- Israel

- /

- Oil and Gas

- /

- TASE:RATI

Undiscovered Gems Including 3 Promising Small Cap Stocks With Robust Fundamentals

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have shown resilience despite a backdrop of declining consumer confidence and mixed economic indicators. While major indexes like the S&P 500 and Nasdaq Composite have experienced fluctuations, small-cap indices such as the Russell 2000 continue to offer unique opportunities for investors seeking growth potential in less saturated segments of the market. Identifying stocks with robust fundamentals—such as strong balance sheets, consistent earnings growth, and competitive advantages—can be key to uncovering promising investment opportunities amidst these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

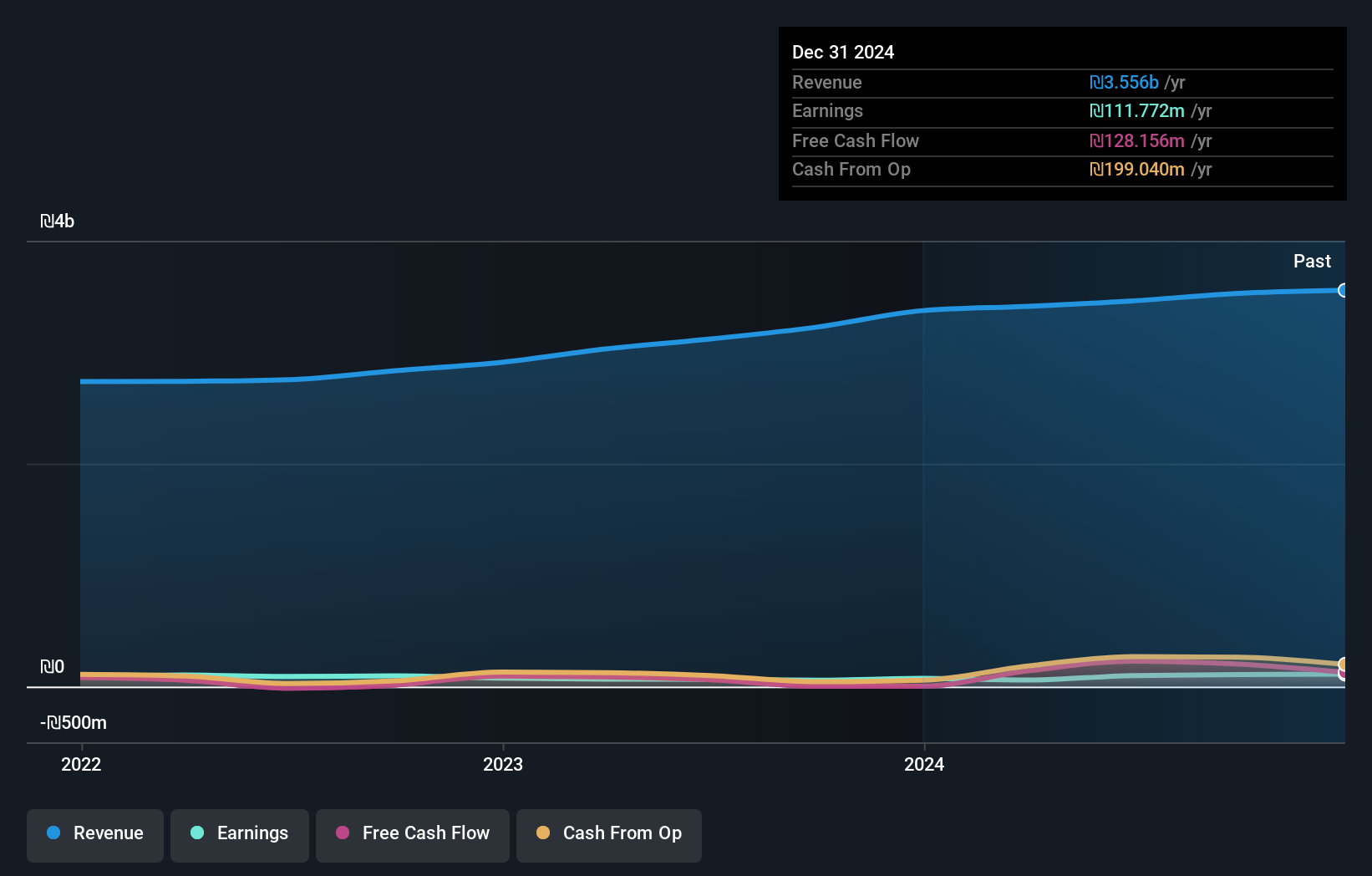

Overview: Diplomat Holdings Ltd. is a sales and distribution company in the fast-moving consumer goods sector with a market cap of ₪1.40 billion.

Operations: Diplomat Holdings generates revenue primarily through its sales and distribution activities in the fast-moving consumer goods sector. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

Diplomat Holdings, a nimble player in its field, showcases a satisfactory net debt to equity ratio of 29.2%, reflecting prudent financial management. The company's interest payments are well-covered by EBIT at 7.5 times, indicating robust earnings quality. Over the past five years, earnings have grown steadily at 3.1% annually, although recent growth of 53.8% slightly lags behind the industry average of 56.7%. Trading significantly below its estimated fair value by 95.7%, Diplomat offers potential for value seekers despite some challenges in keeping pace with industry growth rates recently highlighted during their extraordinary shareholders meeting last October.

- Dive into the specifics of Diplomat Holdings here with our thorough health report.

Assess Diplomat Holdings' past performance with our detailed historical performance reports.

Plasson Industries (TASE:PLSN)

Simply Wall St Value Rating: ★★★★★★

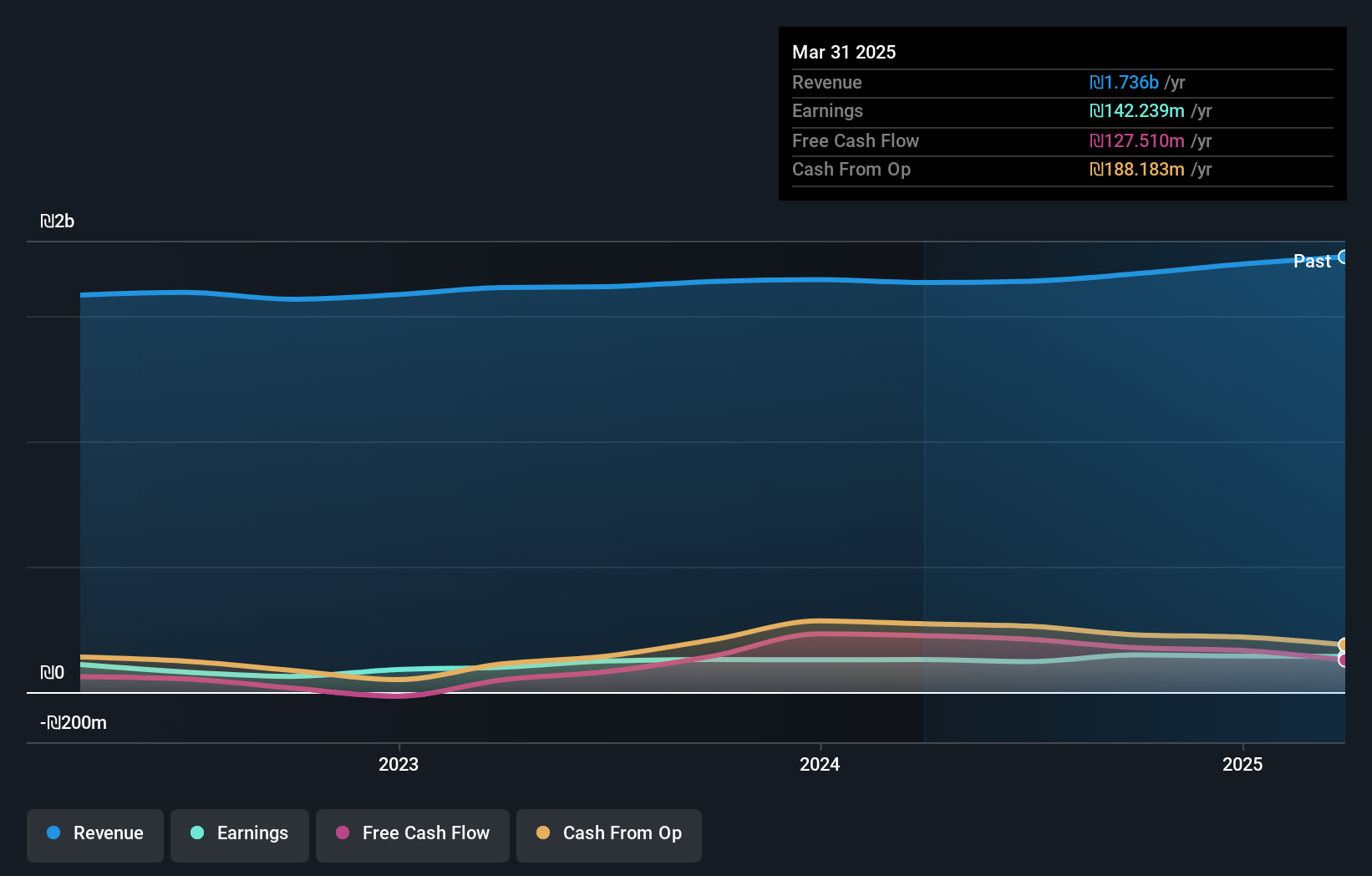

Overview: Plasson Industries Ltd specializes in the development, manufacturing, and marketing of technical products across various global regions including Israel, Europe, Brazil, Oceania, the United States, Asia, Africa, and the rest of the Americas with a market capitalization of ₪1.79 billion.

Operations: Plasson Industries generates revenue primarily from connection accessories for plumbing (₪855.62 million) and products for animals (₪555.94 million).

Plasson Industries, a compact player in the machinery sector, stands out with its earnings growth of 14.3% over the past year, surpassing the industry's 4.9%. Its debt to equity ratio has improved from 56.5% to 38.7% over five years, signaling better financial health. The company trades at a significant discount of 45.3% below estimated fair value and maintains satisfactory net debt levels at 13.3%. Recent earnings show robust performance with Q3 net income rising to ILS 49 million from ILS 22.35 million last year, while basic EPS jumped to ILS 5.13 from ILS 2.34 previously reported.

- Delve into the full analysis health report here for a deeper understanding of Plasson Industries.

Explore historical data to track Plasson Industries' performance over time in our Past section.

Ratio Energies - Limited Partnership (TASE:RATI)

Simply Wall St Value Rating: ★★★★☆☆

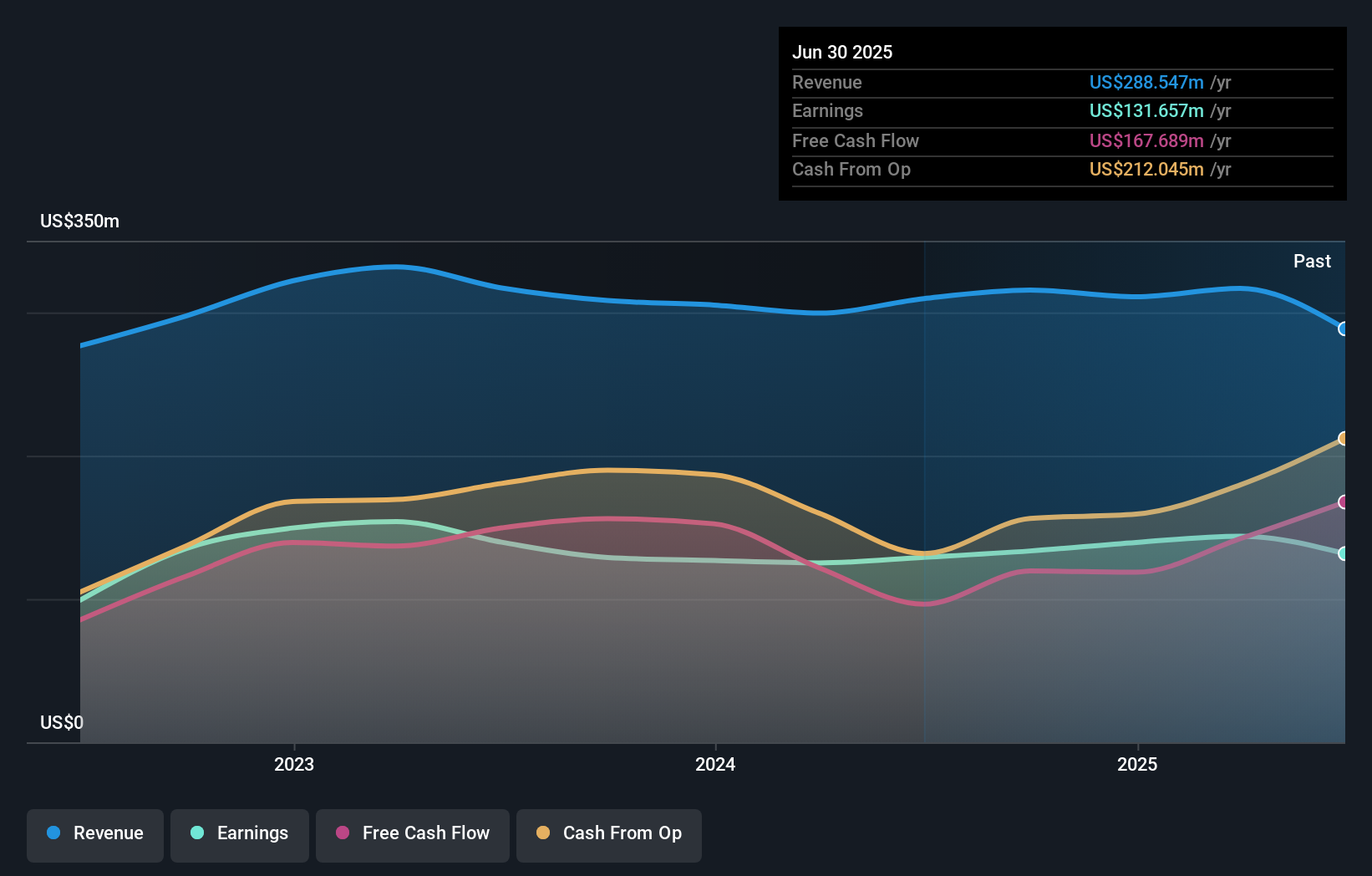

Overview: Ratio Energies - Limited Partnership, along with its subsidiaries, is engaged in the exploration, development, and production of oil and natural gas both in Israel and internationally, with a market cap of ₪3.98 billion.

Operations: Ratio Energies generates revenue primarily from its oil and gas exploration and production segment, amounting to $315.58 million. The company has a market capitalization of approximately ₪3.98 billion.

Ratio Energies, a relatively small player in the energy sector, has shown promising financial metrics. Despite earnings growth of 3.5% lagging behind the industry's 12.8%, it trades at 24.8% below its estimated fair value, suggesting potential undervaluation. Over five years, its net debt to equity ratio impressively decreased from 445.8% to 114.8%, although still considered high at 90.2%. The company reported third-quarter revenue of US$85 million and net income of US$38 million, with basic earnings per share rising to US$0.034 from US$0.03 last year—indicating steady profitability despite industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of Ratio Energies - Limited Partnership.

Understand Ratio Energies - Limited Partnership's track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 4647 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RATI

Ratio Energies - Limited Partnership

Explores, develops, and produces oil and natural gas in Israel and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives