- Israel

- /

- Healthcare Services

- /

- TASE:ILX

Earnings Troubles May Signal Larger Issues for Ilex Medical (TLV:ILX) Shareholders

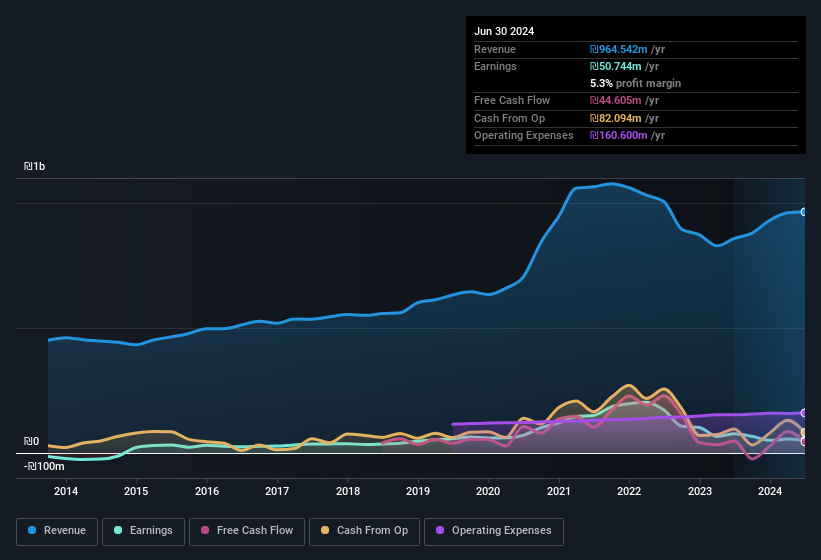

A lackluster earnings announcement from Ilex Medical Ltd (TLV:ILX) last week didn't sink the stock price. We think that investors are worried about some weaknesses underlying the earnings.

View our latest analysis for Ilex Medical

The Impact Of Unusual Items On Profit

For anyone who wants to understand Ilex Medical's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from ₪5.3m worth of unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. If Ilex Medical doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ilex Medical.

Our Take On Ilex Medical's Profit Performance

Arguably, Ilex Medical's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Ilex Medical's statutory profits are better than its underlying earnings power. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. To that end, you should learn about the 2 warning signs we've spotted with Ilex Medical (including 1 which is a bit concerning).

This note has only looked at a single factor that sheds light on the nature of Ilex Medical's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ILX

Ilex Medical

Engages in import, marketing, distribution, and sale of diagnostic products, kits, and consumables in Israel, South Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026