- United Arab Emirates

- /

- Hospitality

- /

- ADX:NCTH

Middle Eastern Penny Stocks With At Least US$9M Market Cap

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced mixed performances, with Saudi Arabia's bourse declining due to weak earnings while Dubai's index saw a slight uptick. In such fluctuating market conditions, investors often seek opportunities in less conventional areas like penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can offer unique growth potential and financial resilience.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.442 | ₪169.33M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.07 | ₪3.32B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR4.11 | SAR1.65B | ★★★★★★ |

| Tgi Infrastructures (TASE:TGI) | ₪2.37 | ₪176.19M | ★★★★★☆ |

| Yesil Yapi Endüstrisi (IBSE:YYAPI) | TRY1.46 | TRY1.24B | ★★★★★☆ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY1.91 | TRY534.8M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.29 | AED9.69B | ★★★★★☆ |

| Peninsula Group (TASE:PEN) | ₪2.399 | ₪533.56M | ★★★★☆☆ |

| Orad (TASE:ORAD) | ₪0.768 | ₪71.66M | ★★★★★★ |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.628 | AED381.98M | ★★★★★★ |

Click here to see the full list of 90 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

National Corporation for Tourism and Hotels (ADX:NCTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: National Corporation for Tourism and Hotels invests in, owns, and manages hotels and leisure complexes in the United Arab Emirates, with a market cap of AED2.27 billion.

Operations: Revenue Segments: No specific revenue segments are reported for this company.

Market Cap: AED2.27B

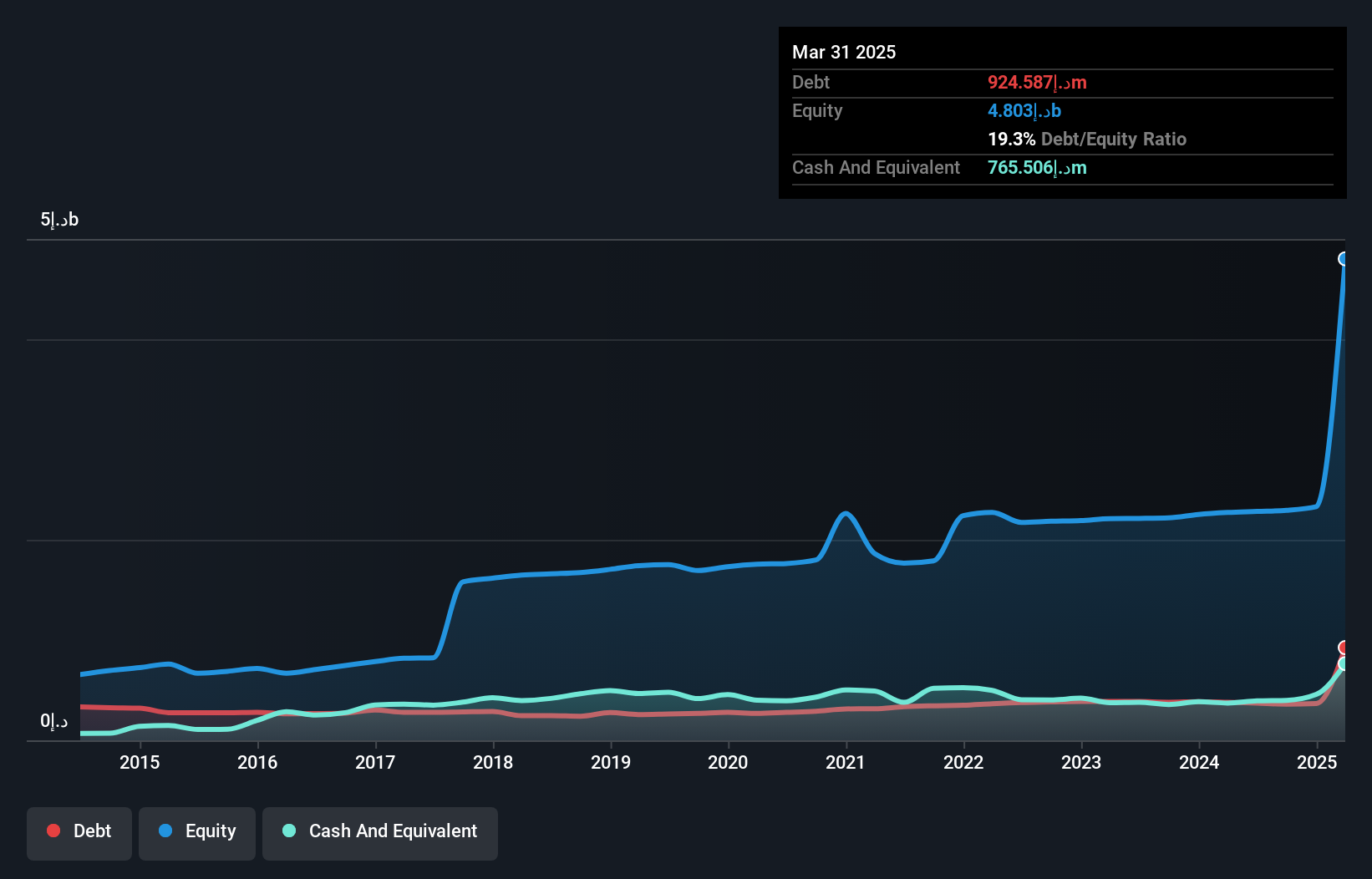

National Corporation for Tourism and Hotels, with a market cap of AED2.27 billion, recently reported annual sales of AED 698.56 million and net income of AED 74.03 million, reflecting modest growth from the previous year. Despite low return on equity at 3.2%, the company trades below its estimated fair value, indicating potential undervaluation in the market. Its debt is well-covered by operating cash flow, and both short-term and long-term liabilities are adequately managed with sufficient assets on hand. Earnings grew by 8.7% last year, surpassing industry growth rates, though past five-year earnings have declined annually by 13%.

- Dive into the specifics of National Corporation for Tourism and Hotels here with our thorough balance sheet health report.

- Explore historical data to track National Corporation for Tourism and Hotels' performance over time in our past results report.

Bram Industries (TASE:BRAM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bram Industries Ltd. operates through its subsidiaries in the development, production, and marketing of plastic products using injection-molding technology in Israel, with a market cap of ₪34.19 million.

Operations: The company generates revenue from two main segments: Packaging for The Food Industry, which contributes ₪53.29 million, and Unique Products for the Home, accounting for ₪44.62 million.

Market Cap: ₪34.19M

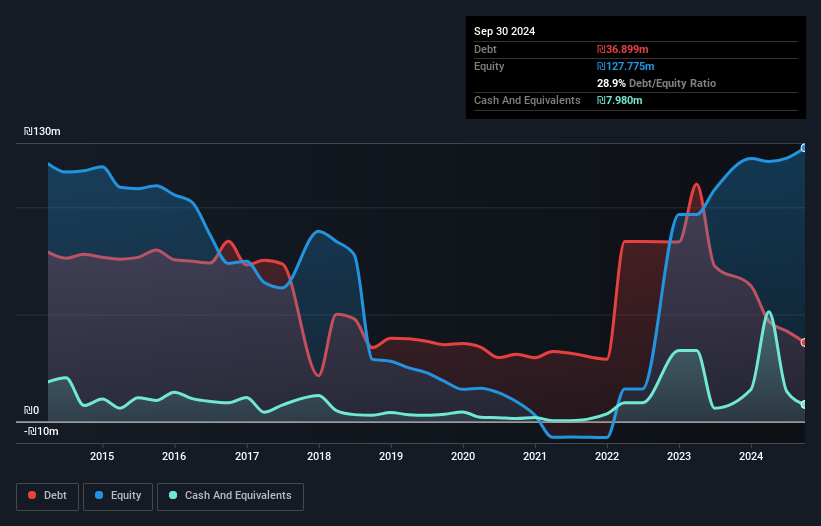

Bram Industries, with a market cap of ₪34.19 million, operates in the plastic products sector and has shown some financial challenges typical of penny stocks. Despite having sales revenue from its packaging and home product segments, Bram remains unprofitable with increasing losses over the past five years. The company's debt is well-managed relative to cash flow, but it carries a high net debt to equity ratio of 50.5%. Recent earnings reports indicate declining sales and persistent net losses, yet there has been improvement in quarterly loss figures compared to previous periods. The board's experience adds stability amid high share price volatility.

- Unlock comprehensive insights into our analysis of Bram Industries stock in this financial health report.

- Gain insights into Bram Industries' past trends and performance with our report on the company's historical track record.

Tgi Infrastructures (TASE:TGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tgi Infrastructures Ltd, with a market cap of ₪176.19 million, operates in Israel's automotive industry by producing, processing, assembling, and marketing mechanical assemblies made of magnesium through its subsidiary.

Operations: TASE:TGI generates revenue primarily from its Infrastructure and Energy segment, which accounts for ₪85.56 million, and The Metal and Electrical Industries segment, contributing ₪76.24 million.

Market Cap: ₪176.19M

Tgi Infrastructures, with a market cap of ₪176.19 million, operates in Israel's automotive industry and has demonstrated profitability growth over the past five years. Its revenue is primarily derived from its Infrastructure and Energy segment (₪85.56 million) and The Metal and Electrical Industries segment (₪76.24 million). The company's short-term assets exceed both its short-term and long-term liabilities, indicating solid liquidity. However, recent earnings have been negatively impacted by large one-off gains, leading to a negative earnings growth of -6.5% over the past year amidst stable weekly volatility of 5%.

- Click here and access our complete financial health analysis report to understand the dynamics of Tgi Infrastructures.

- Understand Tgi Infrastructures' track record by examining our performance history report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 90 Middle Eastern Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Corporation for Tourism and Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:NCTH

National Corporation for Tourism and Hotels

Invests in, owns, and manages hotels and leisure complexes in the United Arab Emirates.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives