- Israel

- /

- Healthcare Services

- /

- TASE:MDTR

What Type Of Shareholders Own The Most Number of Mediterranean Towers Ltd. (TLV:MDTR) Shares?

Every investor in Mediterranean Towers Ltd. (TLV:MDTR) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

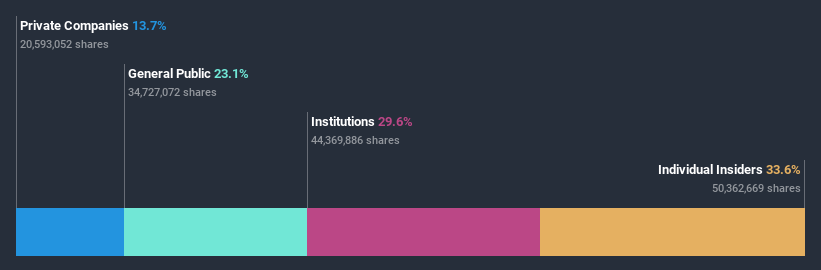

Mediterranean Towers is not a large company by global standards. It has a market capitalization of ₪1.4b, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutional investors have bought into the company. Let's take a closer look to see what the different types of shareholders can tell us about Mediterranean Towers.

See our latest analysis for Mediterranean Towers

What Does The Institutional Ownership Tell Us About Mediterranean Towers?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

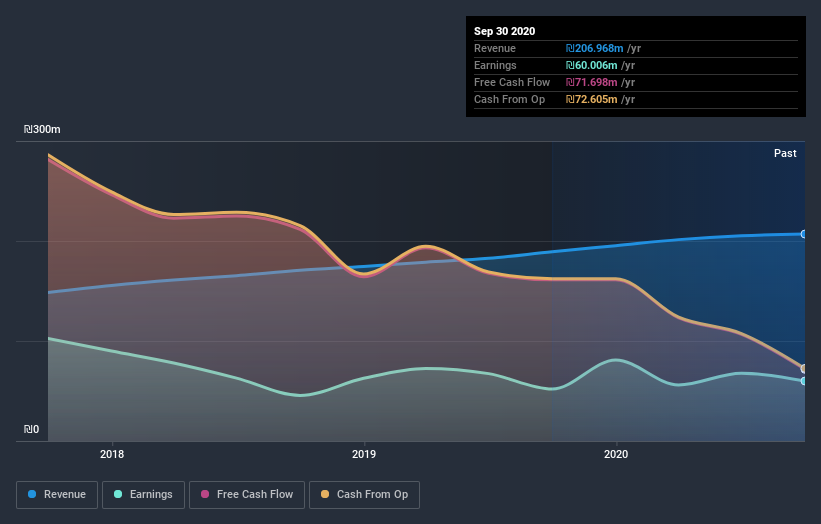

Mediterranean Towers already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Mediterranean Towers' earnings history below. Of course, the future is what really matters.

Mediterranean Towers is not owned by hedge funds. A.A.K.M. Investments Ltd. is currently the largest shareholder, with 12% of shares outstanding. For context, the second largest shareholder holds about 11% of the shares outstanding, followed by an ownership of 11% by the third-largest shareholder. Mordechai Kirschenbaum, who is the third-largest shareholder, also happens to hold the title of Member of the Board of Directors.

We did some more digging and found that 6 of the top shareholders account for roughly 55% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Mediterranean Towers

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders maintain a significant holding in Mediterranean Towers Ltd.. It has a market capitalization of just ₪1.4b, and insiders have ₪458m worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public holds a 23% stake in Mediterranean Towers. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

Our data indicates that Private Companies hold 14%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Mediterranean Towers (2 are concerning) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Mediterranean Towers, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:MDTR

Mediterranean Towers

Owns and operates residential homes for the elderly population in Israel.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)