Middle Eastern Market Gems: Al Dhafra Insurance Company P.S.C Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced a downturn, with investor caution driving most Gulf indices lower due to escalating geopolitical concerns and worries over U.S. tariffs. Despite these challenges, the search for promising investments continues, particularly in niche areas like penny stocks. Although the term 'penny stock' may seem outdated, these smaller or newer companies can still offer significant growth opportunities when supported by strong financial health.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.96 | SAR1.6B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.45 | SAR540M | ✅ 2 ⚠️ 3 View Analysis > |

| E.E.A.M.I (TASE:EEAM-M) | ₪0.087 | ₪8.53M | ✅ 0 ⚠️ 5 View Analysis > |

| Tectona (TASE:TECT) | ₪3.274 | ₪75.91M | ✅ 1 ⚠️ 6 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.483 | ₪172.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.911 | ₪2.83B | ✅ 1 ⚠️ 2 View Analysis > |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.68 | ₪17.83M | ✅ 0 ⚠️ 6 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.149 | ₪159.76M | ✅ 1 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.685 | AED416.65M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.32 | AED9.82B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 101 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Al Dhafra Insurance Company P.S.C (ADX:DHAFRA)

Simply Wall St Financial Health Rating: ★★★★★★

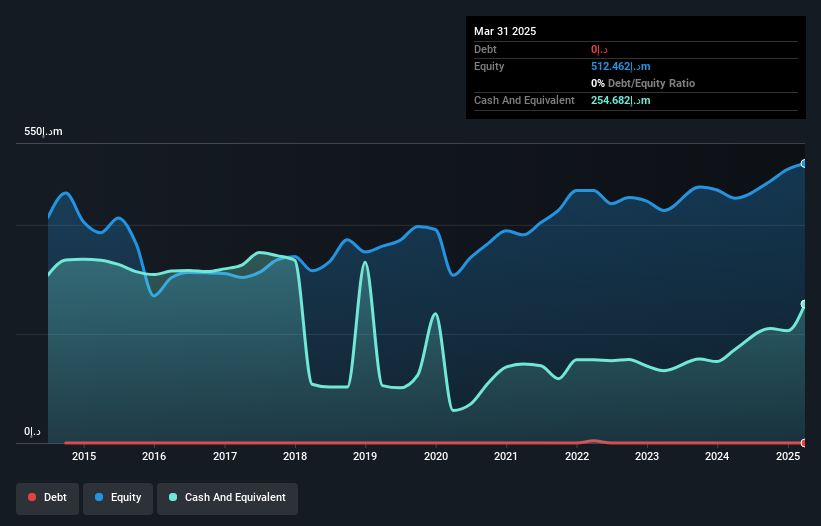

Overview: Al Dhafra Insurance Company P.S.C. operates in the insurance and reinsurance sectors across the United Arab Emirates, other GCC countries, and internationally, with a market cap of AED 486 million.

Operations: The company generates revenue through two main segments: Investments, contributing AED 45.89 million, and Underwriting, accounting for AED 70.39 million.

Market Cap: AED486M

Al Dhafra Insurance Company P.S.C., with a market cap of AED 486 million, operates without debt, which can be appealing for risk-averse investors. Despite recent earnings declines, the company maintains high-quality earnings and a stable weekly volatility of 4%. Its short-term assets significantly exceed both short-term and long-term liabilities, indicating solid financial health. The proposed cash dividend of AED 35 million highlights its commitment to returning value to shareholders. However, the declining net income from AED 41.3 million to AED 38.38 million and reduced profit margins suggest challenges in maintaining profitability amidst industry pressures.

- Click here to discover the nuances of Al Dhafra Insurance Company P.S.C with our detailed analytical financial health report.

- Gain insights into Al Dhafra Insurance Company P.S.C's past trends and performance with our report on the company's historical track record.

Allmed Solutions (TASE:ALMD)

Simply Wall St Financial Health Rating: ★★★★★★

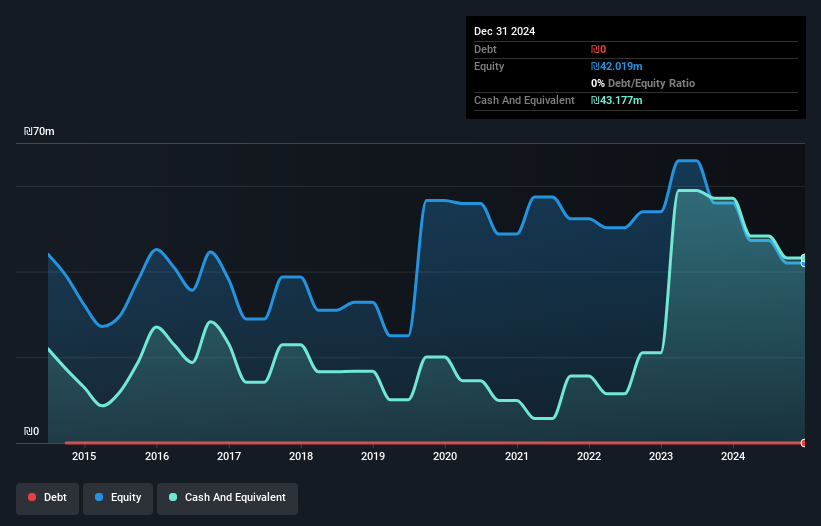

Overview: Allmed Solutions Ltd develops, manufactures, and markets minimally invasive medical products across various disciplines in Israel and internationally, with a market cap of ₪35.59 million.

Operations: Allmed Solutions Ltd has not reported any specific revenue segments.

Market Cap: ₪35.59M

Allmed Solutions Ltd, with a market cap of ₪35.59 million, is pre-revenue and unprofitable, experiencing increased losses over the past five years. Despite this, the company benefits from a strong financial position with short-term assets of ₪43.8 million exceeding both its short-term and long-term liabilities. It operates debt-free and has not diluted shareholders recently. The management team and board are experienced, contributing to strategic stability. Although highly volatile with a 9% weekly volatility rate, Allmed's cash runway extends over three years based on current free cash flow levels, providing some cushion for future operations amidst ongoing challenges in revenue generation.

- Click to explore a detailed breakdown of our findings in Allmed Solutions' financial health report.

- Gain insights into Allmed Solutions' historical outcomes by reviewing our past performance report.

Terminal X Online (TASE:TRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Terminal X Online Ltd. operates as an online retailer providing clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenagers under various brands with a market cap of ₪618.76 million.

Operations: Terminal X Online Ltd. does not report specific revenue segments.

Market Cap: ₪618.76M

Terminal X Online Ltd., with a market cap of ₪618.76 million, has recently turned profitable, reporting sales of ₪492.34 million and a net income of ₪25.21 million for 2024, compared to a loss the previous year. The company maintains strong financial health, with short-term assets exceeding liabilities and more cash than debt. Its board and management team are experienced, contributing to strategic stability. Despite low Return on Equity at 10.4%, Terminal X has reduced its debt significantly over five years and announced an annual dividend of ILS 0.1825 per share, reflecting confidence in sustained profitability.

- Unlock comprehensive insights into our analysis of Terminal X Online stock in this financial health report.

- Learn about Terminal X Online's historical performance here.

Turning Ideas Into Actions

- Reveal the 101 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terminal X Online might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TRX

Terminal X Online

Offers clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenager under various brands through online.

Flawless balance sheet and good value.

Market Insights

Community Narratives