Here's Why We're Not Too Worried About Evogene's (TLV:EVGN) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, Evogene (TLV:EVGN) stock is up 214% in the last year, providing strong gains for shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky Evogene's cash burn is. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Evogene

When Might Evogene Run Out Of Money?

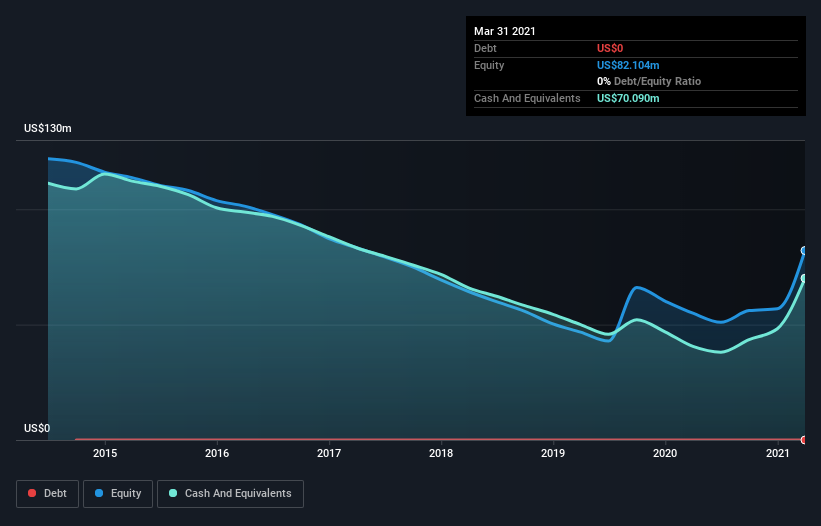

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2021, Evogene had cash of US$70m and no debt. In the last year, its cash burn was US$19m. That means it had a cash runway of about 3.6 years as of March 2021. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

How Is Evogene's Cash Burn Changing Over Time?

Whilst it's great to see that Evogene has already begun generating revenue from operations, last year it only produced US$1.3m, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. With the cash burn rate up 2.2% in the last year, it seems that the company is ratcheting up investment in the business over time. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Evogene Raise More Cash Easily?

While its cash burn is only increasing slightly, Evogene shareholders should still consider the potential need for further cash, down the track. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Evogene has a market capitalisation of US$139m and burnt through US$19m last year, which is 14% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Evogene's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Evogene's cash burn. For example, we think its cash runway suggests that the company is on a good path. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Taking a deeper dive, we've spotted 5 warning signs for Evogene you should be aware of, and 2 of them are significant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Evogene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:EVGN

Moderate with adequate balance sheet.