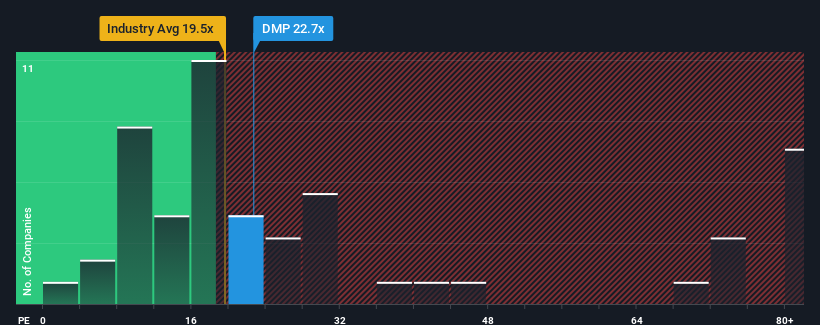

When close to half the companies in Germany have price-to-earnings ratios (or "P/E's") below 15x, you may consider Dermapharm Holding SE (ETR:DMP) as a stock to potentially avoid with its 22.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

While the market has experienced earnings growth lately, Dermapharm Holding's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Dermapharm Holding

How Is Dermapharm Holding's Growth Trending?

In order to justify its P/E ratio, Dermapharm Holding would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 4.8% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 44% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 39% during the coming year according to the five analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 21%, which is noticeably less attractive.

In light of this, it's understandable that Dermapharm Holding's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Dermapharm Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Dermapharm Holding (1 is concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Dermapharm Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DMP

Dermapharm Holding

Manufactures and sells off-patent branded pharmaceutical products in Germany, France, Spain, Austria, Switzerland, and internationally.

Good value with proven track record.

Market Insights

Community Narratives