- Saudi Arabia

- /

- Building

- /

- SASE:1302

3 Undiscovered Gems in Middle East to Enhance Your Portfolio

Reviewed by Simply Wall St

As the Middle East markets navigate mixed signals from easing U.S.-China trade tensions and tepid corporate earnings, investors are keeping a keen eye on the shifting dynamics within the region's financial landscape. With Gulf markets showing varied performances amid these global developments, identifying stocks with robust fundamentals and potential for growth becomes essential in enhancing one's portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Bawan (SASE:1302)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bawan Company engages in the manufacturing and sale of metal and steel works in Saudi Arabia, with a market capitalization of SAR3.35 billion.

Operations: Bawan generates revenue primarily from its Metal and Wood segment, contributing SAR1.93 billion, followed by the Electrical segment at SAR722.97 million and the Plastic segment at SAR397.67 million.

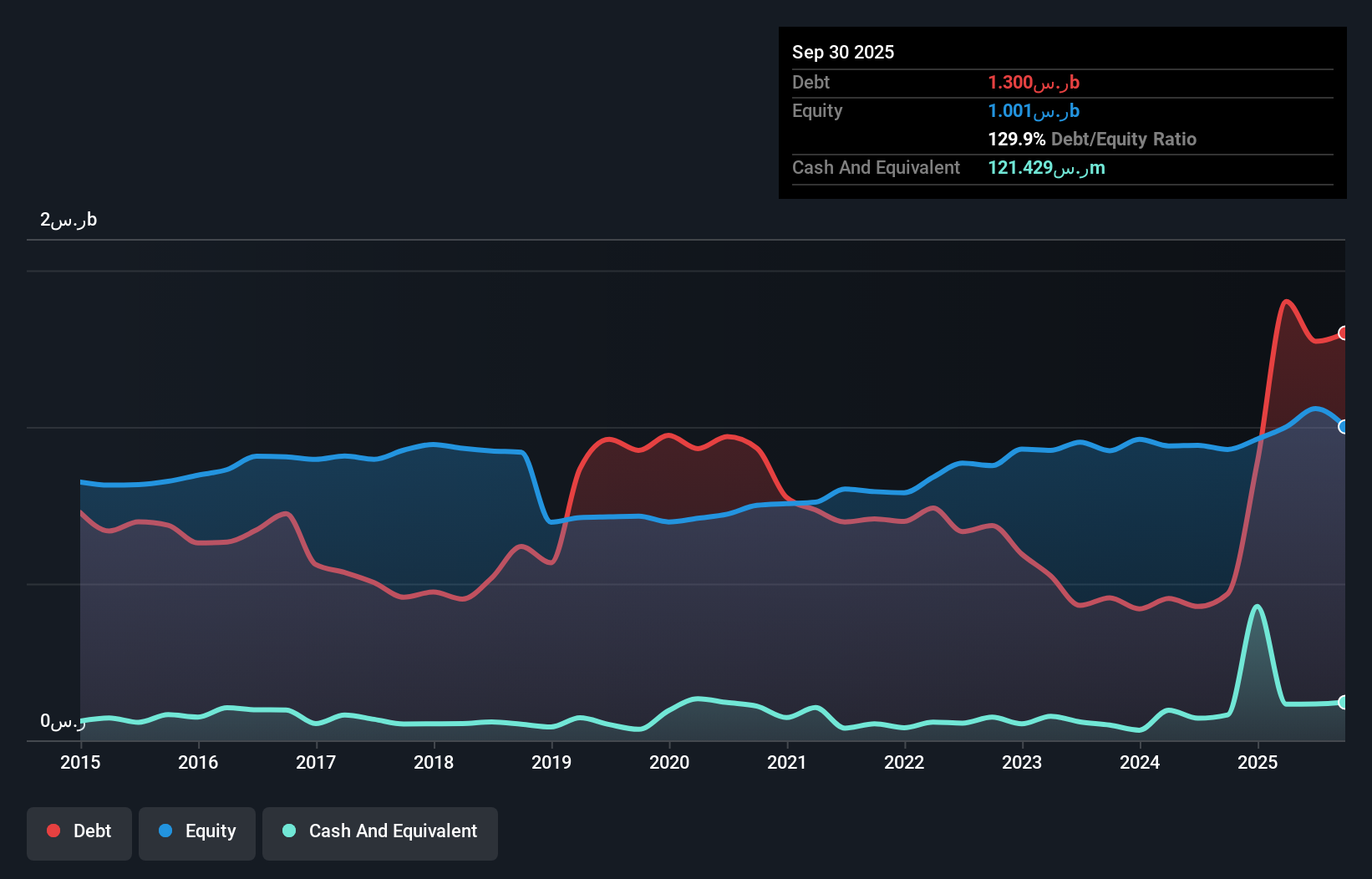

Bawan, a notable player in the Middle East's building sector, has shown promising growth with earnings climbing 11.8% over the past year, outpacing its industry peers. The company's net income for Q2 2025 reached SAR 50.37 million, up from SAR 23.12 million a year prior, reflecting a solid performance boost. Despite its high net debt to equity ratio of 109.3%, interest payments are well covered at 3.9 times by EBIT, indicating financial resilience amidst expansion efforts and strategic leadership changes with Mr. Ziyad Abdullatif Al-Barak stepping in as Acting CEO later this year.

- Click here to discover the nuances of Bawan with our detailed analytical health report.

Understand Bawan's track record by examining our Past report.

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individual and corporate clients in Israel, with a market capitalization of ₪2.88 billion.

Operations: I.D.I. Insurance derives its revenue primarily from providing insurance products to individual and corporate clients in Israel. The company's financial performance is reflected in its market capitalization of approximately ₪2.88 billion, with a focus on optimizing operational efficiency to enhance profitability.

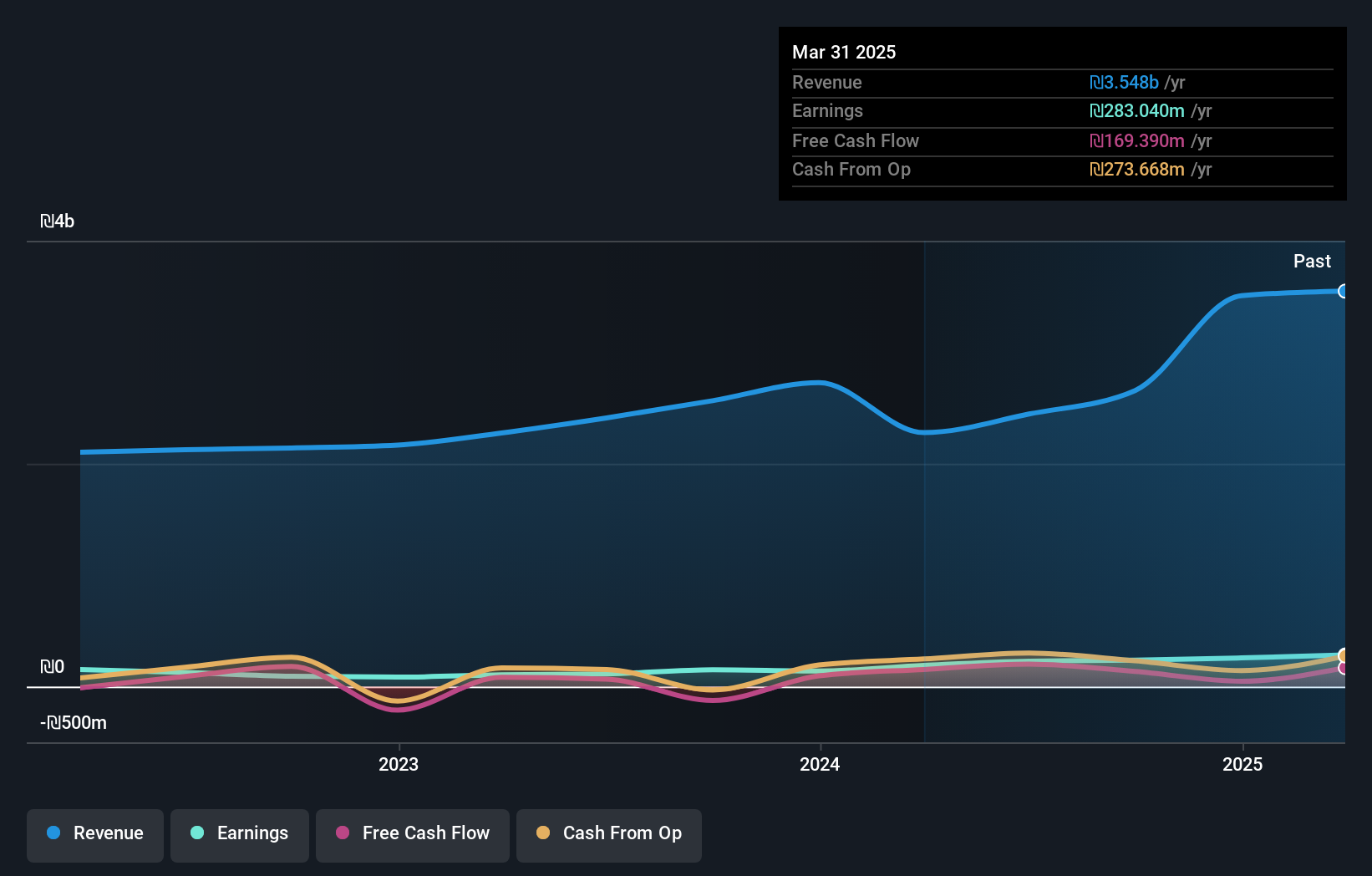

With a price-to-earnings ratio of 9.4x, I.D.I. Insurance stands out as an attractive option in Israel's market, where the average is 15.9x. Over the past five years, earnings have grown at a steady pace of 6% annually, showcasing resilience in a competitive industry. The company has successfully eliminated its debt from a previous debt-to-equity ratio of 74%, enhancing financial stability and reducing interest payment concerns. Recent reports highlight robust performance with net income reaching ILS 94.62 million for Q2 2025, up from ILS 59.53 million last year, reflecting strong operational efficiency and potential for future growth.

Wesure Global Tech (TASE:WESR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wesure Global Tech Ltd, with a market cap of ₪1.27 billion, operates internationally by developing and marketing technologies for digital platforms within the insurance and finance sectors.

Operations: Wesure Global Tech generates revenue primarily from its General Insurance segment, with Ayalon Insurance contributing ₪2.44 billion and Wesure Insurance adding ₪327.35 million. The Life Insurance and Long-Term Savings segment also plays a significant role, bringing in ₪1.55 billion.

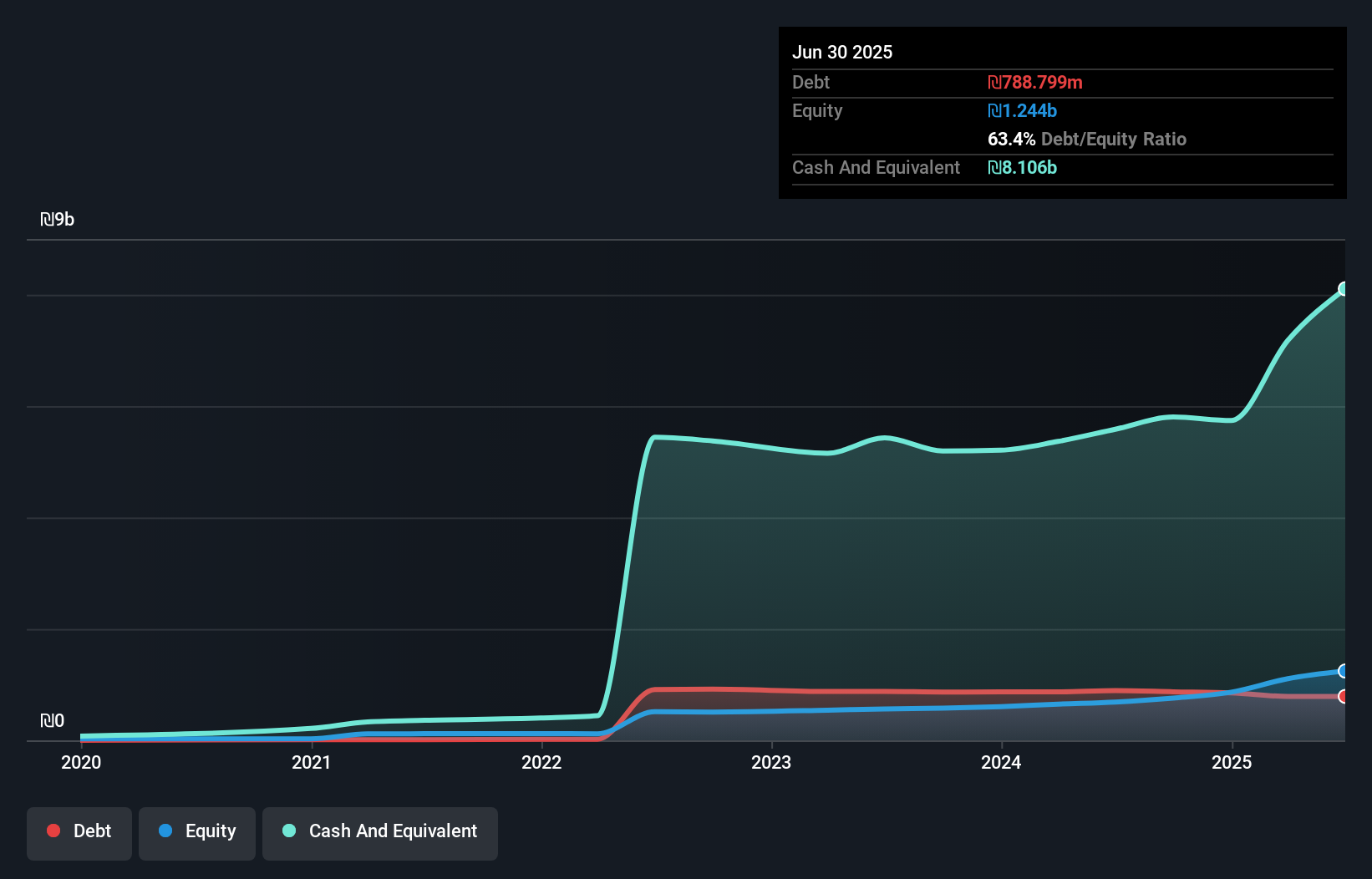

Wesure Global Tech, a relatively small player in the insurance sector, is capturing attention with its robust financials. The company's earnings growth of 55% over the past year outpaced the industry average of 35%, showcasing its competitive edge. Trading at a price-to-earnings ratio of 8.1x, Wesure appears undervalued compared to the IL market's 15.9x. Despite a volatile share price recently, its interest payments are comfortably covered by EBIT at six times coverage, indicating strong operational health. Recent reports show net income for Q2 reached ILS 95 million from ILS 46 million last year, reflecting solid profitability improvements.

Key Takeaways

- Discover the full array of 211 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bawan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1302

Bawan

Manufactures and sells metal and steel works in the Kingdom of Saudi Arabia.

Proven track record with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)