Harel Insurance (TASE:HARL) Valuation Check After Strong Net Income and EPS Jump

Reviewed by Simply Wall St

Harel Insurance Investments and Financial Services (TASE:HARL) just delivered a strong earnings surprise, with net income and earnings per share jumping sharply for both the third quarter and the first nine months versus last year.

See our latest analysis for Harel Insurance Investments & Financial Services.

The upbeat quarterly numbers arrive after a powerful run, with the share price posting a year to date return of around 141 percent and a three year total shareholder return of roughly 338 percent, signaling strong, still positive momentum.

If this kind of performance has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as you search for the market’s next standout stories.

Yet with the share price already near analyst targets and recent gains far outpacing earnings growth, investors now face a key question: is there still a buying opportunity here, or is the market already pricing in future growth?

Price-to-Earnings of 12.2x: Is it justified?

With shares at ₪125.1, Harel Insurance Investments & Financial Services trades on a 12.2x price to earnings multiple, sitting below the wider IL market but slightly ahead of regional insurance peers.

The price to earnings ratio compares the company’s current share price to its per share earnings. This makes it a useful shorthand for how much investors are willing to pay for each unit of profit in a relatively mature, earnings focused sector like insurance.

Relative to the domestic market, HARL’s 12.2x multiple versus the IL market’s 15.3x suggests investors are not paying a premium for its earnings, even though profits have grown faster than the broader market over the past year and have compounded at roughly 9 percent annually over five years.

However, against the Asian Insurance industry, where the average price to earnings stands at 10.9x and our estimated fair price to earnings ratio for HARL is 11.5x, the current 12.2x looks punchy. This indicates the market may be stretching above what long run fundamentals alone would support.

Explore the SWS fair ratio for Harel Insurance Investments & Financial Services

Result: Price-to-Earnings of 12.2x (ABOUT RIGHT)

However, risks remain, including a valuation already near analyst targets and relatively modest net income growth that could limit future share price gains.

Find out about the key risks to this Harel Insurance Investments & Financial Services narrative.

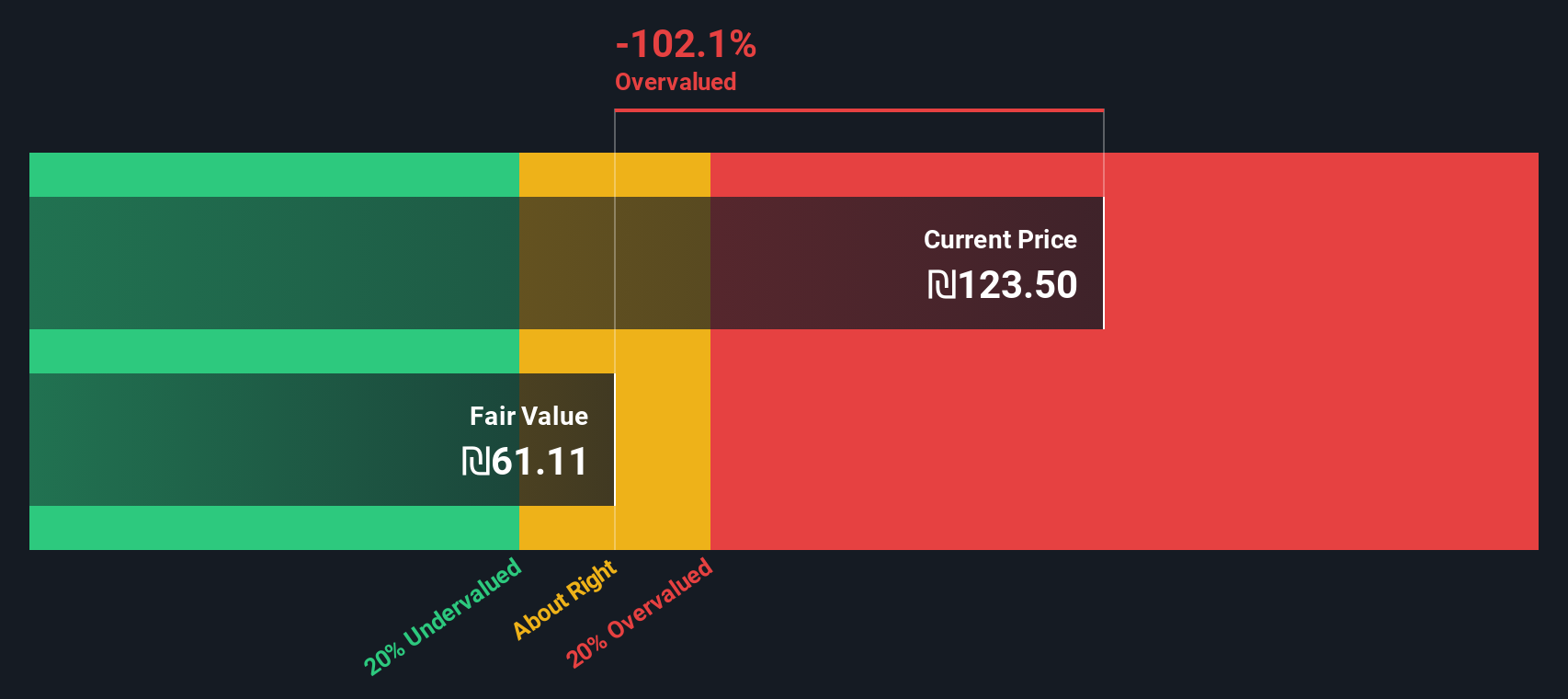

Another Angle, SWS DCF Model Flags Overvaluation

Our DCF model paints a starker picture, suggesting Harel Insurance Investments & Financial Services is trading well above its estimated fair value of ₪52.13 at the current ₪125.1 share price. If cash flow fundamentals are right, is the recent rally leaning too far ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Harel Insurance Investments & Financial Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Harel Insurance Investments & Financial Services Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in under three minutes: Do it your way.

A great starting point for your Harel Insurance Investments & Financial Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not park your gains and stop there. Use the Simply Wall St Screener to uncover fresh, data backed opportunities that could power your next winning move.

- Capitalize on innovation by targeting these 25 AI penny stocks that are turning automation and machine learning into revenue growth.

- Seek potentially steadier returns with these 14 dividend stocks with yields > 3% that may deliver income alongside long term capital appreciation.

- Position yourself in the digital finance shift by focusing on these 81 cryptocurrency and blockchain stocks tapping into blockchain infrastructure, payments, and tokenization themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harel Insurance Investments & Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:HARL

Harel Insurance Investments & Financial Services

Offers insurance and financial services in Israel, Europe, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026