After Leaping 25% Libra Insurance Company Ltd (TLV:LBRA) Shares Are Not Flying Under The Radar

Despite an already strong run, Libra Insurance Company Ltd (TLV:LBRA) shares have been powering on, with a gain of 25% in the last thirty days. The annual gain comes to 184% following the latest surge, making investors sit up and take notice.

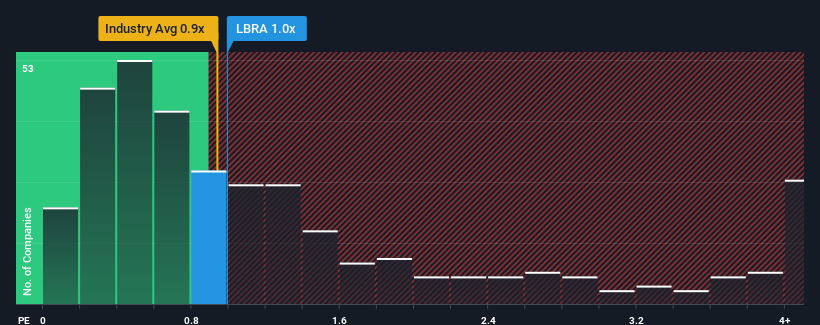

Since its price has surged higher, you could be forgiven for thinking Libra Insurance is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1x, considering almost half the companies in Israel's Insurance industry have P/S ratios below 0.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Libra Insurance

What Does Libra Insurance's P/S Mean For Shareholders?

Recent times have been quite advantageous for Libra Insurance as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Libra Insurance's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Libra Insurance's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 77%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 9.5% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's understandable that Libra Insurance's P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What Does Libra Insurance's P/S Mean For Investors?

Libra Insurance shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Libra Insurance revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Libra Insurance with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Libra Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:LBRA

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives