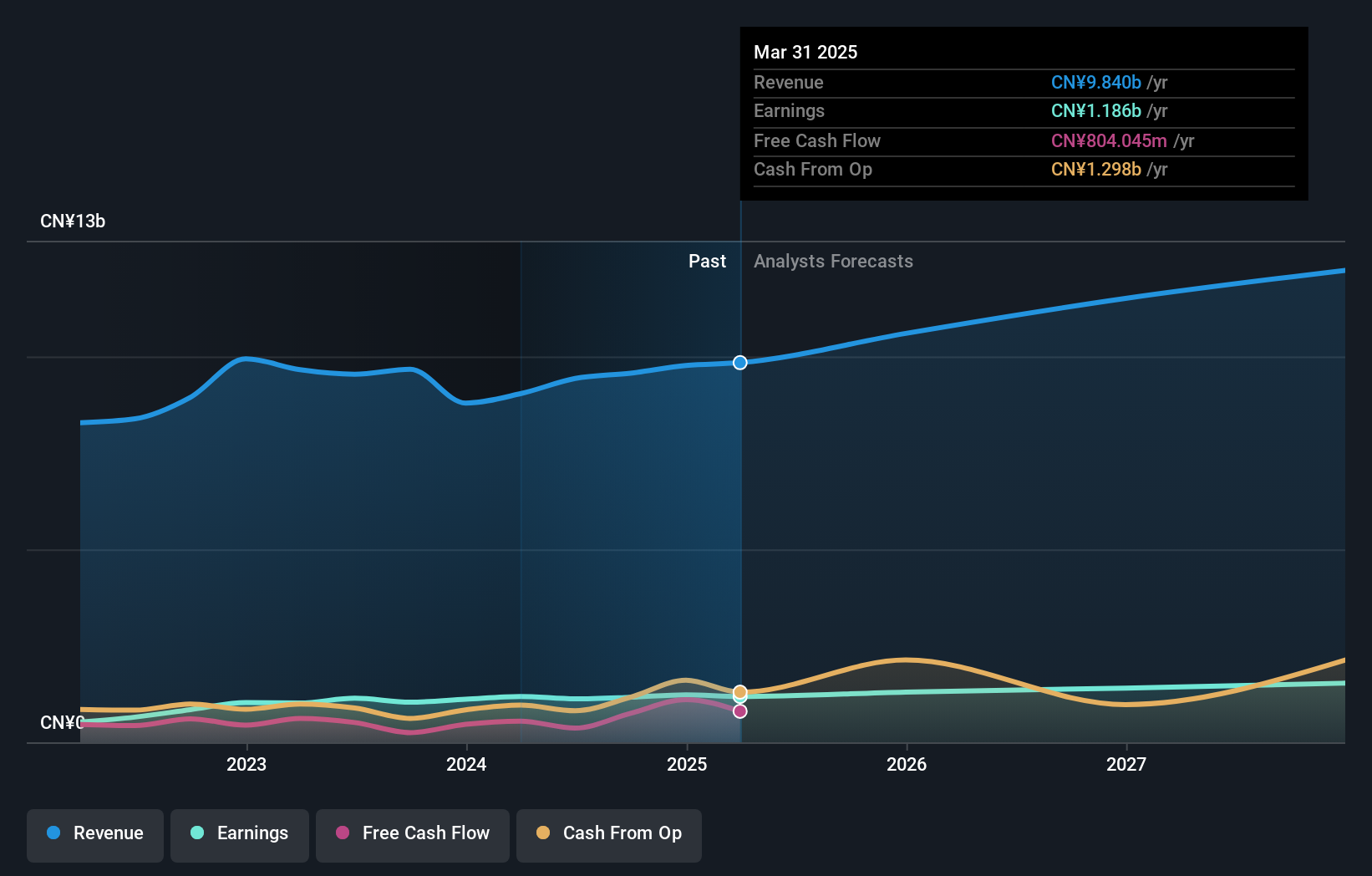

Overview: Kingclean Electric Co., Ltd, with a market cap of CN¥13.17 billion, is an electric household company that manufactures and sells home appliances, kitchen appliances, and garden tools under the KingClean brand in the People’s Republic of China.

Operations: Kingclean Electric Co., Ltd generates revenue primarily from the Appliance & Tool segment, amounting to CN¥9.57 billion. The company's market cap stands at CN¥13.17 billion.

Kingclean Electric, a nimble player in the consumer durables sector, has shown promising growth with earnings rising 12.5% over the past year, outpacing the industry average of -0.2%. The company reported sales of CNY 7.25 billion for nine months ending September 2024, up from CNY 6.47 billion year-over-year, indicating robust demand for its products. Despite an increased debt-to-equity ratio reaching 93.8% over five years, Kingclean's financial health remains solid with more cash than total debt and positive free cash flow at CNY 749 million as of September 2024, suggesting strong operational efficiency and potential for sustained profitability.

- Delve into the full analysis health report here for a deeper understanding of Kingclean ElectricLtd.

Kamada (TASE:KMDA)

Simply Wall St Value Rating: ★★★★★★

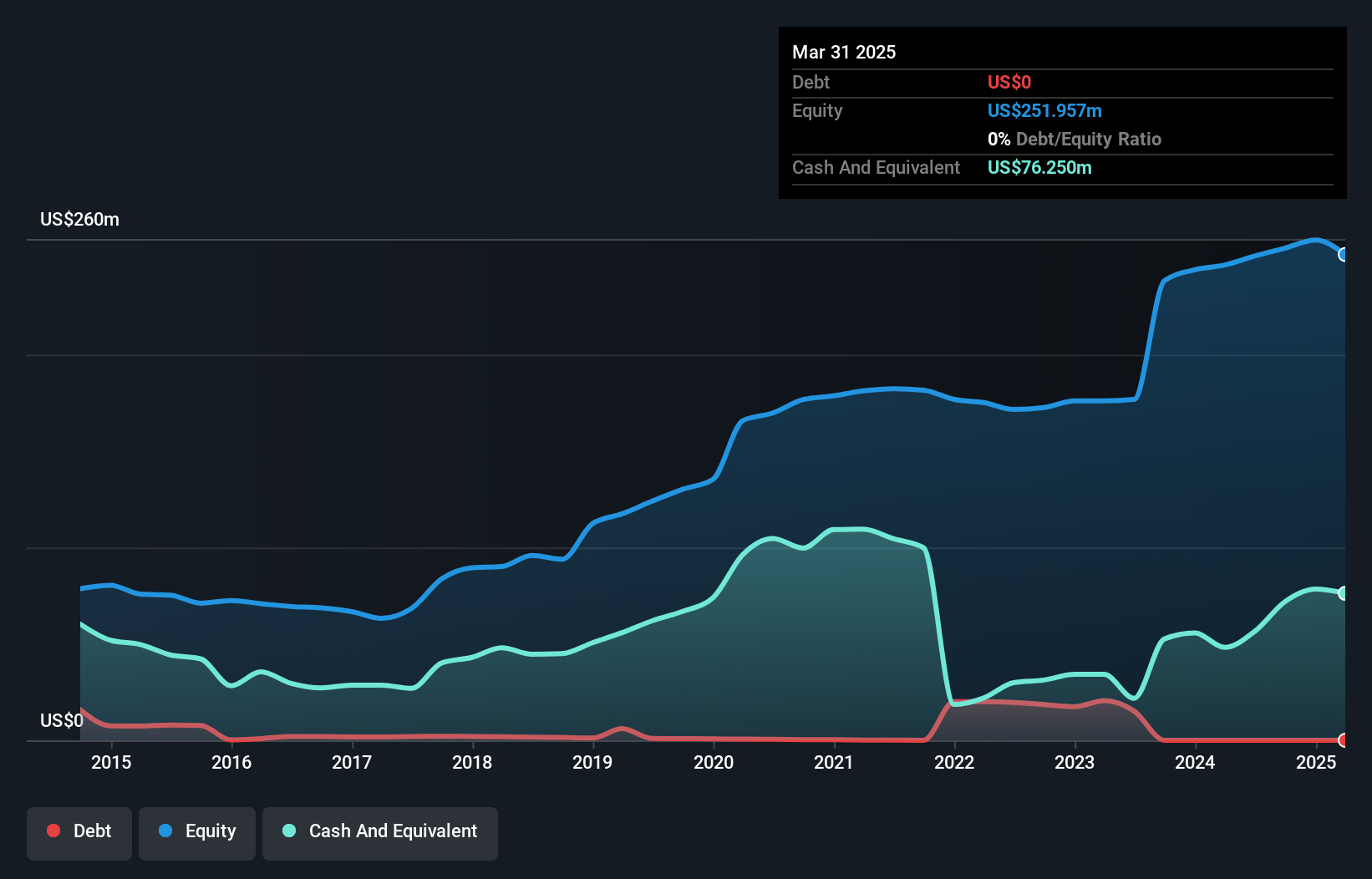

Overview: Kamada Ltd. manufactures and sells plasma-derived protein therapeutics with a market cap of ₪1.27 billion.

Operations: Revenue primarily stems from proprietary products, contributing $139.05 million, while distribution accounts for $19.33 million.

Kamada, a nimble player in the biotech space, showcases impressive growth with earnings skyrocketing by 154.7% over the past year, outpacing the industry average of 7.1%. The company is debt-free and trades at nearly 60% below its estimated fair value, indicating potential upside for investors. Recent expansions include a new plasma collection center in Houston, anticipated to generate US$8-10 million annually once fully operational. With Q3 revenue hitting US$41.74 million and net income climbing to US$3.86 million, Kamada’s robust financial health supports its pursuit of strategic M&A opportunities aimed at sustaining double-digit growth beyond 2024.

- Click to explore a detailed breakdown of our findings in Kamada's health report.

Understand Kamada's track record by examining our Past report.

Make It Happen

- Embark on your investment journey to our 4612 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kamada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KMDA

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)