- Turkey

- /

- Retail REITs

- /

- IBSE:PAGYO

3 Middle Eastern Dividend Stocks Yielding Up To 5.3%

Reviewed by Simply Wall St

Amidst the backdrop of softer oil prices impacting most Gulf markets, investors are keenly observing how these fluctuations affect regional indices and economic dynamics. In such a climate, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to navigate the current market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.36% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.54% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.86% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.76% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.58% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.56% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.55% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.40% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.93% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.05% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our Top Middle Eastern Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

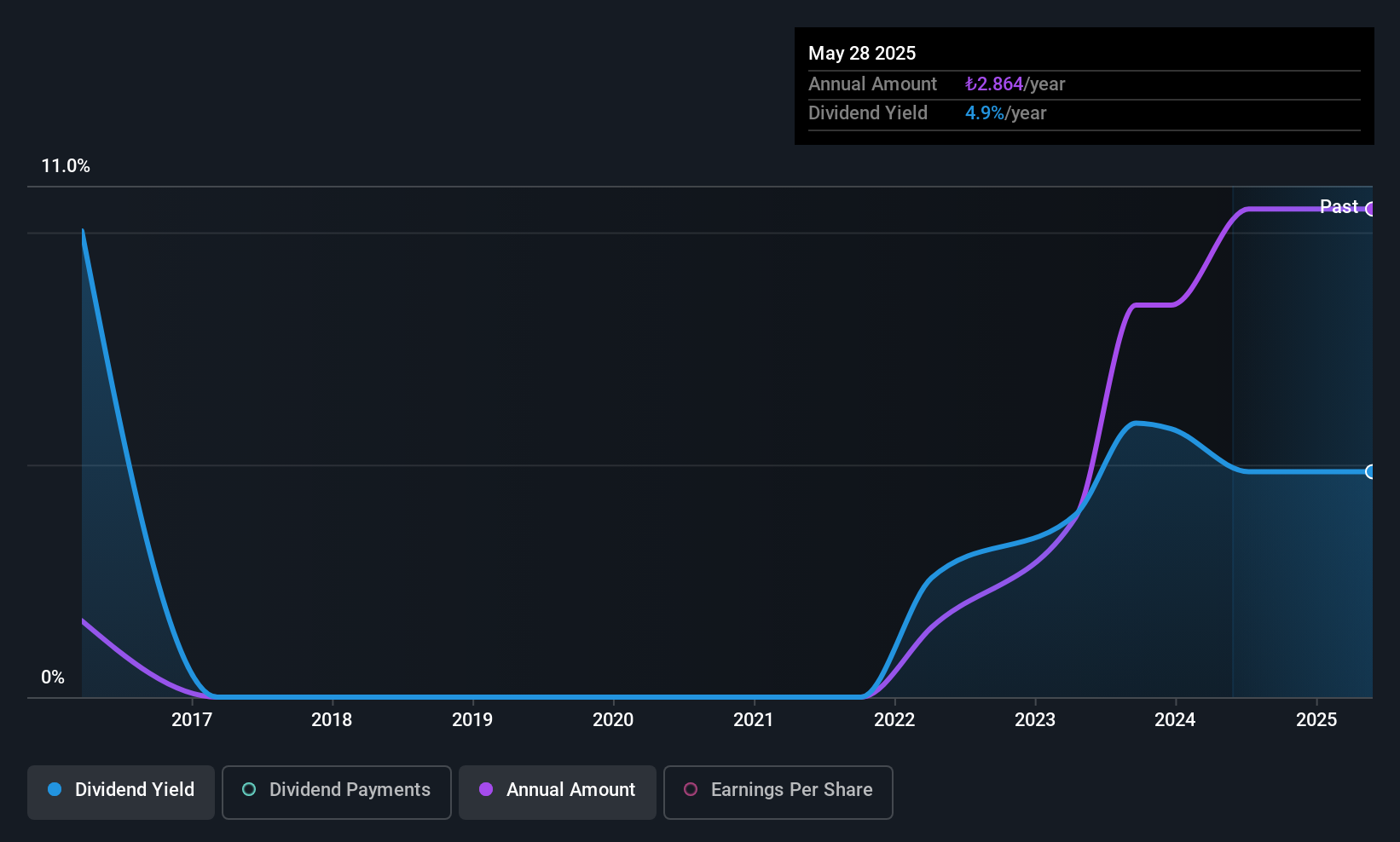

Panora Gayrimenkul Yatirim Ortakligi (IBSE:PAGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Panora Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector, with a market capitalization of TRY7.03 billion.

Operations: Panora Gayrimenkul Yatirim Ortakligi A.S. generates revenue primarily from its REIT - Commercial segment, which amounts to TRY842.94 million.

Dividend Yield: 3.5%

Panora Gayrimenkul Yatirim Ortakligi's recent earnings report shows a decline in net income despite increased sales, impacting its dividend sustainability. With a high payout ratio of 122.5%, dividends are not well covered by earnings, though cash flow coverage is reasonable at 65.2%. The dividend yield of 3.55% ranks in the top quartile in Turkey, yet historical volatility and unreliability raise concerns about consistency. Its P/E ratio of 10.4x suggests it may be undervalued compared to the market average.

- Take a closer look at Panora Gayrimenkul Yatirim Ortakligi's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Panora Gayrimenkul Yatirim Ortakligi shares in the market.

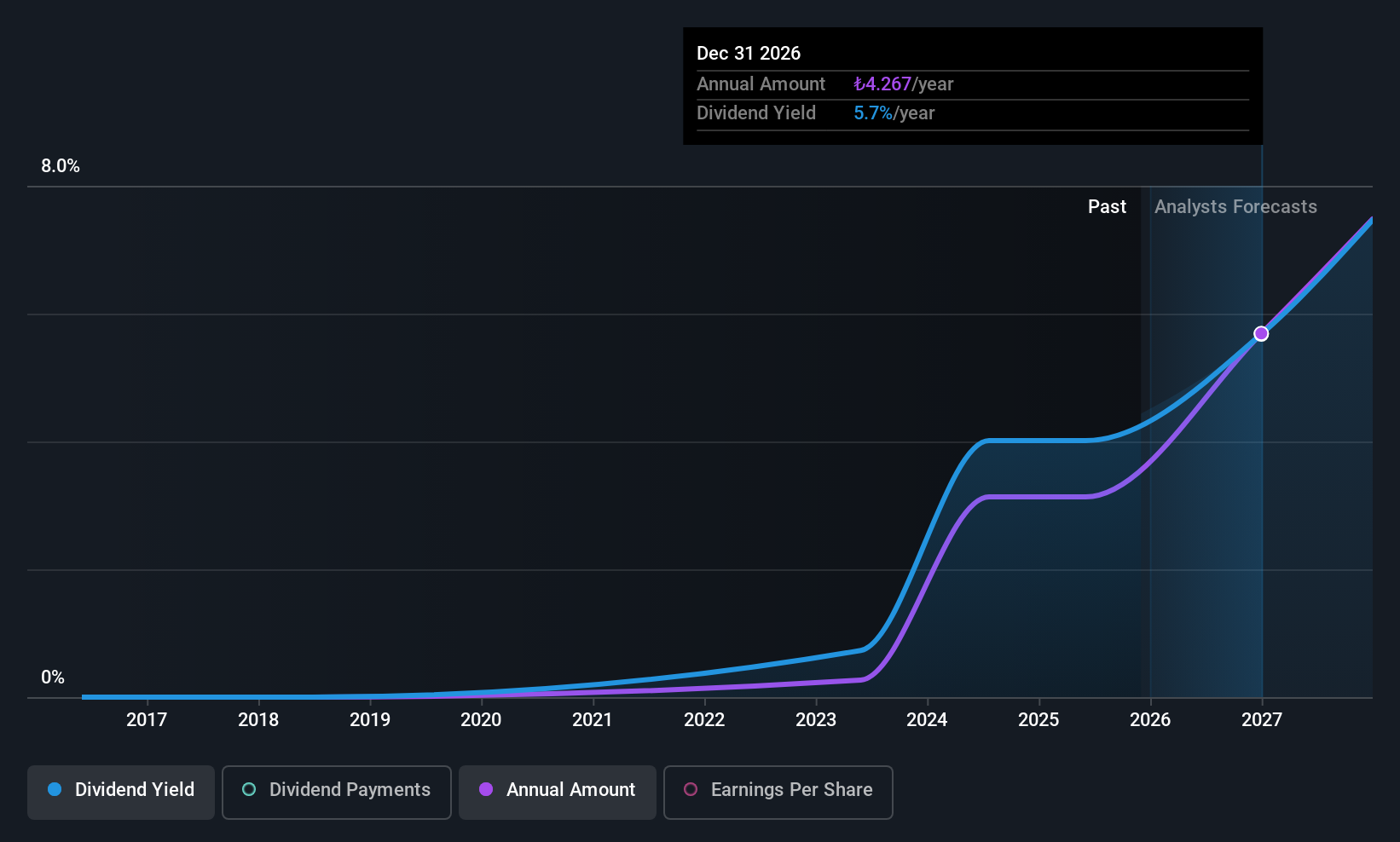

Torunlar Gayrimenkul Yatirim Ortakligi (IBSE:TRGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Torunlar Gayrimenkul Yatirim Ortakligi operates as a real estate investment company in Turkey, with a market capitalization of TRY71.47 billion.

Operations: Torunlar Gayrimenkul Yatirim Ortakligi's revenue segments include Residential and Office Projects - Torun Center (TRY306.29 million), Office for Rent and Shopping Malls - Torium AVM (TRY594.59 million), Korupark AVM (TRY1.24 billion), Torun Center (TRY514.94 million), Torium Hostels (TRY24.92 million), 5 Levent Project (TRY5.88 billion), 5 Levent Bazaar (TRY36.53 million), Mall of Antalya (TRY587.77 million), Zafer Plaza AVM (TRY247.13 million), Antalya Deepo AVM (TRY363.97 million), Mall of Istanbul AVM (TRY2.82 billion), Income from Tourism Hilton Hotel (TRY319.91 million) and MOI 2nd Stage Office and Commercial Projects, along with other smaller segments like Korupark Independent Sections, and Mall of Istanbul Residences and Offices contributing to the overall portfolio.

Dividend Yield: 3.3%

Torunlar Gayrimenkul Yatirim Ortakligi's recent earnings reveal increased sales but a decline in quarterly net income. Despite this, dividends remain covered by both earnings and cash flows, with payout ratios of 94.5% and 65.1%, respectively. The company has only been paying dividends for three years, yet they have grown steadily without volatility. Its P/E ratio of 4.2x indicates potential undervaluation compared to the Turkish market average, while its dividend yield is among the top quartile in Turkey at 3.27%.

- Delve into the full analysis dividend report here for a deeper understanding of Torunlar Gayrimenkul Yatirim Ortakligi.

- Our valuation report here indicates Torunlar Gayrimenkul Yatirim Ortakligi may be overvalued.

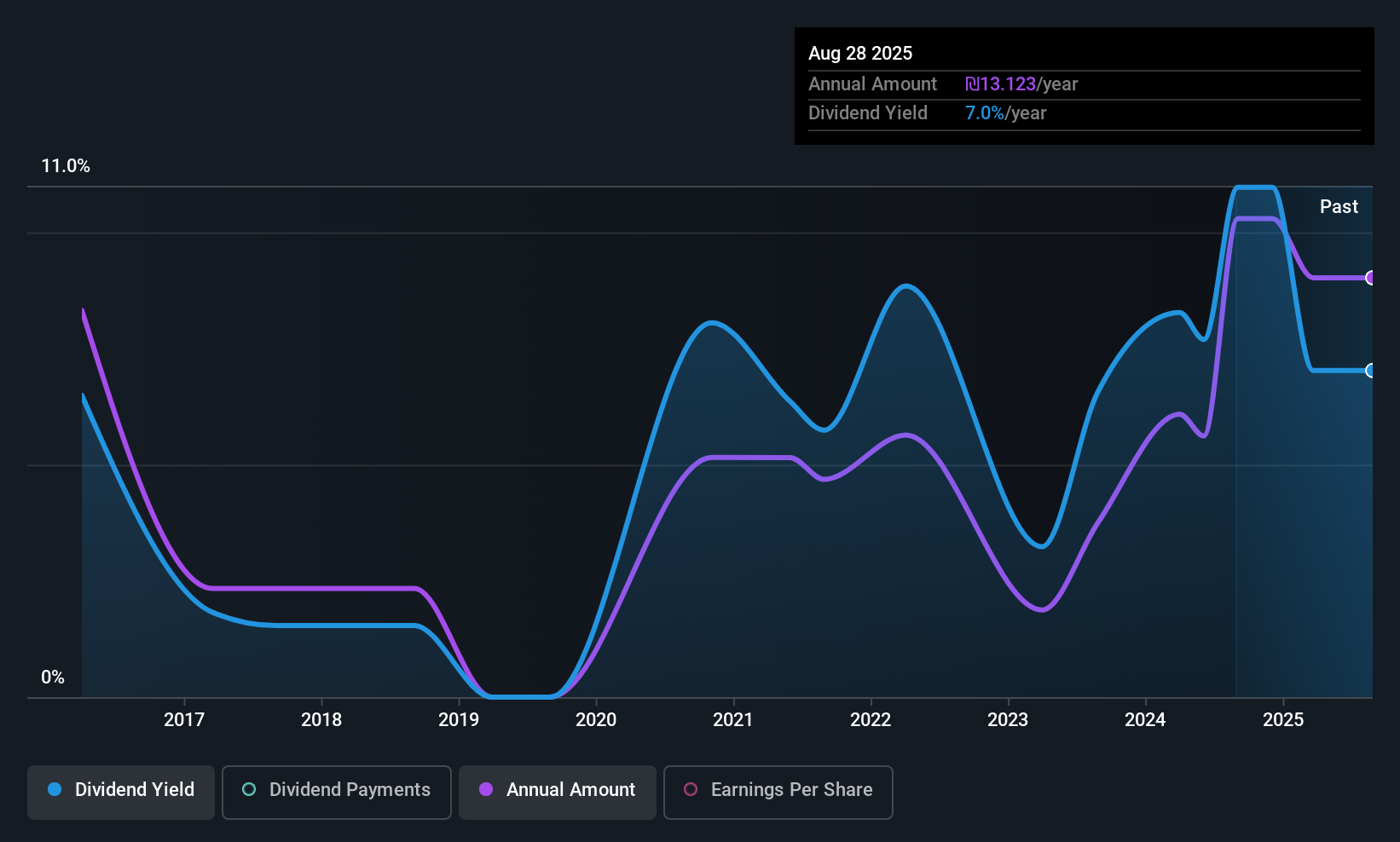

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individual and corporate clients in Israel, with a market cap of ₪3.65 billion.

Operations: I.D.I. Insurance Company Ltd.'s revenue is derived from providing a variety of insurance products and services to both personal and business customers in Israel.

Dividend Yield: 5.3%

I.D.I. Insurance's dividend yield of 5.31% ranks in the top 25% within the IL market, though it is not well covered by cash flows due to a high cash payout ratio of 264.1%. Despite a low payout ratio of 35.3%, dividends have been volatile over the past decade with significant annual drops, reflecting unreliable payments. The company's P/E ratio of 11.9x suggests relative undervaluation compared to the market average, offering potential appeal for value-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of I.D.I. Insurance.

- In light of our recent valuation report, it seems possible that I.D.I. Insurance is trading beyond its estimated value.

Make It Happen

- Dive into all 64 of the Top Middle Eastern Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:PAGYO

Panora Gayrimenkul Yatirim Ortakligi

Panora Gayrimenkul Yatirim Ortakligi A.S.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026