- France

- /

- Capital Markets

- /

- ENXTPA:VIL

3 Promising Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by central banks adjusting interest rates and major indices showing mixed performance, the spotlight has turned to small-cap stocks, which have recently underperformed compared to their larger counterparts. In this environment, identifying promising yet overlooked stocks can offer unique opportunities for portfolio diversification and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across multiple regions including Europe, the Middle East, Africa, the Americas, and Asia-Pacific with a market cap of approximately €683.29 million.

Operations: VIEL & Cie generates revenue primarily from professional intermediation, which contributes €1.05 billion, and stock exchange online services at €71.02 million. The company also benefits from contributions from holdings amounting to €3.63 million, while real estate and other activities show a slight negative impact of -€0.15 million on revenue.

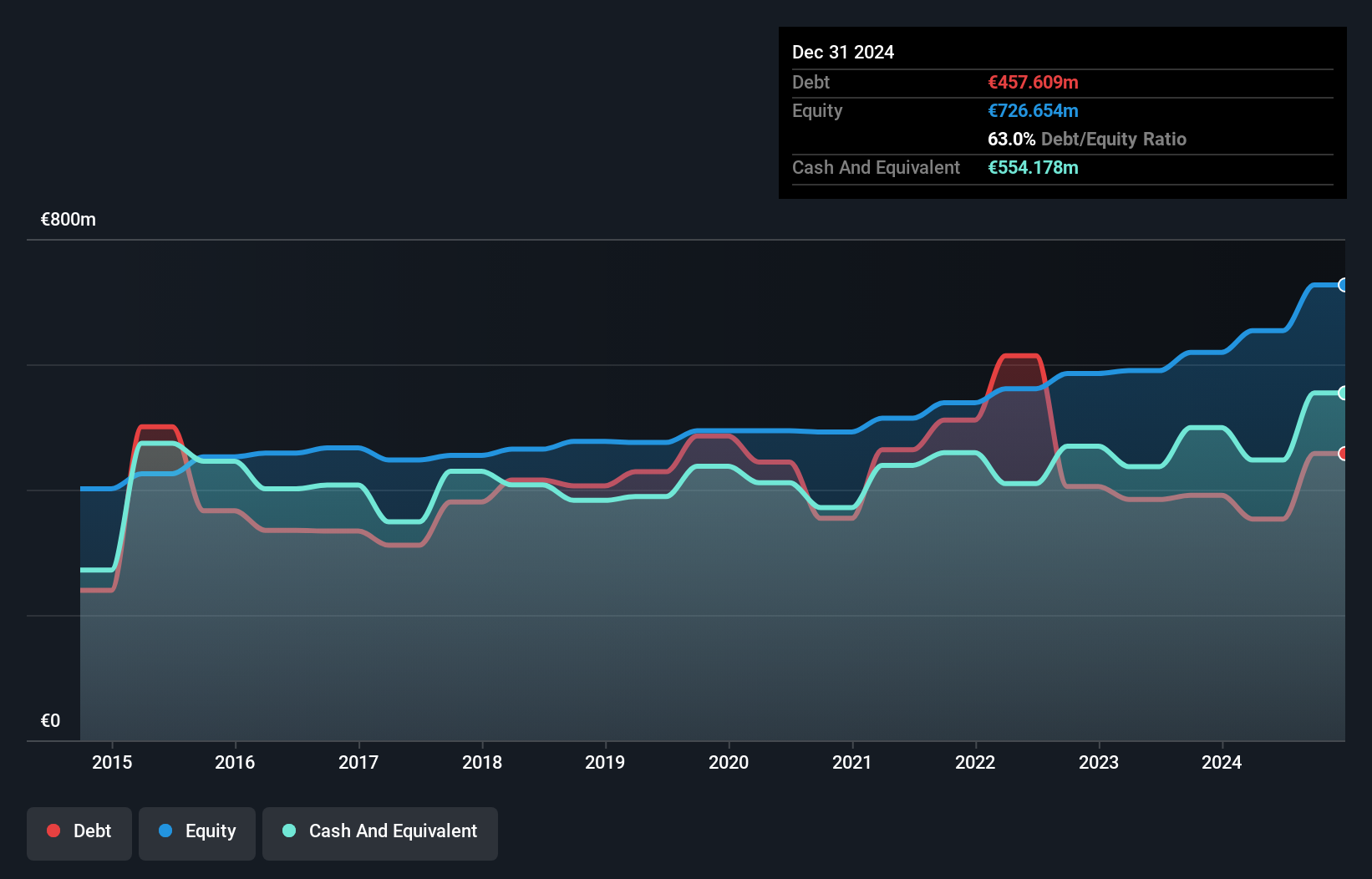

VIEL & Cie, a small cap player in the financial sector, exhibits high-quality earnings with a consistent growth of 19.9% annually over the past five years. Its debt to equity ratio has improved significantly from 90.2% to 54%, indicating better financial health. Despite trading at 41.1% below its estimated fair value, recent earnings growth of 36.3% lagged slightly behind the industry average of 38.7%. The company is free cash flow positive and holds more cash than total debt, suggesting robust liquidity management and potential for future stability or expansion within its niche market segment.

- Delve into the full analysis health report here for a deeper understanding of VIEL & Cie société anonyme.

Learn about VIEL & Cie société anonyme's historical performance.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer care across various global regions, with a market cap of approximately SEK7.03 billion.

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, which reported SEK1.17 billion in sales.

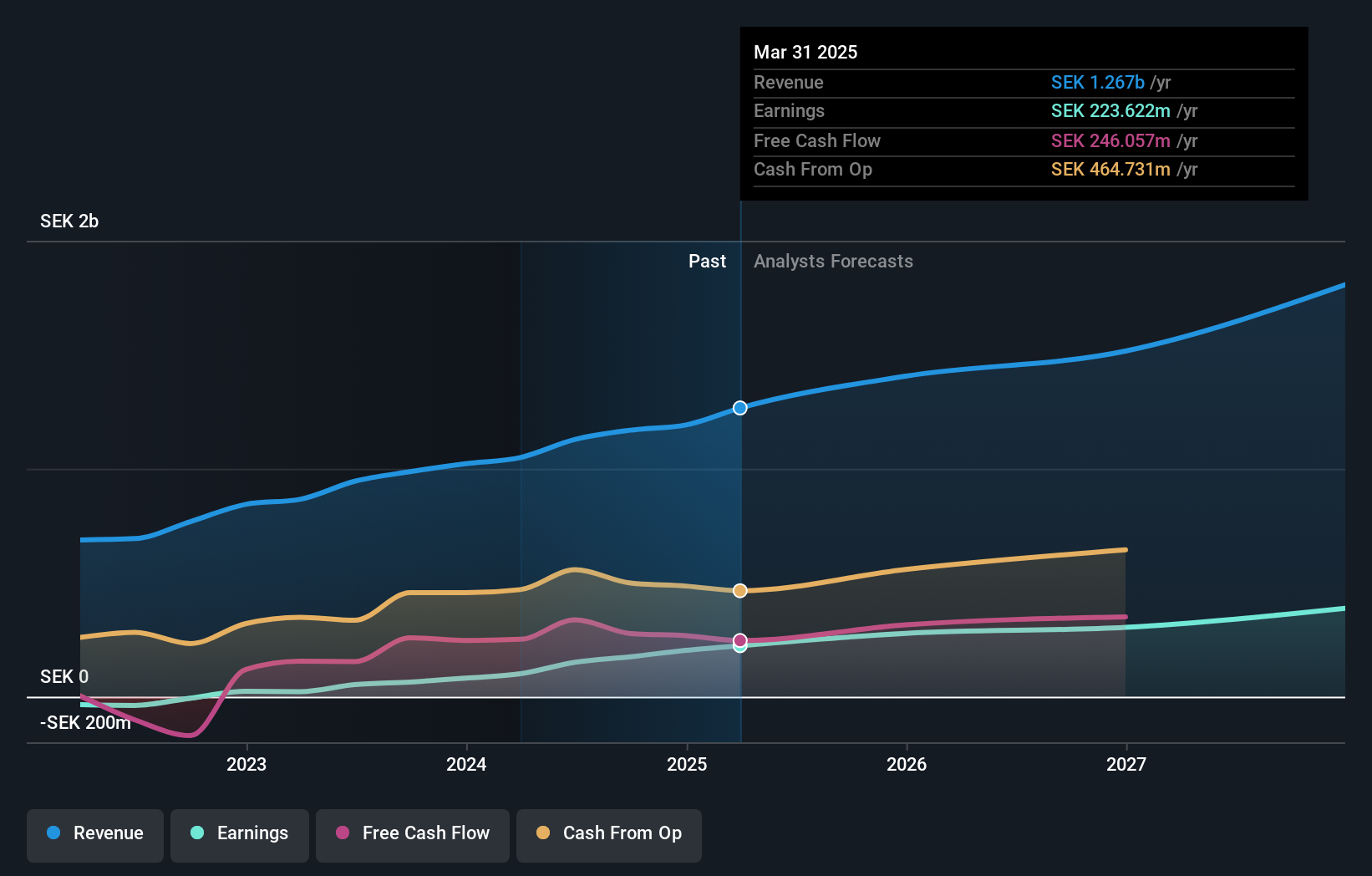

RaySearch Laboratories, a nimble player in the healthcare technology sector, has demonstrated impressive financial health with no debt and high-quality earnings. Over the past year, its earnings surged by 173%, significantly outpacing the Healthcare Services industry growth of 3.6%. Recent client announcements underscore its expanding footprint in Europe, with substantial orders from Institut Curie and other French centers under Unicancer agreements. For Q3 2024, sales reached SEK 293 million while net income jumped to SEK 45 million from SEK 22 million a year ago. The company is poised for continued growth with projected annual earnings expansion of over 24%.

Polyram Plastic Industries (TASE:POLP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Polyram Plastic Industries LTD specializes in the manufacturing and supply of thermoplastic compounds both within Israel and on an international scale, with a market cap of ₪1.39 billion.

Operations: Polyram Plastic Industries generates revenue primarily from three segments: Engineering Thermoplastic Compounds (₪555.54 million), Bondyram (₪347.59 million), and Polytron (₪105.96 million).

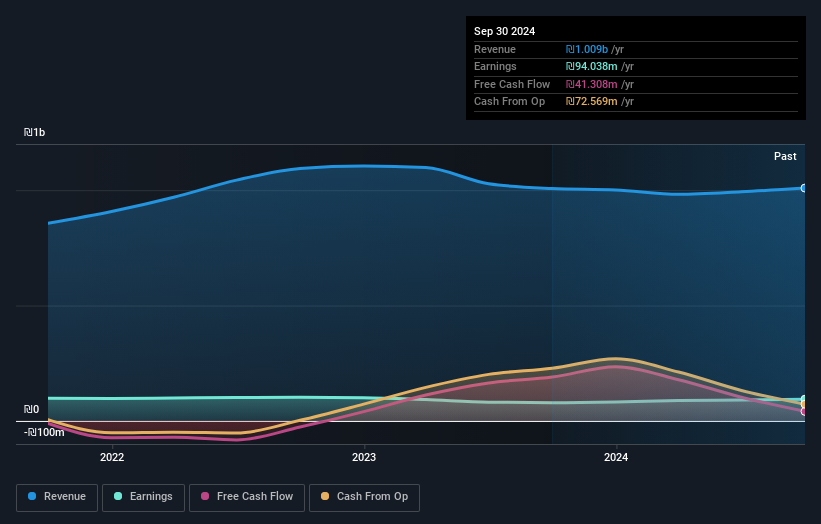

Polyram Plastic Industries, with its compact market presence, has shown robust earnings growth of 19.4% over the past year, outpacing the Chemicals industry's 9.7%. This performance is underlined by a price-to-earnings ratio of 14.8x, slightly below the industry average of 14.9x, suggesting potential value for investors. The company's interest payments are well covered with an EBIT coverage of 7.1x, indicating solid financial health despite a slight increase in debt to equity from 44.2% to 45.5% over five years. Recent quarterly sales rose to ILS266 million from ILS250 million last year, reflecting steady progress in revenue generation and profitability gains amidst industry challenges.

Next Steps

- Click through to start exploring the rest of the 4499 Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIL

VIEL & Cie société anonyme

An investment company, provides interdealer broking, online trading, and private banking services in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region.

Solid track record with excellent balance sheet and pays a dividend.