- Israel

- /

- Oil and Gas

- /

- TASE:NWMD

NewMed Energy - Limited Partnership's (TLV:NWMD) Shares Not Telling The Full Story

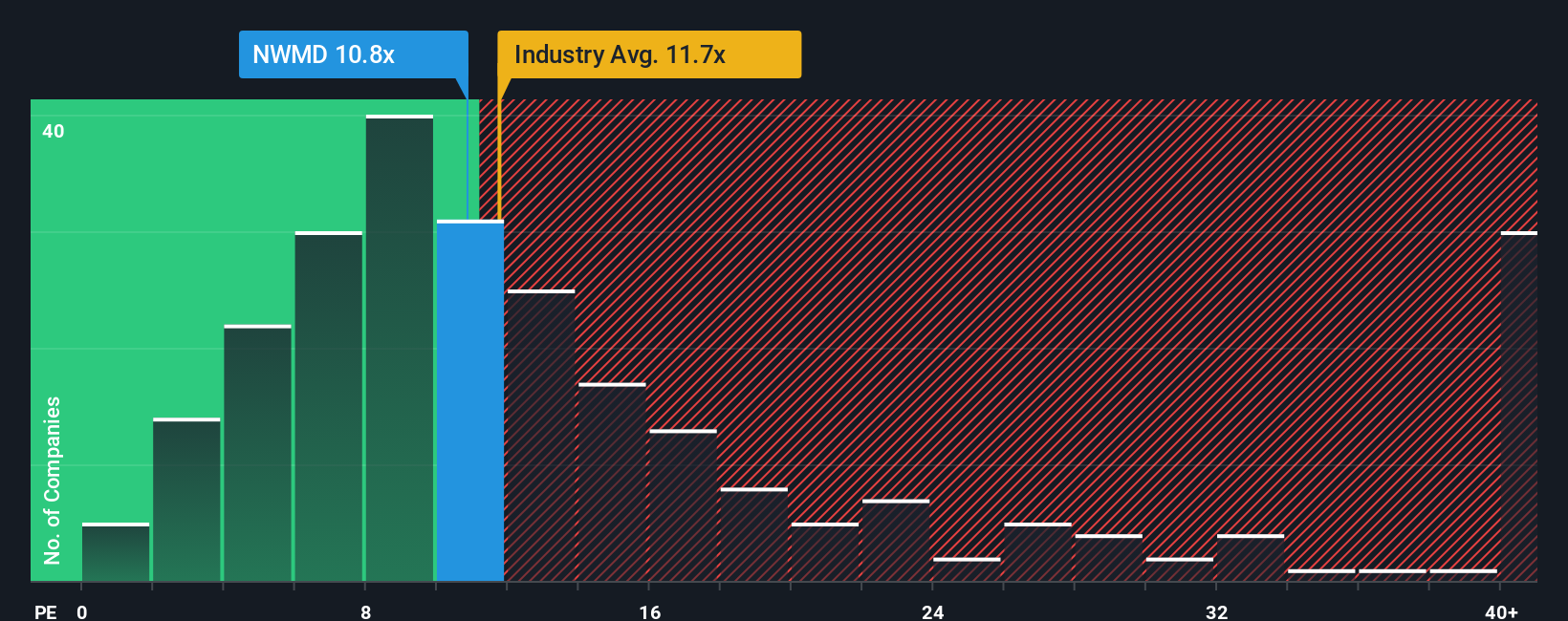

With a price-to-earnings (or "P/E") ratio of 10.8x NewMed Energy - Limited Partnership (TLV:NWMD) may be sending bullish signals at the moment, given that almost half of all companies in Israel have P/E ratios greater than 17x and even P/E's higher than 27x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, NewMed Energy - Limited Partnership has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for NewMed Energy - Limited Partnership

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, NewMed Energy - Limited Partnership would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 20%. The latest three year period has also seen an excellent 422% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 7.6% per annum as estimated by the sole analyst watching the company. With the market predicted to deliver 7.6% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it odd that NewMed Energy - Limited Partnership is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From NewMed Energy - Limited Partnership's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that NewMed Energy - Limited Partnership currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for NewMed Energy - Limited Partnership you should be aware of.

If you're unsure about the strength of NewMed Energy - Limited Partnership's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NewMed Energy - Limited Partnership might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:NWMD

NewMed Energy - Limited Partnership

Engages in the exploration, development, production, and sale of petroleum, natural gas, and condensate in Israel, Jordan and Egypt.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives