Middle Eastern Dividend Stocks Featuring Gulf Medical Projects Company (PJSC) And Two Others

Reviewed by Simply Wall St

As Gulf markets display a mixed performance, with strong corporate earnings counterbalancing concerns over U.S. trade policies, investors are keenly observing the potential impact on regional indices. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to navigate the current market dynamics.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.46% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.08% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.45% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.33% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.88% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.73% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.34% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 5.67% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.23% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.76% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top Middle Eastern Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

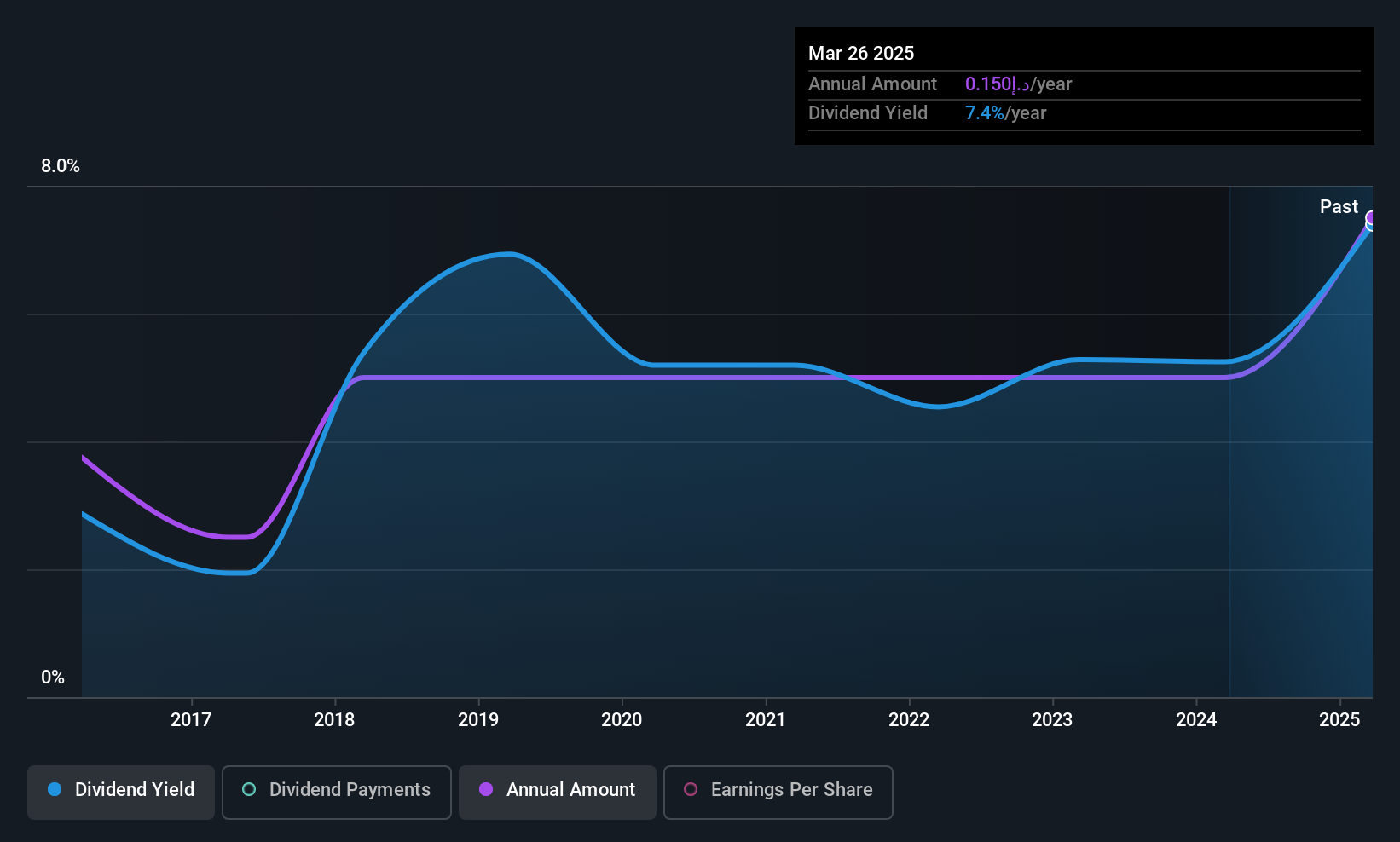

Gulf Medical Projects Company (PJSC) (ADX:GMPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gulf Medical Projects Company (PJSC) operates hospitals in the United Arab Emirates and has a market cap of AED1.50 billion.

Operations: Gulf Medical Projects Company (PJSC) generates revenue primarily from Health Services & Others, amounting to AED690.34 million, and Investments, contributing AED37.79 million.

Dividend Yield: 7.0%

Gulf Medical Projects Company (PJSC) reported a notable increase in earnings, with net income rising to AED 22.47 million for Q1 2025. Despite this growth, the company's dividend payments have been volatile and not consistently reliable over the past decade. While offering a high yield of 6.98%, dividends are not well covered by earnings, though they are supported by cash flows with a cash payout ratio of 73.1%. The stock trades significantly below its estimated fair value.

- Take a closer look at Gulf Medical Projects Company (PJSC)'s potential here in our dividend report.

- According our valuation report, there's an indication that Gulf Medical Projects Company (PJSC)'s share price might be on the cheaper side.

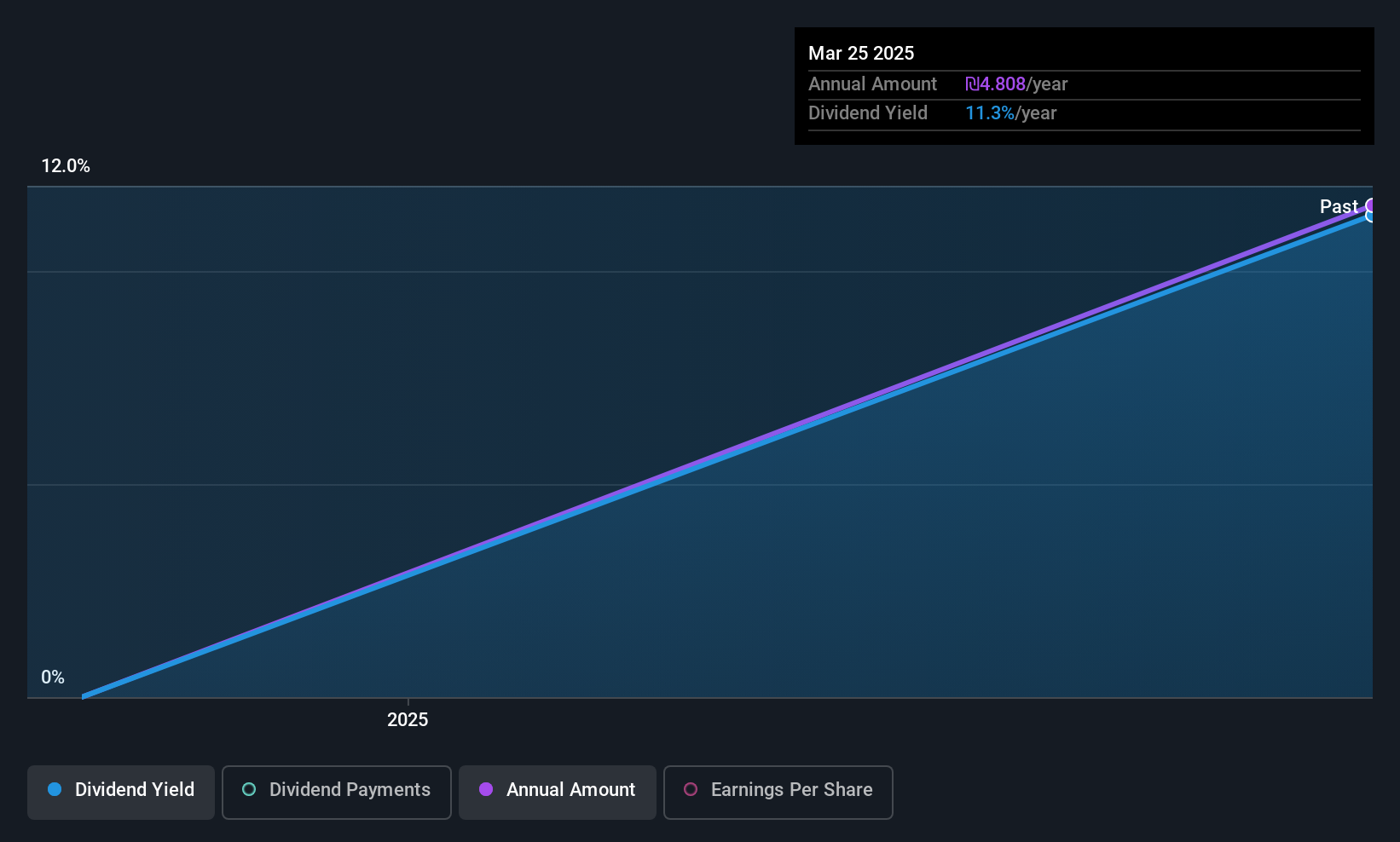

Ayalon Insurance (TASE:AYAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ayalon Insurance Company Ltd, with a market cap of ₪1.57 billion, operates through its subsidiaries to offer a range of insurance products in Israel.

Operations: Ayalon Insurance's revenue segments include Health insurance at ₪647.28 million and Life Insurance and Long-Term Savings at ₪1.18 billion.

Dividend Yield: 7.7%

Ayalon Insurance's dividend yield of 7.7% ranks in the top 25% of IL market payers, with dividends well covered by earnings and cash flows due to low payout ratios (30% and 34.4%, respectively). However, it's too early to assess the reliability or growth of these payments as they have only recently begun. The stock trades at a significant discount to its estimated fair value, while recent earnings show strong growth with net income reaching ILS 56.72 million for Q1 2025.

- Click to explore a detailed breakdown of our findings in Ayalon Insurance's dividend report.

- Our expertly prepared valuation report Ayalon Insurance implies its share price may be lower than expected.

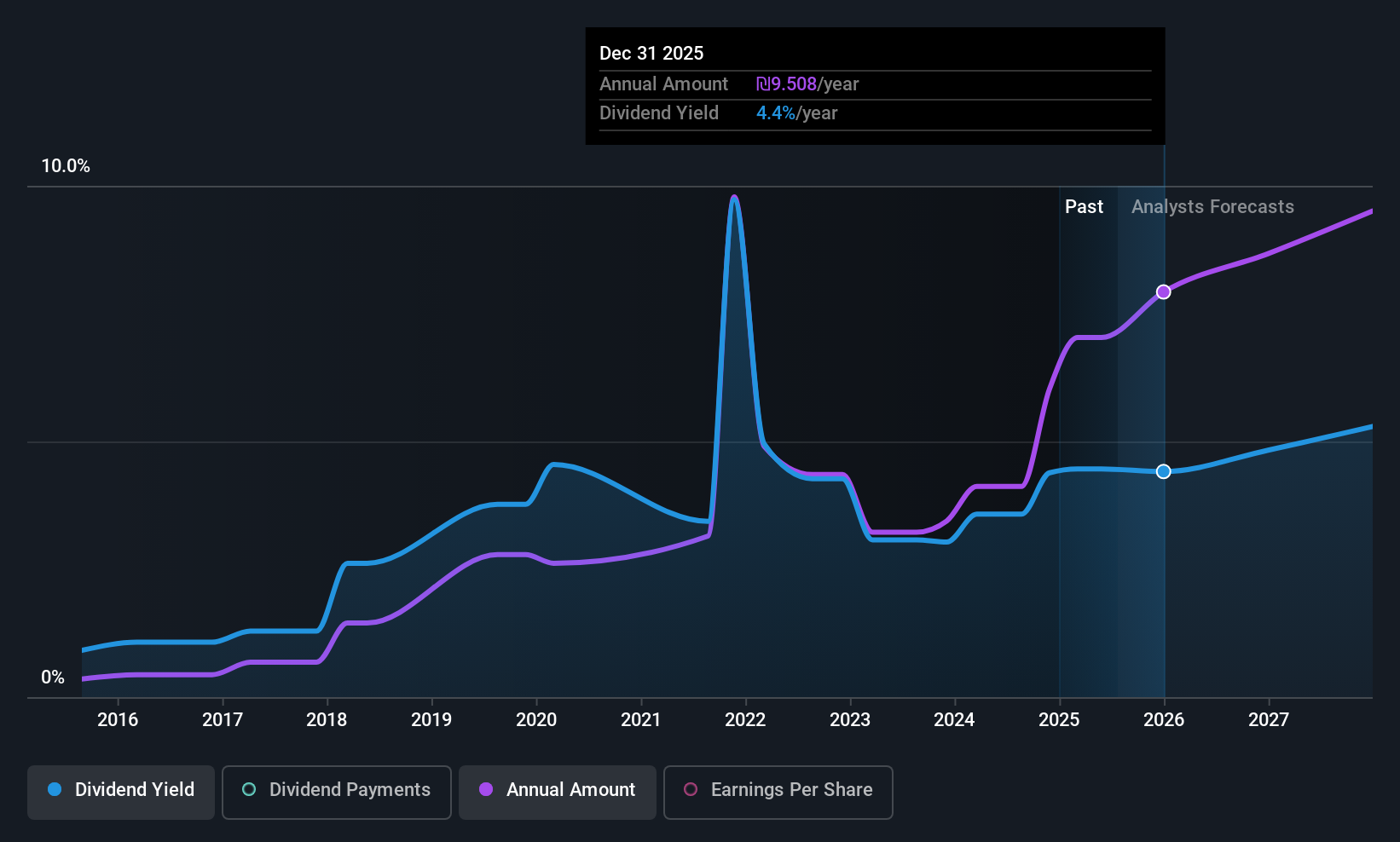

Mizrahi Tefahot Bank (TASE:MZTF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mizrahi Tefahot Bank Ltd. offers a variety of international, commercial, domestic, and personal banking services to individuals and businesses in Israel and abroad, with a market cap of ₪56.46 billion.

Operations: Mizrahi Tefahot Bank Ltd. generates revenue through its diverse banking services, catering to both individual and business clients in Israel and internationally.

Dividend Yield: 3.8%

Mizrahi Tefahot Bank's dividend yield of 3.84% is below the top 25% in the IL market, with a stable payout ratio around 40%, indicating dividends are well covered by earnings. Despite recent growth in earnings by 13.7%, the bank has an unstable dividend track record over the past decade. Trading slightly below its fair value, Mizrahi Tefahot's revenue is expected to grow annually by 6.77%, but dividend reliability remains a concern for investors seeking stability.

- Unlock comprehensive insights into our analysis of Mizrahi Tefahot Bank stock in this dividend report.

- The analysis detailed in our Mizrahi Tefahot Bank valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Unlock our comprehensive list of 75 Top Middle Eastern Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MZTF

Mizrahi Tefahot Bank

Provides a range of international, commercial, domestic, and personal banking services to individuals and businesses in Israel and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives