Uncovering None And 2 Other Promising Small Caps For Your Portfolio

Reviewed by Simply Wall St

In the wake of a significant market rally spurred by expectations of favorable economic policies following the U.S. election, small-cap stocks have shown promising momentum, with the Russell 2000 Index leading gains despite remaining slightly below its record high. As investors navigate this evolving landscape marked by potential regulatory changes and tax reforms, identifying promising small-cap opportunities becomes crucial for diversifying portfolios and capitalizing on growth prospects. In this context, uncovering undiscovered gems requires a focus on companies with strong fundamentals and adaptability to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 86.64% | 24.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

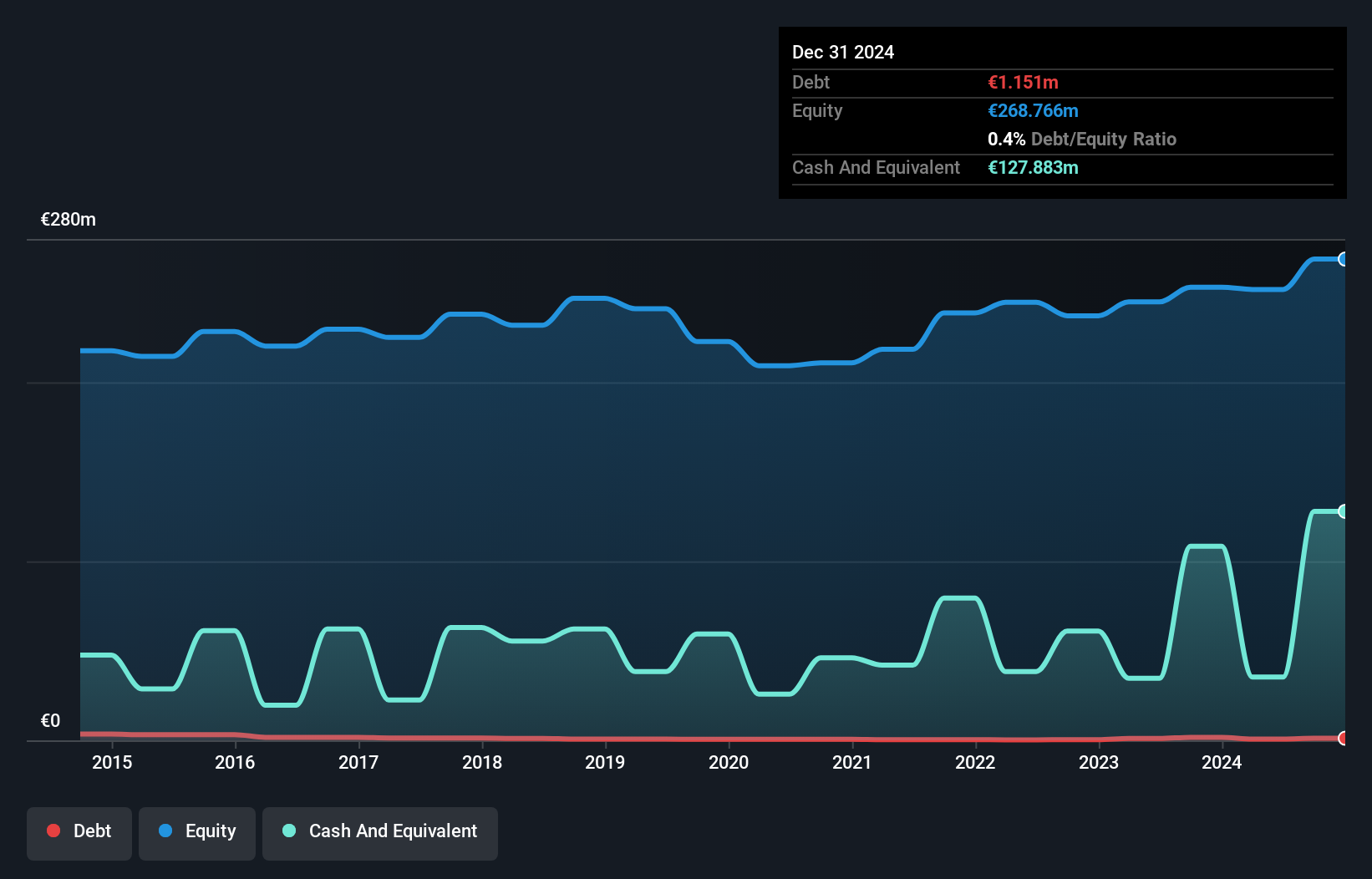

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, along with its subsidiaries, is engaged in the mining, production, and sale of salt across Germany, the European Union, and internationally; it has a market capitalization of approximately €661.97 million.

Operations: Südwestdeutsche Salzwerke generates revenue primarily from its salt segment, contributing €283.67 million, and waste management services, which add €62.46 million. The company reports a net profit margin of 8.5%, reflecting its profitability after accounting for all expenses and taxes.

Südwestdeutsche Salzwerke, a smaller player in its sector, has seen an impressive earnings growth of 4290.9% over the past year, outpacing the Food industry's 26.8%. Despite this rapid growth, its share price has been highly volatile over the last three months. The company is trading at a significant discount of 89.2% below estimated fair value, suggesting potential undervaluation. Additionally, Südwestdeutsche Salzwerke maintains high-quality earnings and boasts more cash than total debt, indicating strong financial health and stability in covering interest obligations without concern for liquidity issues.

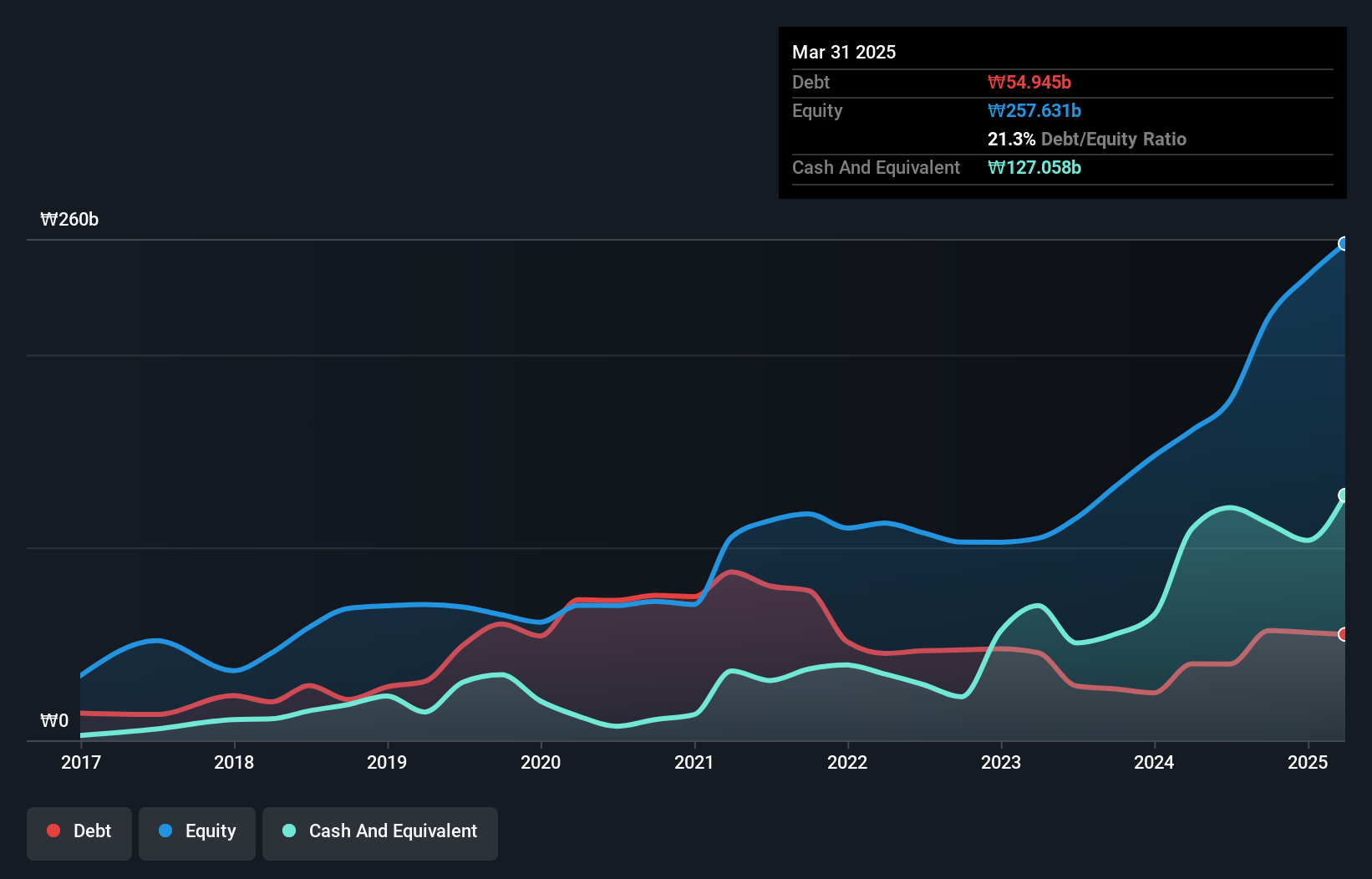

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. is a company that specializes in the production and export of laminating machines and films globally, with a market capitalization of approximately ₩1.24 trillion.

Operations: VT Co., Ltd. generates revenue primarily from its cosmetic segment, which accounts for ₩256.27 billion, followed by the entertainment and laminating segments at ₩93.74 billion and ₩33.86 billion respectively.

VT Co., Ltd. has shown impressive financial growth, with recent quarterly sales reaching KRW 113.35 billion, a significant increase from KRW 74.69 billion the previous year. Net income also saw a substantial rise to KRW 15.40 million from KRW 5.09 million, reflecting strong profitability and high-quality earnings as indicated by their EBIT covering interest payments at an impressive multiple of 175 times. Over the past year, earnings surged by over fivefold compared to industry averages of around 30%, suggesting robust performance in the personal products sector despite a volatile share price in recent months.

- Unlock comprehensive insights into our analysis of VT stock in this health report.

Explore historical data to track VT's performance over time in our Past section.

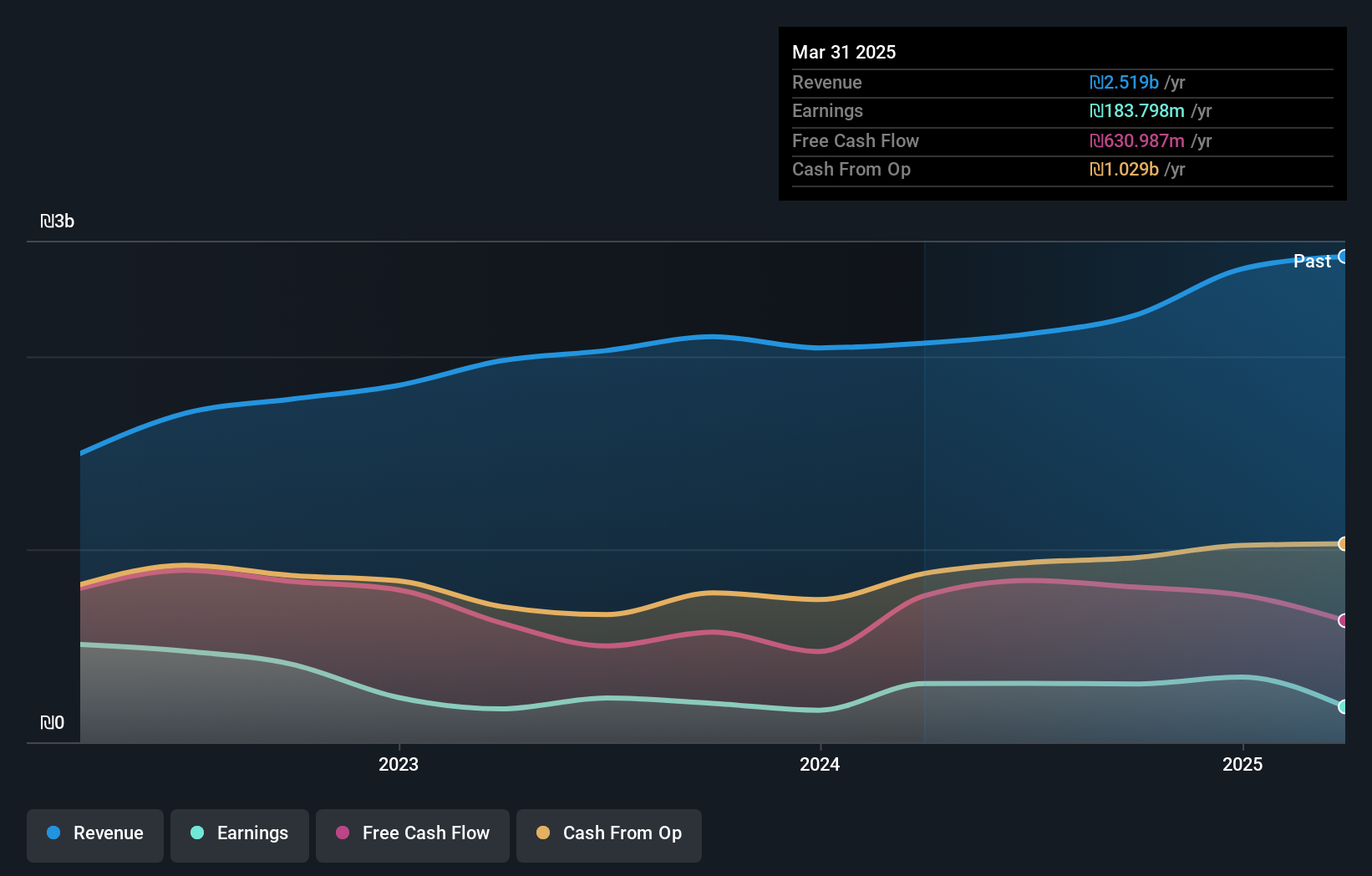

Naphtha Israel Petroleum (TASE:NFTA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Naphtha Israel Petroleum Corp. Ltd. focuses on the exploration, production, and sale of oil and gas in Israel and the United States with a market capitalization of ₪2.29 billion.

Operations: Naphtha Israel Petroleum generates revenue primarily from its oil and gas operations, with ₪1.59 billion from Israel and ₪462.14 million from the USA.

Naphtha Israel Petroleum, a relatively small player in the oil and gas sector, has shown notable financial resilience. Over the past year, its earnings surged by 33%, outpacing industry averages. The company reported a net income of ILS 59.65 million for Q2 2024, up from ILS 57.61 million the previous year, with revenue climbing to ILS 583.8 million from ILS 535.54 million. Its debt management appears prudent with a net debt to equity ratio of just 24.6%, down significantly over five years from 107%. Trading at a substantial discount to estimated fair value suggests potential upside for investors seeking undervalued opportunities in this sector.

Summing It All Up

- Explore the 4673 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:SSH

Südwestdeutsche Salzwerke

Südwestdeutsche Salzwerke AG, together with its subsidiaries, mines, produces, and sells salt in Germany, the European Union, and internationally.

Solid track record with excellent balance sheet and pays a dividend.