Ihlas Gazetecilik Leads Our Trio Of Middle Eastern Penny Stock Picks

Reviewed by Simply Wall St

Amidst the uncertainty surrounding U.S.-China trade talks, Gulf stock markets have remained relatively stable, with investors cautiously awaiting further corporate earnings reports. For those interested in exploring beyond the well-known names, penny stocks—though an outdated term—continue to hold potential value. These smaller or newer companies can offer a mix of growth and resilience that larger firms sometimes miss, making them intriguing options for investors seeking under-the-radar opportunities.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.09 | SAR1.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.27 | SAR504M | ✅ 2 ⚠️ 3 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪1.031 | ₪126.98M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.689 | ₪188.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.925 | ₪2.88B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.162 | ₪160.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.702 | AED423.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.39 | AED430.81M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.30 | AED9.74B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ihlas Gazetecilik (IBSE:IHGZT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Gazetecilik A.S. is engaged in the publishing, selling, distributing, and marketing of newspapers, books, encyclopedias, brochures, and magazines in Turkey and internationally with a market cap of TRY1.09 billion.

Operations: The company's revenue is primarily derived from its publishing segment, specifically newspapers, which generated TRY1.78 billion.

Market Cap: TRY1.09B

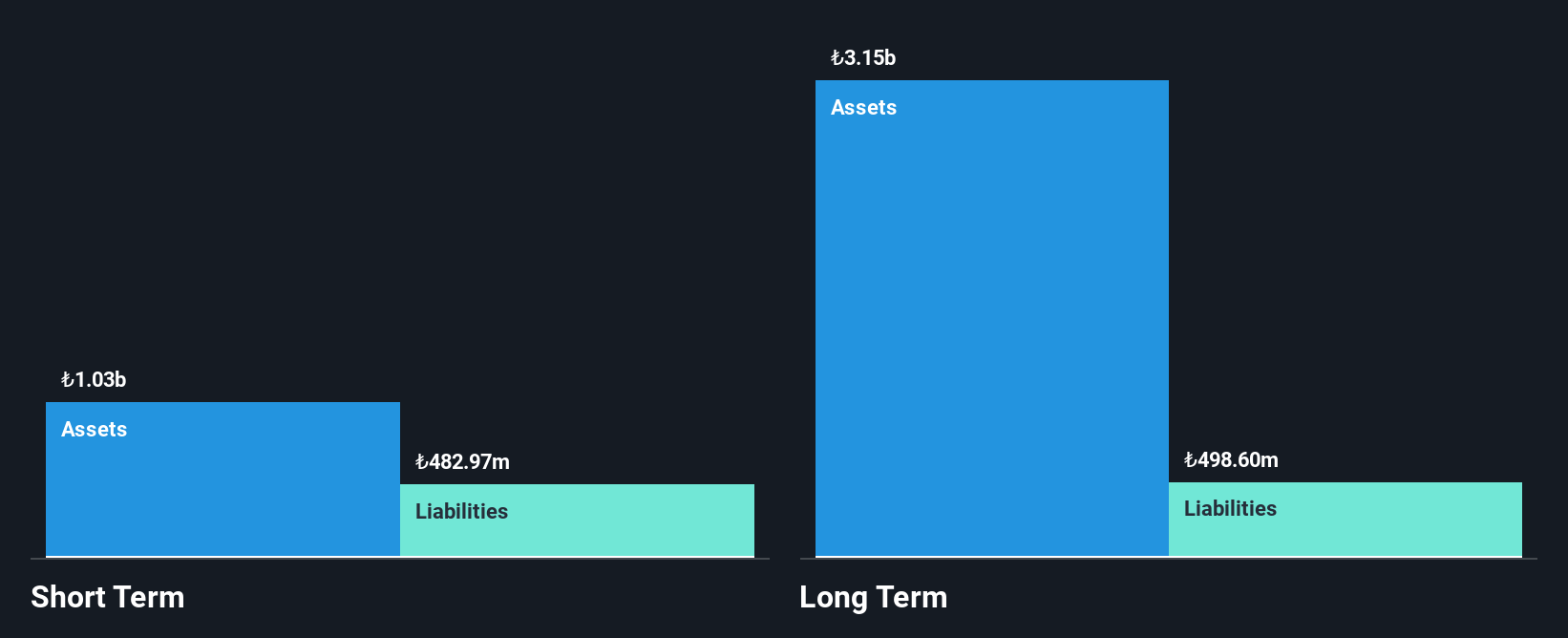

Ihlas Gazetecilik A.S. has transitioned to profitability, reporting a net income of TRY114.35 million for 2024, a significant improvement from the previous year's loss. The company's short-term assets comfortably cover both its short and long-term liabilities, indicating strong liquidity. Its cash reserves exceed total debt, although operating cash flow coverage is limited at 2.8%. Despite a low return on equity of 3.9%, the price-to-earnings ratio of 9.5x suggests potential undervaluation compared to the broader Turkish market average of 18.1x. However, investors should be cautious due to high share price volatility and large one-off financial impacts.

- Jump into the full analysis health report here for a deeper understanding of Ihlas Gazetecilik.

- Evaluate Ihlas Gazetecilik's historical performance by accessing our past performance report.

Bram Industries (TASE:BRAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bram Industries Ltd., with a market cap of ₪33.55 million, develops, produces, and markets plastic products using injection-molding technology through its subsidiaries in Israel.

Operations: Bram Industries generates revenue primarily from two segments: Packaging for The Food Industry, accounting for ₪54.08 million, and Unique Products for the Home, contributing ₪0.74 million.

Market Cap: ₪33.55M

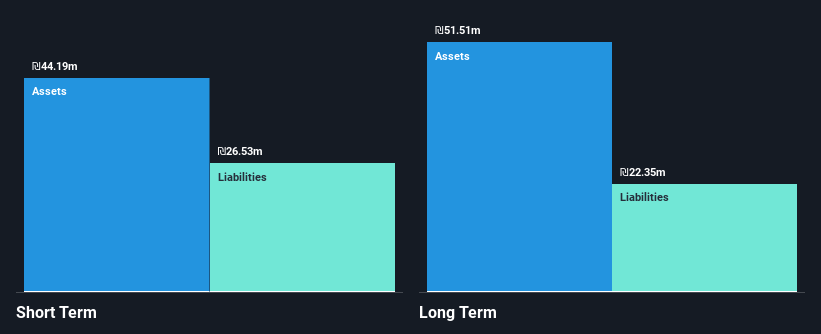

Bram Industries Ltd., with a market cap of ₪33.55 million, is experiencing financial challenges, reporting a net loss of ₪17.46 million for 2024 despite generating sales of ₪49.65 million. The company's short-term assets exceed both its short and long-term liabilities, reflecting solid liquidity management. However, Bram remains unprofitable with negative return on equity and increasing losses over the past five years at an annual rate of 19.8%. While its debt-to-equity ratio has improved significantly from 91.8% to 42.1%, operating cash flow coverage remains inadequate at only 20% of debt obligations, highlighting potential cash flow constraints.

- Unlock comprehensive insights into our analysis of Bram Industries stock in this financial health report.

- Assess Bram Industries' previous results with our detailed historical performance reports.

NRGene Technologies (TASE:NRGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NRGene Technologies Ltd, with a market cap of ₪33.10 million, is an AI genomics company that offers computational tools and develops advanced algorithms across North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Operations: The company generates $1.29 million in revenue from its service offerings.

Market Cap: ₪33.1M

NRGene Technologies Ltd, with a market cap of ₪33.10 million, operates in AI genomics and reported revenues of US$1.29 million for 2024, down from US$2 million the previous year. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges with a net loss of US$3.36 million and less than a year of cash runway if current free cash flow trends continue. A recent breakthrough in developing clubroot-resistant canola traits could bolster its position in agricultural biotechnology, potentially enhancing future revenue streams through partnerships and commercialization efforts by NRGene Green.

- Take a closer look at NRGene Technologies' potential here in our financial health report.

- Explore historical data to track NRGene Technologies' performance over time in our past results report.

Turning Ideas Into Actions

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 93 more companies for you to explore.Click here to unveil our expertly curated list of 96 Middle Eastern Penny Stocks.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bram Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BRAM

Bram Industries

Through its subsidiaries, engages in the development, production, and marketing of plastic products using injection-molding technology in Israel.

Adequate balance sheet very low.

Market Insights

Community Narratives