- Japan

- /

- Commercial Services

- /

- TSE:9308

Menora Mivtachim Holdings And These 3 Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across sectors, with financials and energy benefiting from deregulation hopes while healthcare faces pressures. Amidst these market dynamics, dividend stocks can offer a measure of stability through regular income streams, making them an attractive consideration for those seeking to balance potential volatility with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Menora Mivtachim Holdings (TASE:MMHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Menora Mivtachim Holdings Ltd operates in the insurance and finance sectors in Israel with a market cap of ₪8.17 billion.

Operations: Menora Mivtachim Holdings Ltd generates revenue primarily from Life Insurance and Long Term Savings - Life Insurance (₪5.32 billion), General Insurance - Automobile Property Insurance (₪1.75 billion), Health Insurance (₪2.22 billion), Compulsory Vehicle Insurance (₪888.61 million), Provident Savings (₪556.46 million), Pension Services (₪738 million), and various other insurance divisions including Property and Other Liabilities, totaling significant contributions to its financial performance in Israel's insurance sector.

Dividend Yield: 4.2%

Menora Mivtachim Holdings offers a dividend covered by earnings and cash flows, with payout ratios of 36.1% and 49.8%, respectively, though its yield of 4.22% is below the IL market's top tier. Despite a history of volatile dividends, payouts have grown over the past decade. Recent financials show strong earnings growth despite revenue decline, with net income for Q2 reaching ILS 296.95 million from ILS 21.16 million a year prior, amidst impairments reported in Q2 2024.

- Get an in-depth perspective on Menora Mivtachim Holdings' performance by reading our dividend report here.

- Our valuation report here indicates Menora Mivtachim Holdings may be undervalued.

Inui Global Logistics (TSE:9308)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inui Global Logistics Co., Ltd. operates in shipping, warehousing, and realty sectors both within Japan and internationally, with a market capitalization of ¥37.87 billion.

Operations: Inui Global Logistics Co., Ltd. generates its revenue from three primary segments: shipping, warehousing, and realty operations across domestic and international markets.

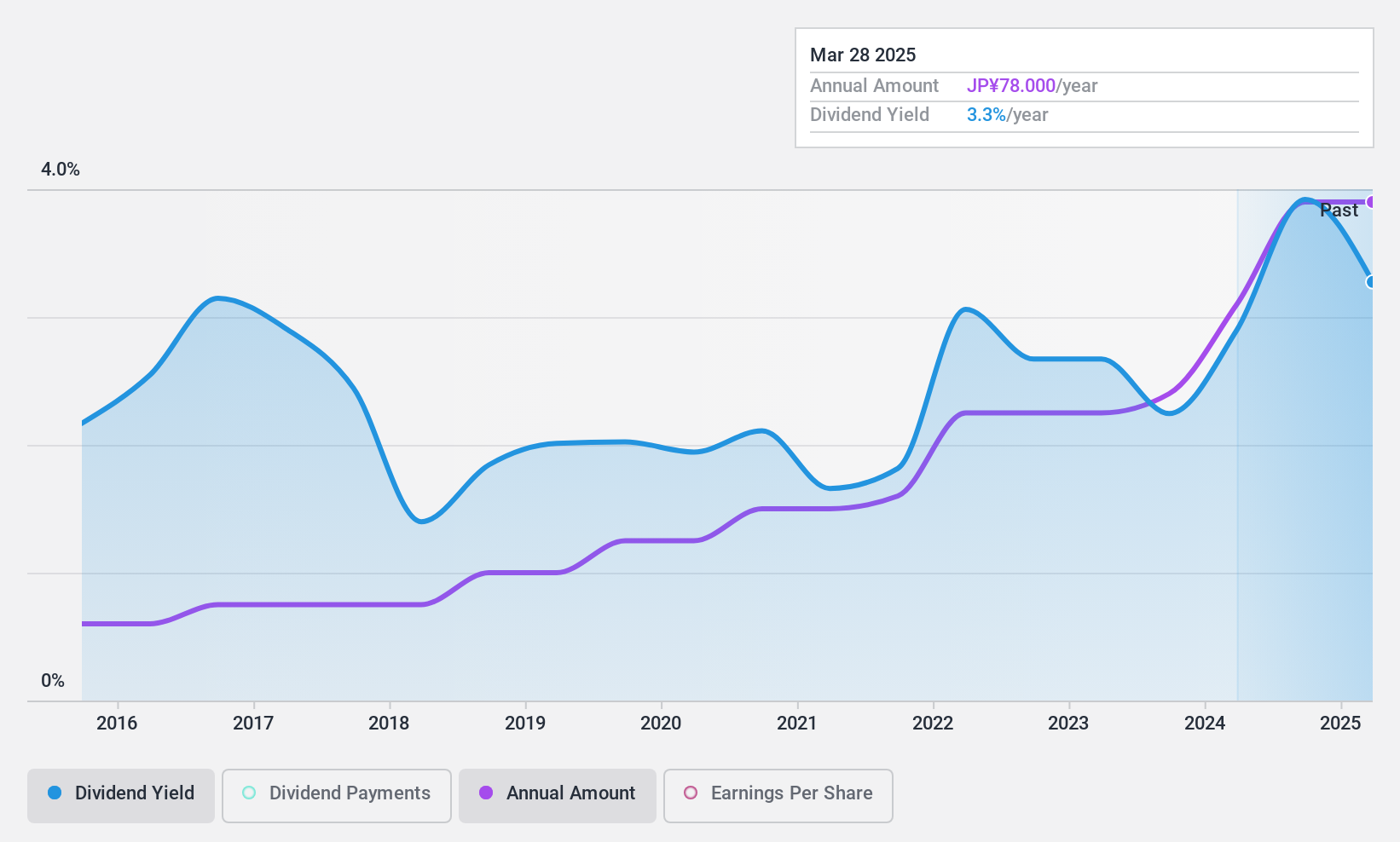

Dividend Yield: 7.4%

Inui Global Logistics' dividend yield of 7.42% ranks among the top 25% in Japan, yet it faces sustainability challenges due to a high cash payout ratio (135.2%) and volatile past payments. While earnings grew by 66.4% last year, large one-off items impacted results, raising concerns about quality and consistency. The price-to-earnings ratio of 9.1x suggests potential undervaluation compared to the broader market, but dividend reliability remains questionable given historical volatility and coverage issues.

- Navigate through the intricacies of Inui Global Logistics with our comprehensive dividend report here.

- The analysis detailed in our Inui Global Logistics valuation report hints at an inflated share price compared to its estimated value.

Business Brain Showa-Ota (TSE:9658)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Business Brain Showa-Ota Inc. offers consulting and system development solutions in Japan, with a market cap of ¥23.22 billion.

Operations: Business Brain Showa-Ota Inc. generates its revenue through consulting and system development solutions in Japan.

Dividend Yield: 3.9%

Business Brain Showa-Ota's dividend yield of 3.89% ranks in the top 25% of Japan's market, supported by a stable and growing dividend history over the past decade. With a low payout ratio (22.6%) and cash payout ratio (33%), dividends are well covered by both earnings and cash flows, indicating sustainability. Despite trading at 53.7% below estimated fair value, recent profit margins have declined to 5.7%, suggesting potential challenges ahead for profitability improvement.

- Unlock comprehensive insights into our analysis of Business Brain Showa-Ota stock in this dividend report.

- According our valuation report, there's an indication that Business Brain Showa-Ota's share price might be on the cheaper side.

Summing It All Up

- Unlock our comprehensive list of 1951 Top Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9308

Inui Global Logistics

Engages in shipping, warehousing, and realty businesses in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.