- Israel

- /

- Medical Equipment

- /

- TASE:PULS

3 Middle Eastern Penny Stocks With Over US$20M Market Cap

Reviewed by Simply Wall St

As Middle Eastern markets navigate the complexities of oil oversupply fears and geopolitical developments, investor sentiment remains varied across the region. In such a landscape, penny stocks — often smaller or newer companies — can offer unique opportunities for those seeking value beyond traditional investments. Despite being considered an outdated term by some, these stocks continue to attract interest due to their potential for significant returns when backed by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.18 | SAR1.67B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.95 | SAR474M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.781 | ₪194.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.92 | ₪2.86B | ✅ 1 ⚠️ 2 View Analysis > |

| Tarya Israel (TASE:TRA) | ₪0.549 | ₪162.98M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.211 | ₪164.37M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.71 | AED431.25M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.19 | AED368.44M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.40 | AED10.16B | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Formet Metal ve Cam Sanayi (IBSE:FORMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Formet Metal ve Cam Sanayi A.S. manufactures and sells steel doors primarily in Turkey, with a market cap of TRY2.25 billion.

Operations: The company generates revenue of TRY666.25 million from its Building Products segment.

Market Cap: TRY2.25B

Formet Metal ve Cam Sanayi A.S., with a market cap of TRY2.25 billion, operates in the steel door industry and reported TRY666.25 million in revenue for 2024, down from TRY751.38 million the previous year, alongside a net loss of TRY152.44 million. Despite increased losses over five years and short-term cash runway challenges, recent capital raised through a follow-on equity offering of TRY538.13 million may provide some financial relief. The company's debt management shows improvement with a reduced debt to equity ratio from 87.9% to 35.2%, though its high share price volatility remains a concern for investors seeking stability in penny stocks.

- Take a closer look at Formet Metal ve Cam Sanayi's potential here in our financial health report.

- Examine Formet Metal ve Cam Sanayi's past performance report to understand how it has performed in prior years.

Pulsenmore (TASE:PULS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulsenmore Ltd. provides self-scan ultrasound devices for remote clinical diagnosis and screening, with a market cap of ₪154.87 million.

Operations: Pulsenmore Ltd. has not reported any specific revenue segments.

Market Cap: ₪154.87M

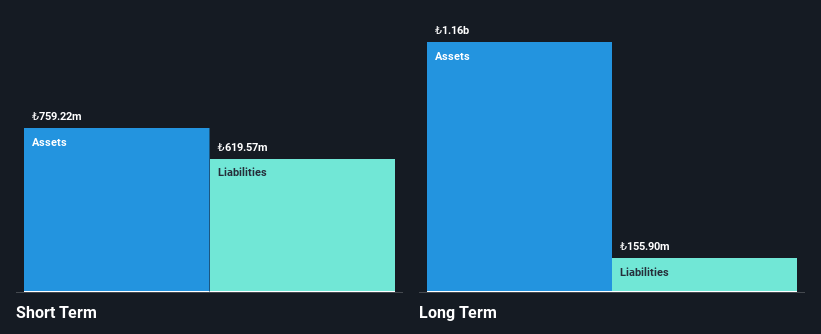

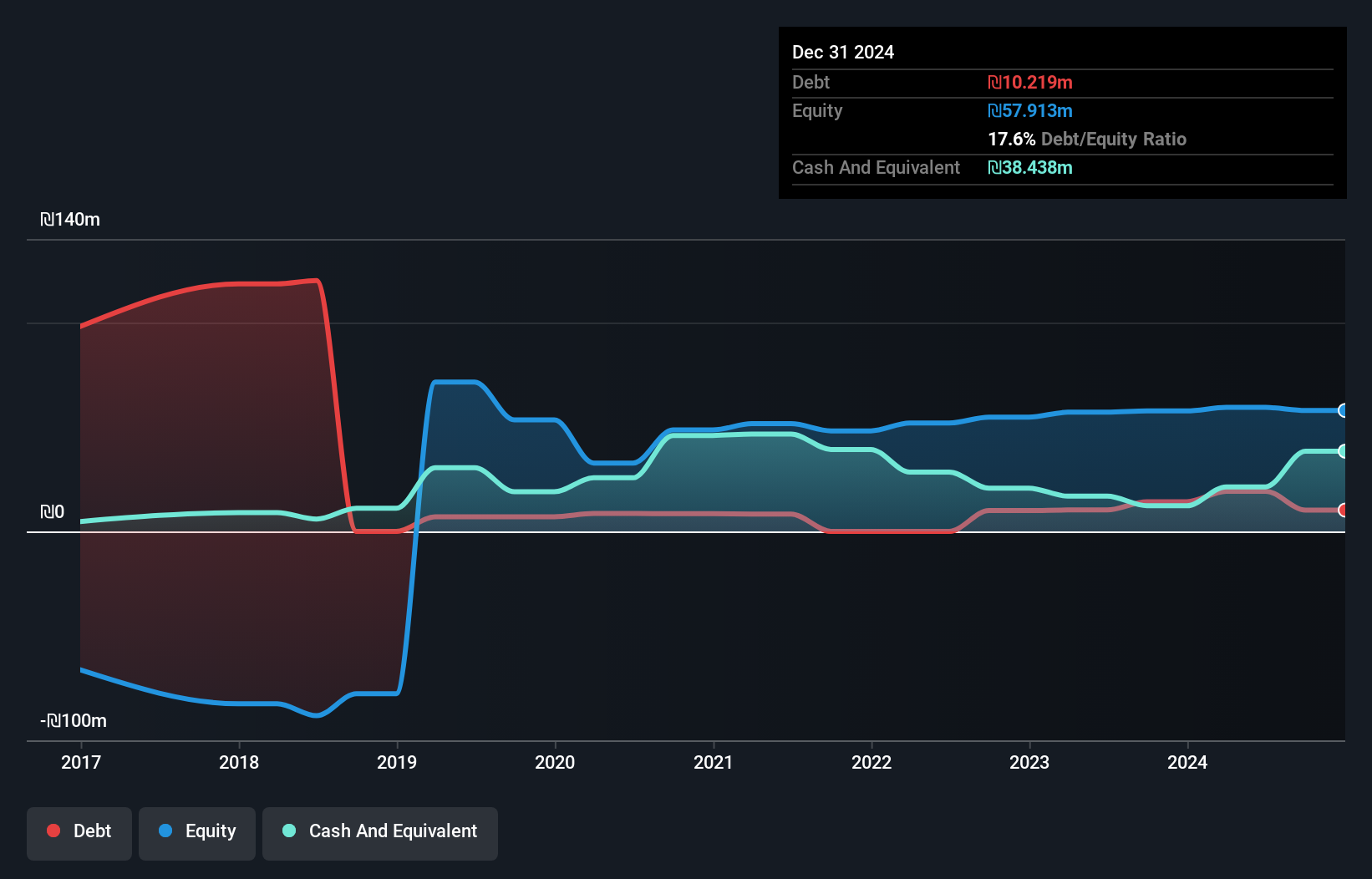

Pulsenmore Ltd., with a market cap of ₪154.87 million, is pre-revenue, reporting sales of ₪9.66 million for 2024 and a net loss of ₪36.74 million. Despite the losses, the company has no debt and maintains sufficient cash runway for over a year based on current free cash flow trends. Its short-term assets significantly exceed both short- and long-term liabilities, providing some financial stability amid high share price volatility. The board is experienced with an average tenure of 4.4 years, though the management team has slightly less experience at 2.8 years on average.

- Unlock comprehensive insights into our analysis of Pulsenmore stock in this financial health report.

- Review our historical performance report to gain insights into Pulsenmore's track record.

Utron (TASE:UTRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Utron Ltd specializes in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions and has a market cap of ₪99.44 million.

Operations: The company generates revenue from its heavy construction segment, which amounts to ₪89.61 million.

Market Cap: ₪99.44M

Utron Ltd, with a market cap of ₪99.44 million, has shown financial resilience despite challenges in earnings growth and declining profit margins. The company reported sales of ₪89.61 million for 2024, down from the previous year, with net income decreasing to ₪0.158 million. Utron's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity management. While its debt is well covered by operating cash flow and shareholders have not faced significant dilution recently, interest coverage remains a concern at 2x EBIT. The experienced board and management team offer stability amid these operational hurdles.

- Click here and access our complete financial health analysis report to understand the dynamics of Utron.

- Gain insights into Utron's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Take a closer look at our Middle Eastern Penny Stocks list of 95 companies by clicking here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pulsenmore, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PULS

Pulsenmore

Engages in the provision of self-scan ultrasound devices for remote clinical diagnosis and screening.

Flawless balance sheet slight.

Market Insights

Community Narratives