In a week marked by cautious Federal Reserve commentary and political uncertainty, global markets experienced notable fluctuations, with U.S. stocks facing broad-based declines despite a late-week rally. As investors navigate these turbulent times, dividend stocks can offer stability and income potential, making them an attractive option for those seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

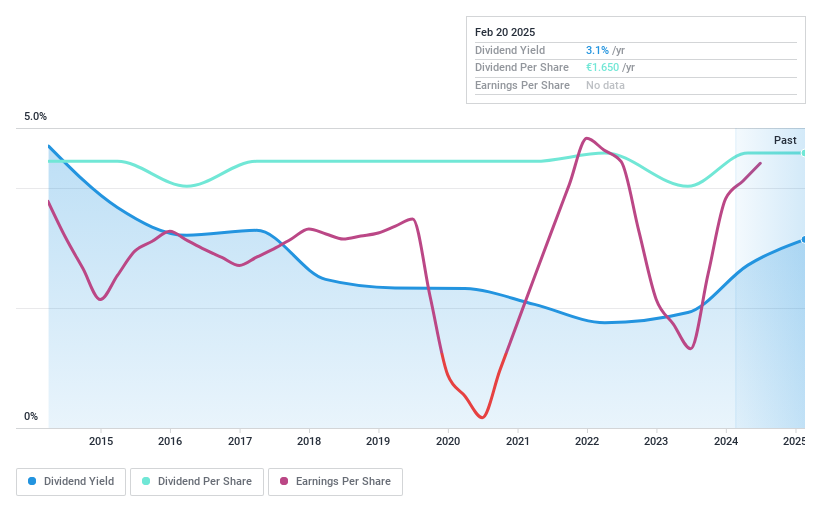

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, with a market cap of €572.66 million, mines, produces, and sells salt in Germany, the European Union, and internationally through its subsidiaries.

Operations: Südwestdeutsche Salzwerke AG generates its revenue primarily from the Salt segment (€283.67 million) and Waste Management (€62.46 million).

Dividend Yield: 3%

Südwestdeutsche Salzwerke offers a reliable dividend option with a stable payout history over the past decade. Its dividends are well-covered by both earnings and cash flows, boasting low payout ratios of 43.5% and 24.5%, respectively. Despite trading significantly below its estimated fair value, the dividend yield of 3.03% is modest compared to top-tier German market payers. Recent earnings growth suggests potential for future stability, although share price volatility remains high in recent months.

- Click here and access our complete dividend analysis report to understand the dynamics of Südwestdeutsche Salzwerke.

- The analysis detailed in our Südwestdeutsche Salzwerke valuation report hints at an inflated share price compared to its estimated value.

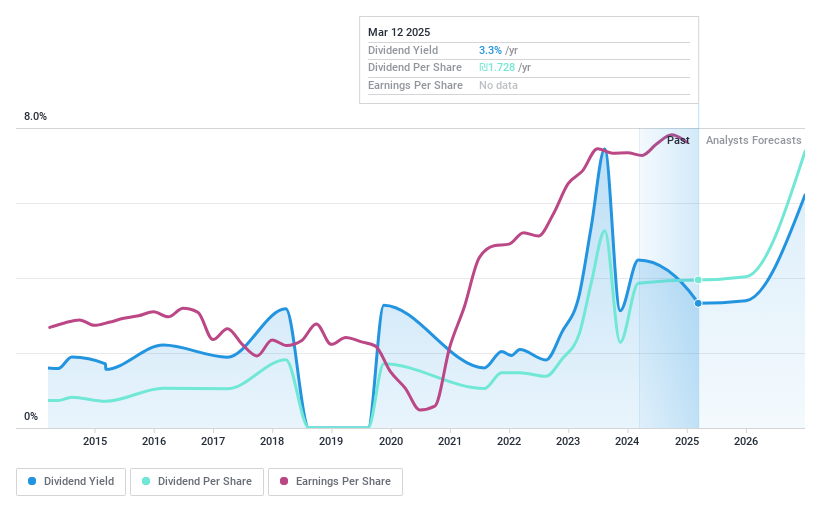

Menora Mivtachim Holdings (TASE:MMHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Menora Mivtachim Holdings Ltd operates in the insurance and finance sectors in Israel, with a market capitalization of ₪9.11 billion.

Operations: Menora Mivtachim Holdings Ltd generates revenue from various segments, including Life Insurance and Long Term Savings - Life Insurance (₪6.25 billion), Health Insurance (₪2.28 billion), General Insurance - Automobile Property Insurance (₪1.82 billion), General Insurance - Compulsory Vehicle Insurance (₪928.10 million), Life Insurance and Long Term Savings - Provident (₪615.33 million), General Insurance - Property Divisions and Others (₪423.34 million), General Insurance - Other Liabilities Divisions (₪315.40 million), and Life Insurance and Long Term Savings - Pension (₪756.46 million).

Dividend Yield: 5.1%

Menora Mivtachim Holdings has shown a mixed dividend profile. Recent earnings reveal a significant revenue increase to ILS 3.97 billion for Q3 2024, although net income declined year-over-year. The company maintains a reasonable payout ratio of 50.8%, ensuring dividends are covered by earnings and cash flows, with a cash payout ratio of 43.5%. However, its dividend yield of 5.05% lags behind top-tier Israeli payers, and the dividend history is marked by volatility over the past decade.

- Click to explore a detailed breakdown of our findings in Menora Mivtachim Holdings' dividend report.

- Our valuation report here indicates Menora Mivtachim Holdings may be undervalued.

Bank Hapoalim B.M (TASE:POLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Hapoalim B.M., along with its subsidiaries, offers a range of banking and financial products and services both in Israel and internationally, with a market cap of ₪57.14 billion.

Operations: Bank Hapoalim B.M.'s revenue segments include Israel - Households - Other at ₪6.48 billion, Overseas - Business Activity at ₪992 million, Israel - Institutional Entities at ₪375 million, Households - Housing Loans Israel at ₪1.65 billion, and Israel - Households - Credit Cards at ₪338 million.

Dividend Yield: 3.9%

Bank Hapoalim B.M. demonstrates a complex dividend profile with recent earnings growth, reporting net income of ILS 1.91 billion for Q3 2024, up from ILS 1.67 billion the previous year. Despite a low payout ratio of 29.2%, ensuring dividends are well-covered by earnings, its dividend yield of 3.92% is below top-tier Israeli payers and has been unstable over the past decade, marked by volatility and unreliability in payments.

- Dive into the specifics of Bank Hapoalim B.M here with our thorough dividend report.

- Upon reviewing our latest valuation report, Bank Hapoalim B.M's share price might be too pessimistic.

Where To Now?

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1965 more companies for you to explore.Click here to unveil our expertly curated list of 1968 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Menora Mivtachim Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MMHD

Menora Mivtachim Holdings

Operates in insurance and finance sectors in Israel.

Excellent balance sheet with proven track record and pays a dividend.